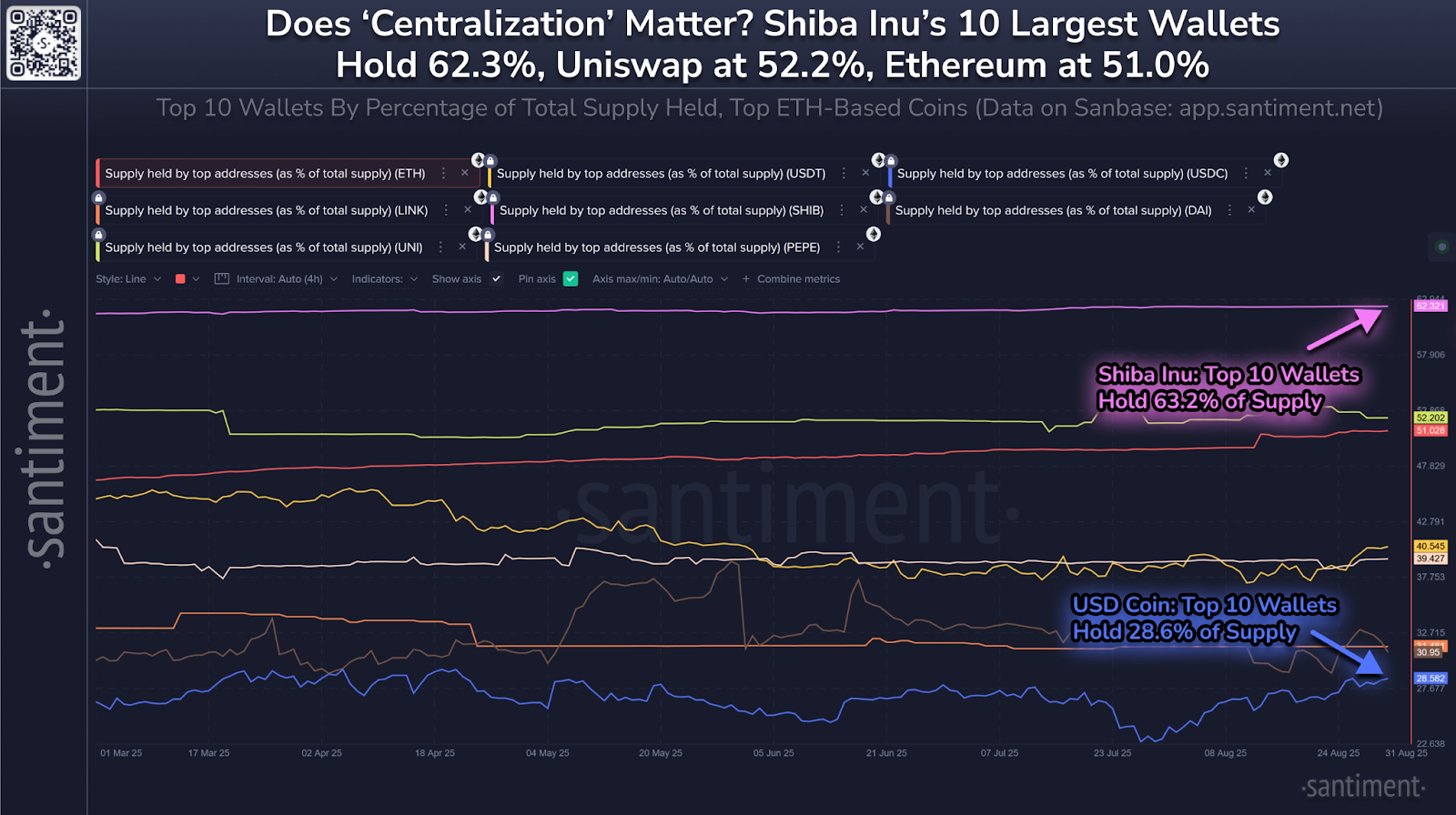

- Shiba Inu top 10 wallets control 62.3% of the supply.

- Ethereum and Uniswap wallets each hold more than half of the total supply.

- Stablecoins like USDC and DAI exhibit a broader distribution, with values below 32%

Shiba Inu largest wallets hold more than 62% of the token’s supply, according to Santiment. The crypto analytics platform released fresh data showing supply concentration across leading Ethereum-based assets.

Shiba Inu Holds the Highest Concentration

Santiment reported that the top 10 wallets controlling Shiba Inu own 62.3% of the token’s supply. The meme-inspired cryptocurrency ranked first among the tokens reviewed for centralization of holdings.

Related: Crypto’s Deepest Pockets Are All Making the Same Bet Right Now – Ethereum

This level of concentration means a small number of addresses command the majority of SHIB’s supply, potentially influencing market liquidity and trading activity.

Top 10 Largest SHIB Holders: A Quick Overview

Etherscan data shows that the top SHIB holders include the official burn address, major exchanges, and unidentified wallets.

- 1: Burn address (0xdEA…42069) — 410.43T SHIB (Ethereum founder Vitalik Buterin burned the largest percentage in 2021)

- 2: Unknown, likely a smart contract — 53.37T SHIB

- 3–6: Robinhood, Binance Hot Wallet 20, Crypto.com, Binance 28 — holding between 19.51T–39.27T SHIB

- 7: Unknown (0xa70…71FA9) — 12.04T SHIB

- 8–9: Robinhood & Binance wallets — 11.41T and 9.04T SHIB

- 10: Unknown — 7.65T SHIB

Together, these addresses hold a significant portion of the SHIB supply. Notably, Shiba Inu has dropped 42.2% year-to-date, trading at $0.00001237. Despite more than 410 trillion tokens burned since 2021, the supply remains high at about 589 trillion, limiting the impact of burn campaigns.

Still, Santiment data showed that whales accumulated roughly 4.66 trillion SHIB in August, which may suggest that some large holders view current price levels as an opportunity.

Ethereum and Uniswap Above 50%

Ethereum (ETH) and Uniswap (UNI) followed Shiba Inu, with 51.0% and 52.2% of supply concentrated in the top 10 wallets. Both tokens crossed the halfway mark, highlighting that a limited number of holders play a significant role in their supply distribution.

Digging further, Ethereum’s top 10 addresses currently hold 71.8 million ETH, or about 60% of the 120.71 million circulating supply. The Beacon Deposit Contract accounts for 68 million ETH, making it the largest holder through validator staking.

Exchanges also feature prominently, with Coinbase holding 5.16 million ETH and Binance 4.06 million. Institutions have expanded their share, led by BlackRock’s iShares Ethereum Trust with more than 3 million ETH, alongside Grayscale and Fidelity funds.

Public companies such as Bitmine Immersion Technologies and SharpLink Gaming have added billions in ETH to corporate treasuries, much of it staked for yield. Notable individuals, including founder Vitalik Buterin and the Winklevoss twins, remain among the biggest private holders.

Stablecoins and Other Tokens Show Broader Distribution

In contrast to Shiba Inu and Ethereum, stablecoins appeared less concentrated. Tether (USDT) showed 40.5% of supply in the largest wallets, while USD Coin (USDC) and DAI held 28.6% and 31.0%, respectively.

Santiment’s data indicates that USDC remains the most broadly distributed among the group, with less than one-third of its supply concentrated in top holders.

Similarly, Chainlink (LINK) saw its top 10 wallets hold 31.5% of supply, while Pepe (PEPE) registered 39.4%. These figures place both tokens in the mid-range between highly concentrated assets like SHIB and more widely distributed stablecoins.

Related: Analyst Lays Out a Two-Stage Roadmap for a 570% Shiba Inu Rally

Tracking supply held by top wallets provides insight into potential market movements. High concentration can raise risks of sudden price swings if large holders decide to move or sell tokens. In contrast, broader distribution may offer more liquidity and reduce reliance on whale activity.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.