- LINK’s price has dropped over the last 24 hours, but still printed weekly gains.

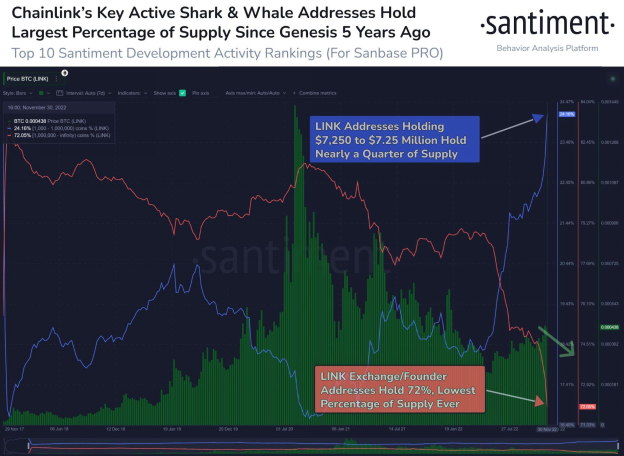

- Data from Santiment shows that LINK sharks and whales hold a quarter of the supply.

- The altcoin’s price is currently still trading above the daily 9 and 20 EMA lines.

The price of Chainlink (LINK) has dropped 0.77% over the last 24 hours according to CoinMarketCap. The altcoin’s price has, however, risen over the last 7 days, and was able to print a gain of 3.32%. As a result, the price of LINK currently stands at $7.37.

LINK’s increase in price over the last week may have something to do with the unprecedented surge in accumulation by LINK shark and whale addresses.

According to a tweet made by the blockchain intelligence firm, Santiment, this morning, LINK sharks and whales have added a collective 26.8 million LINK in just over the last 2 months. This is approximately worth $194.3 million at current prices, and is a 12.8% increase of coins in these holders’ bags.

In addition, the chart shared by Santiment shows that LINK addresses holding $7,250 to $7.25 million hold nearly a quarter of the supply. Meanwhile, LINK exchange and founder addresses hold 72% of the supply, which is the lowest percentage of the supply held by these addresses.

The daily chart for LINK shows how the price of the altcoin entered into an ascending price channel on November 21, 2022. This price channel spanned several days and was accompanied by a bullish cross of the daily 9 and 20 EMA lines – elevating the price of LINK to trade above the 2 EMA lines.

Currently, LINK’s price has broken out of the aforementioned price channel and still trades above the daily 9 and 20 EMA lines. It has, however, retraced slightly over the last 3 days.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.