- Santiment data shows signs of sustained accumulation of BTC by whales.

- Whales have added approximately 46,173 BTC to their wallets since September 27.

- The price of BTC is now trading above the $20k level.

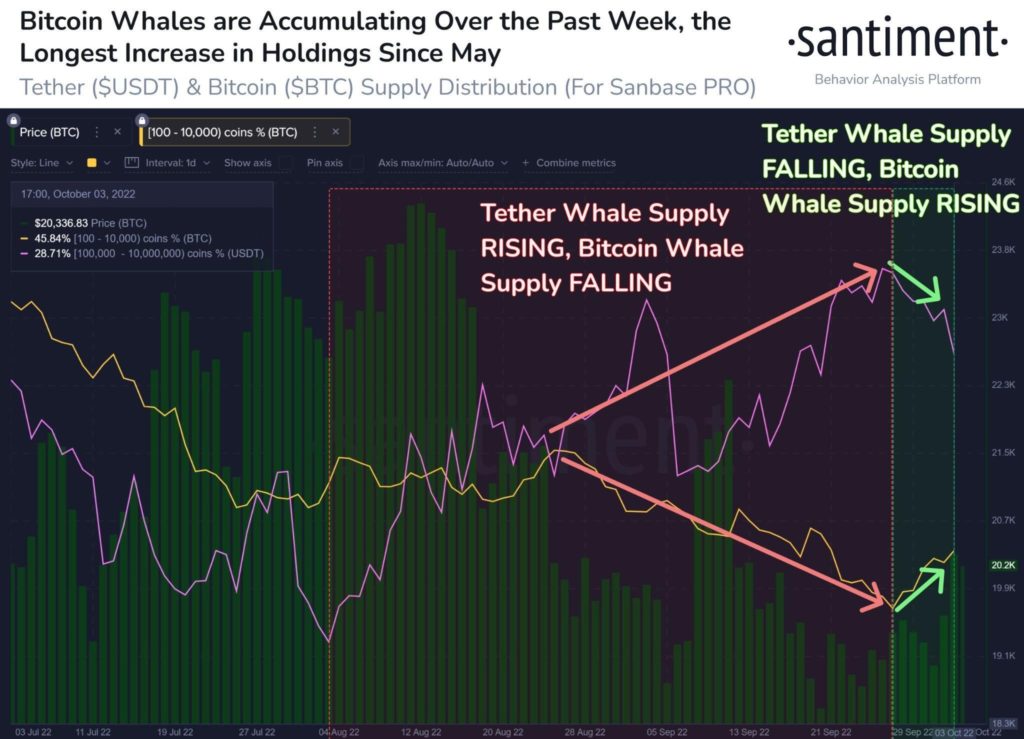

Data from the blockchain analytics firm, Santiment, shows that crypto whales show signs of sustained accumulation of Bitcoin. According to the data, BTC wallet addresses holding 100 to 10k BTC have collectively added back approximately 46,173 BTC to their crypto wallets since September 27.

Between the start of August this year to around the end of September, whales’ supply of Tether (USDT) has been rising, and their supply of Bitcoin (BTC) was falling. However, the trend recently reversed over the last week as BTC whales’ supplies have been rising while their Tether (USDT) supplies have been falling.

Whales were most likely building up their USDT balances to pump BTC’s price, which would subsequently change the longer-term market cycle of the broader crypto market. The fact that the USDT and BTC balances of market whales altered how they did at the time could be more than coincidental, as October is known to be a positive month for crypto.

Whales may be moving now to pump BTC’s price, which will have a livening effect on the rest of the crypto market. At the time of writing, the crypto market leader is trading at $20,178.86 following a 2.84% increase in price over the last 24 hours, according to CoinMarketCap.

Furthermore, ever since the accumulation trend kicked off for the whales shown in the Santiment data, the price of BTC has been able to post a weekly gain. The price of BTC has also risen 7.39% over the last week.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.