- Mac tweeted that Bitcoin and Ether are the only cryptos that can be stacked for a long-term cycle.

- The platform added that no other crypto could be depended on for a long-term investment.

- The trajectory of BTC and Ether had been positive, further bolstering Mac’s claim.

The free crypto content space account, Mac, tweeted that Bitcoin (BTC) and Ether (ETH) are the only digital assets that can be stacked for the long term, adding that “everything else is a Ponzi you should trade in short term cycles.”

The platform tweeted the ideas regarding long-term investments in crypto as a “piece of advice”:

Additionally, Mac tweeted that many investors had been stacking FTT on a long-term basis and had been severely affected by the crash.

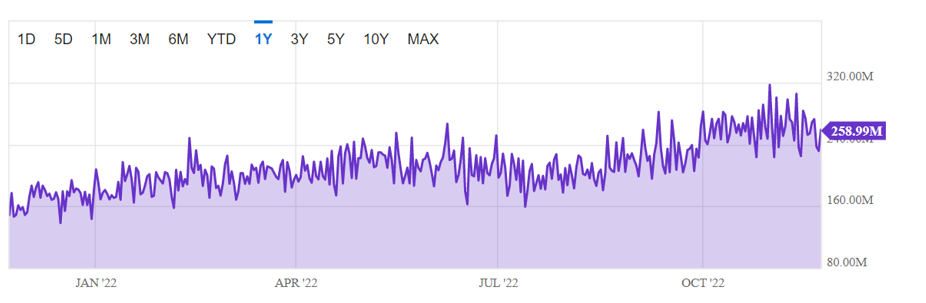

Significantly, both BTC and ETH have been traveling through a reasonable trajectory despite the fall of FTX. The robust infrastructure and technologies of the blockchains may be one of the reasons for their unshattered condition as commented by Cathie Wood, the founder and CEO of Arc Invest. Furthermore, the hash rate of the Bitcoin network is currently at 258.99 M which is a change of 74.07% from one year ago. As Cathie Wood stated, the all-time high hash rate of BTC is a positive indicator of the long-term security of Bitcoins.

Though the whole world of crypto had been highly affected after the fall of FTX and prices of almost all the cryptos were highly volatile, the positions of both BTC and ETH have been comparatively stable.

Notably, ETH is currently trading at a rate lower than $1,600 which could be a positive sign for the traders to purchase more coins intending to accumulate in the future.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.