- SUI’s surge and market FOMO may be diverting attention from ADA’s potential.

Cardano’s technicals show ADA near support levels, signaling a buying opportunity.- Despite recent dips, ADA’s long-term prospects remain strong due to its scalability.

Cardano ($ADA) has been quiet lately, especially with all the hype around $SUI, which has been going up in price and popularity. While investors buy $SUI, $ADA has quietly been falling against Bitcoin ($BTC), making people wonder if this could be a buying opportunity.

Market Sentiment and FOMO: How $SUI’s Popularity is Affecting $ADA

The rise of $SUI shows the strong influence of market sentiment and fear of missing out (FOMO). Investors tend to buy trending assets, and $SUI’s recent price action suggests that it has caught the eye of traders.

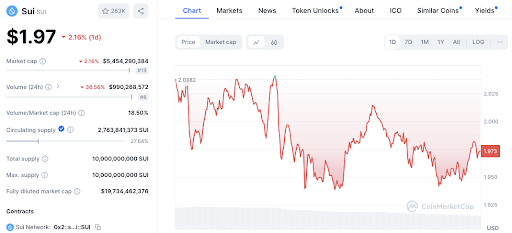

With a recent high of $2.04 and a market cap of $5.47 billion, $SUI’s sharp price fluctuations show high volatility. Key support around $1.95 has held, but trading volume is down by 35.03%, which could mean things are cooling off.

This intense focus on $SUI may be taking attention away from $ADA, which is having short-term price struggles. However, this could be a buying opportunity for those wanting to accumulate Cardano at lower levels.

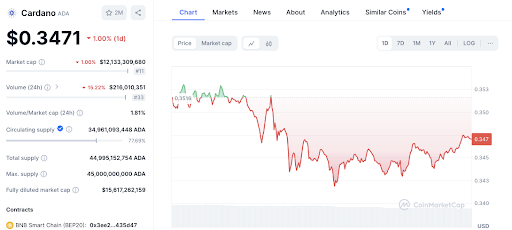

$ADA is currently trading at $0.3475, with a 1.31% drop over the past 24 hours, and has shown resilience near its support levels. The declining trading volume and resistance at $0.3516 suggest that $ADA could soon retest its support at $0.344.

Long-Term Prospects of Cardano: Is $ADA Still a Strong Contender?

Despite its recent price weakness, Cardano is still a significant player in the crypto market. With a market cap of $12.15 billion and a circulating supply of 34.96 billion $ADA, Cardano’s ecosystem keeps growing. Its blockchain technology focuses on scalability, security, and sustainability, which could help it in the long term.

While $ADA’s short-term technical indicators are bearish, the broader trend shows resilience. The cryptocurrency has struggled to break above $0.35, but consistent support near $0.344 shows that buyers are stepping in at lower levels. Also, the ongoing development of Cardano’s network could help it do well in the future.

Comparing Price Volatility: $ADA vs. $BTC

When comparing $ADA to $BTC, the volatility is evident. $ADA has had larger price swings, with a sharp dip of around 4% before recovering.

Read also: ADA vs. Bitcoin: Analyst Predicts 90% Drop for Cardano

Meanwhile, $BTC has been relatively stable, hovering between 0% and 1%. Although $ADA has underperformed compared to $BTC, the high volatility could be good for traders looking for short-term gains.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.