- TokenUnlocks tweeted that INJ has unlocked 93% of the maximum supply of its tokens.

- The impending token unlock for ecosystem development raises the question of the price of INJ.

- INJ trades inside an ascending triangle, it could reach more than $16 when it breaks out.

TokenUnlocks, an analytical dashboard for tokenomics information, tweeted that 93% of the Injective token’s (INJ) maximum supply was unlocked to date. As per the unlocking event scheduled for August 21, there will be another 2.86 Million INJ tokens released for Ecosystem Development read the tweet.

With the impending release of the tokens at hand, the question arises as to whether the token will decrease in price with the increase in supply, or will the buyer cash out INJ. If the buyers cash out INJ, then the price could rise by a large margin.

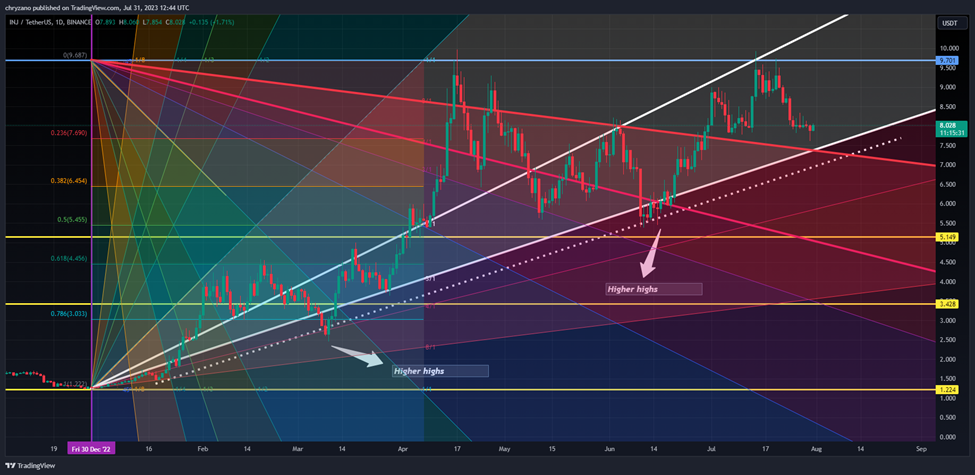

When considering the above chart we could see that INJ has been rising since the beginning of 2023. It has been making higher lows. It rose along the 3:1 Gann line while at times testing and breaking the 2:1 Gann fan line. In particular, INJ rose almost close to the 1:1 Gann line in April 2023.

However, it didn’t have enough momentum to test it. As such, INJ started falling along the 4:1 Gann fan line while landing on the 3:1 Gann line for support just once. Currently, INJ is looking to land on the 3:1 Gann line. If the 3:1 Gann line is broken by the bears, then INJ might seek the assistance of the 4:1 Gann line.

INJ is trading inside an ascending triangle, it has four touchpoints at the moment. However, as the ascending wedge has not been completely formed, we may not see INJ break out of this current pattern. As such, we may expect INJ to rebound off of the lower trend line at around $7.3 if it is to continue this formation.

In the event that INJ continues this formation and breakouts from the ascending triangle, we could expect INJ to rise to Resistance 1 at $14. However, as per the conventional breakout pattern of an ascending triangle, INJ may break out and reach Resistance 2 at $16.8.

The above breakout thesis is derived from the conventional breakout pattern from the triangle, where INJ spikes by the height of the triangle at the early stage from the point of breakout. As such buyers may need to consider having their entry point at the breakout point and the take profit near Resistance 2. They could have their stop-loss at the bottom trend line.

However, if INJ crashes it may first seek support from the trendline support and if it is not supported there, then it may crash further to Support 1 and 2.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.