- A dormant Bitcoin whale moved $634K to Kraken, reflecting a notable shift in market dynamics and investor sentiment.

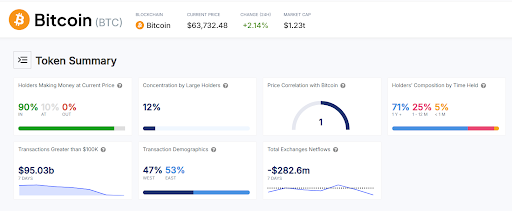

- Bitcoin’s price has risen by 2.06% in the last 24 hours, with 90% of holders currently in profit, indicating strong demand.

Recent trading trends show a notable increase in futures volume and a net outflow of 282.6 million BTC from exchanges.

A Bitcoin whale, dormant since near Bitcoin’s genesis block, just moved $634,000 in BTC to the Kraken exchange. This transfer, flagged by crypto intelligence platform Arkham on X, comes from a wallet holding $73.4 million in Bitcoin and may signal shifts in market sentiment with the BTC price hovering around $63,870.88.

This is not the first time this whale has made waves. Just a month ago, they transferred another portion of their holdings, marking their reemergence after years of inactivity.

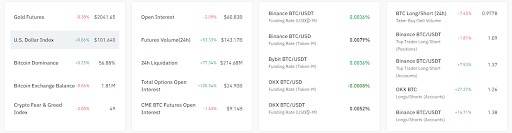

The latest market data reflects a mix of volatility and cautious sentiment across cryptocurrencies and commodities. Bitcoin’s price rose by 2.06% in the past 24 hours. Its trading volume hit approximately $29.64 billion, demonstrating strong investor interest. In addition, Bitcoin’s market capitalization is now at $1.26 trillion. The circulating supply holds at 19,764,400 BTC, with a maximum supply of 21 million BTC.

Elsewhere, the broader market environment is experiencing fluctuations. Gold futures fell by 0.38%. However, the U.S. dollar Index saw slight strengthening. Bitcoin’s dominance remained steady at 56.86%, while exchange balances dropped.

This decline suggests that investors are moving their Bitcoin holdings off exchanges, potentially to cold storage or personal wallets. This behavior often aligns with a decrease in selling pressure. When fewer Bitcoins are readily available on exchanges, it leads to a supply squeeze that can have a positive influence on BTC price.

Trading Activity and Trends

Futures trading has seen a surge lately, with a notable 53.3% increase in volume. Also, there was a sharp rise in liquidations, pointing to heightened market volatility.

Funding rates paint a mixed picture of trader sentiment. While OKX’s BTC/USD pair shows a slightly bearish bias with a negative funding rate, its BTC/USDT pair indicates bullish sentiment. Both Binance and Bybit lean towards long positions with positive funding rates across their BTC/USD and BTC/USDT pairs. Long/short ratios on Binance and OKX reveal a cautious shift, with more traders choosing short positions.

Technical Indicators

Current technical analysis paints a bullish picture for Bitcoin. The Relative Strength Index (RSI) hovers around 56.53, indicating strong upward momentum. While not yet in overbought territory, this suggests further price increases are possible.

Current technical analysis reveals intriguing insights. The Relative Strength Index (RSI) sits at 56.53, indicating that Bitcoin is nearing the upper neutral zone. While it has not yet entered overbought territory, this suggests that the asset is gaining momentum.

If buying pressure continues, Bitcoin could maintain its upward trajectory. However, caution is advised as it approaches the overbought threshold.

Read also: Bitcoin Whales HODLing: Are They Waiting for Retail Investors?

The Moving Average Convergence Divergence (MACD) further supports this bullish outlook. Although the MACD line, 572, is currently below the signal line, 781, the gap is narrowing, hinting at a potential bullish crossover. This crossover, if confirmed, could trigger a surge in buying activity. Red bars on the histogram indicate that bearish momentum exists, though it appears to be weakening.

Institutional Interest

Bitcoin’s October performance has shown a few promising trends. After seven days of trading, Bitcoin is in the green for the month. Historical averages from 2013 to 2024 indicate a potential increase of 21%. Plus, a rise of 15% could push Bitcoin to hit a new all-time high (ATH) this month.

Bitcoin has approximately 90% of holders in profit, and its market capitalization has climbed to $1.23 trillion. What’s more, large holders now own 12% of the total supply. Just last week, transactions over $100K topped $95 billion, showing significant institutional interest.

The data indicates a bullish sentiment as Bitcoin experiences a net outflow of 282.6 million BTC from exchanges. This trend reflects growing confidence among investors, as many choose to hold their assets rather than sell. Notably, 71% of holders have maintained their Bitcoin for over a year, underscoring their belief in Bitcoin’s long-term potential.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.