- Pyth Network’s short-term volatility may hinder potential long-term gains for investors.

- Kaspa’s bearish trend shows strong selling pressure, prompting cautious investor sentiment.

- Stacks’ recent decline raises concerns despite historical Q4 performance in Bitcoin’s ecosystem.

Pyth Network (PYTH), Kaspa (KAS), and Stacks (STX) are flashing bearish signals in the current market conditions. These altcoins have experienced significant price drops and increased volatility.

As is the case with most high-risk assets, the altcoin market also moves quickly, and investors must constantly decide whether to buy, hold, or sell their assets.

Pyth Network (PYTH): Rising Potential, But Short-Term Volatility

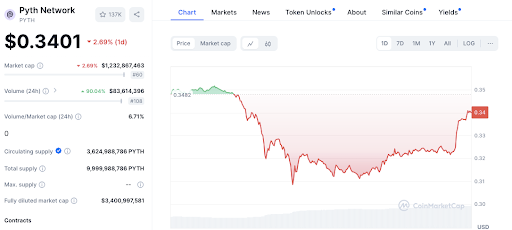

Pyth Network provides decentralized financial market data. Its metrics look promising and suggest it may eventually surpass Chainlink. However, PYTH is in a downward trend, with its price falling by 2.62% in the last 24 hours to $0.3391.

Key resistance at $0.3482 and support at $0.31 indicate that the token is facing pressure from both sides. With a sharp decline earlier in the day from $0.3482 to $0.31, the token seems to be in a sell-off phase before beginning a recovery. The substantial 88.35% increase in trading volume hints at increased volatility.

Read also: Price Action and Derivatives Insights for SEI, PYTH, SUI, STRK, JASMY

Kaspa (KAS): Proof-of-Work Exposure and Market Maker Resilience

Kaspa, a Proof-of-Work blockchain, has caught the attention of market makers this cycle. Despite this, KAS is seeing considerable pressure. The token is down 6.56% in the last 24 hours, trading at $0.1514.

Resistance at $0.162 shows that the token struggled to maintain upward momentum, while support at $0.145 suggests some buying interest at lower levels. KAS tried to recover after touching $0.145, but the overall trend is bearish. The sharp decline from $0.162 to the current consolidation around $0.151 shows that the token could fall further.

Stacks (STX): Betting on Bitcoin Ecosystem Growth

Stacks, a token built to enhance Bitcoin’s ecosystem, typically sees strong Q4 returns. However, recent price action indicates significant selling pressure. STX has dropped 7.55% over the last 24 hours, with its price falling from $1.93 to a low of $1.65 before recovering to $1.79.

Read also: What’s Driving Solana, Stacks, Sei, and Pyth Network’s Gains?

Resistance at $1.93 and support at $1.65 suggest a volatile range for the token. Although the current rebound may signal an upcoming recovery, the sharp decline earlier raises concerns about sustained momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.