- Total crypto market cap bounced from about $3.26T to $3.49T in under two days, adding roughly $227B after an early-week sell-off.

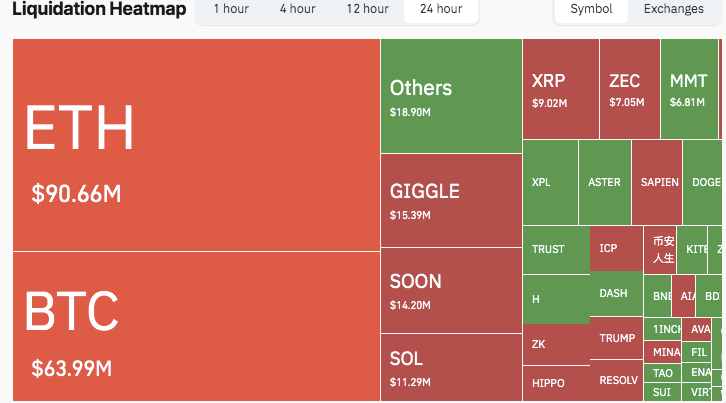

- More than $230M in leveraged positions were liquidated in 24 hours, led by Ethereum at $90.66M and Bitcoin at $63.99M, showing longs got cleared.

- The rebound stalled below the $3.45T to $3.49T zone, so analysts say this was a liquidity reset that now needs fresh catalysts.

The crypto market posted a sharp recovery this week, with total capitalization jumping from around $3.26 trillion to $3.49 trillion in roughly 38 hours, according to TradingView data shared by analyst Ash Crypto.

Related: From Pullback to Comeback: Altcoin Season Hype Builds as Market Recovers

The swing restored about $227 billion that had been wiped out in the earlier correction and showed buyers were ready to step back in once the selling pressure eased. The chart also showed a series of higher lows, which signals that dip buyers were active and that liquidity did not disappear.

$227B Returns As Market Builds Higher Lows

That said, the move stalled near the $3.45 trillion resistance band and slipped into a narrow consolidation, with the latest reading near $3.39 trillion and a small 0.09 percent daily decline. Analysts said that pause looks like short-term profit-taking and reflects caution ahead of upcoming macro prints, so the market still needs a clean breakout to reclaim the highs.

$230M In Liquidations Cleared Out Weak Longs

On-chain watchers said the timing of the rebound lines up with a classic leverage flush. Coinglass data showed more than $230 million in leveraged positions were wiped out across majors in the past 24 hours. Ethereum took the biggest hit with about $90.66 million in forced liquidations, while Bitcoin saw about $63.99 million.

A red-heavy liquidation map means long traders were leaning too far forward and got knocked out as prices retraced from local highs.

According to one market observer, Dr. MoneyGlitcher, he noted that the declines often serve to “trigger fear” and shake out leveraged positions before institutional participants re-enter. The remarks implied that the recent volatility may have reflected coordinated liquidity shifts rather than random trading activity.

Altcoins Also Got Swept In The Reset

The liquidation wave was not limited to BTC and ETH. Among altcoins, GIGGLE saw about $15.39 million in liquidations, SOON followed with $14.20 million, and Solana posted around $11.29 million in forced closes. XRP and Zcash printed $9.02 million and $7.05 million, respectively. A few names such as ASTER, ICP and DASH stayed mostly green, indicating limited downside exposure during the flush. That spread shows the reset hit crowded trades first, leaving lightly margined tokens relatively untouched.

The takeaway is that the market has already done a lot of the cleanup work, $227B restored, $230M in leverage gone, but it is now sitting under resistance and will need either calmer macro signals or a new inflow wave to extend the move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.