- BTC’s price is down 1.85% over the last 24 hours.

- The daily 9 EMA is acting as support for the market leader’s price.

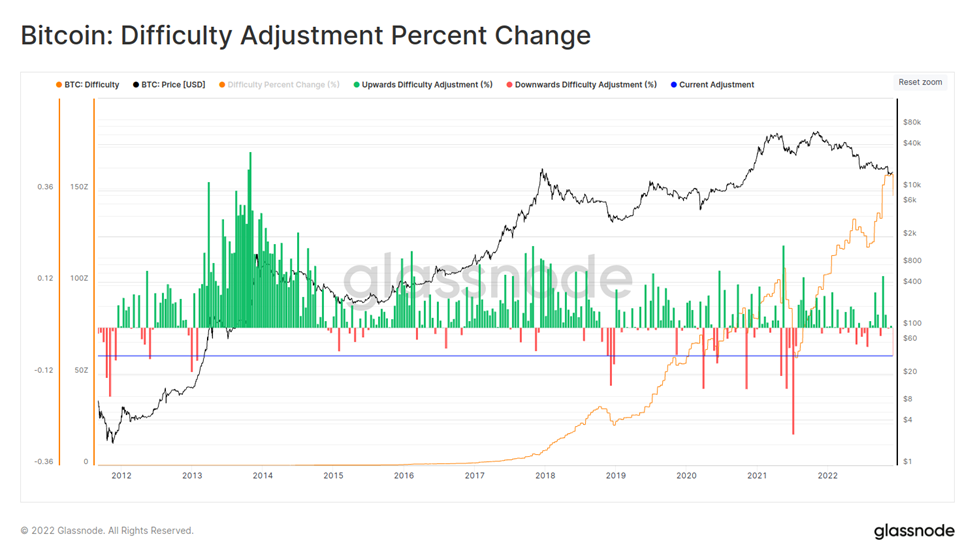

- Glassnode data shows that there has been another mining difficulty adjustment for BTC.

The price of the crypto market leader, Bitcoin (BTC), has fallen over the last 24 hours according to CoinMarketCap. At press time, the price of BTC stands just above the $17,000 level at $17,005.83 after a 1.85% drop in price. Nevertheless, the price of BTC is still up 3.28% over the last 7 days.

The daily chart for BTC shows that the price of BTC has consolidated between the daily 9 and 20 EMA lines over the last 5 days, with today’s price movement looking to continue the trend. The daily RSI line has also moved sideways during the same 5-day period.

With regards to support, the daily 9 EMA line is holding BTC’s price up and there looks to be some buy volume entering BTC’s chart today.

Given that the daily RSI line is positioned above the daily RSI SMA line, there is still a chance that BTC’s price will break out above the current consolidation channel.

Although there could be a price rise for BTC in the coming days, the latest decrease in BTC’s price over the last 2 weeks has led to the mining difficulty of BTC being adjusted. According to a tweet by the blockchain intelligence firm, Glassnode, this adjustment is in response to the falling BTC hash rate.

The tweet made this morning added that this adjustment has resulted in “Yet another inversion of the Hash-ribbons, as the 30 DMA dives below the 60 DMA.”

The chart shared by Glassnode shows that the last hash-ribbon inversion occurred in early June of this year.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.