- Crypto market cap topped $4T as traders eyed signs of an altcoin rally.

- Altseason indicators climbed with CoinGlass index jumping above 70.

- Whales rotated into ETH, SOL, and mid-caps as institutions added risk.

The total crypto market cap closed back above $4 trillion on October 1st, a 4% single-day gain that reignited talk of an altcoin rally in 2025. The move came as Bitcoin hit $119,400, pulling Ethereum, Solana, Dogecoin, and other majors higher. Traders framed the milestone as a signal that risk appetite is returning after weeks of caution.

For U.S. market participants, holding this level is the first condition for a sustained altseason.

Altseason Indicators Strengthen on CoinGlass and CoinMarketCap

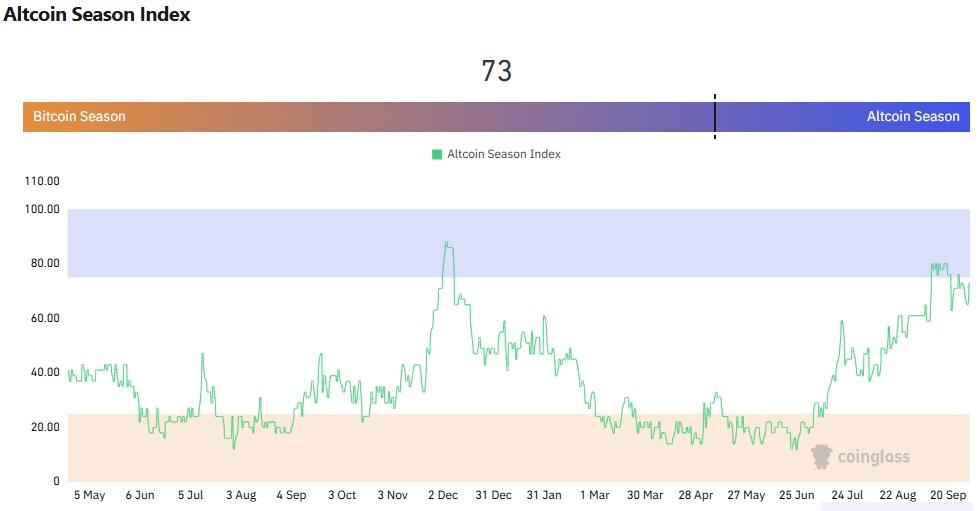

The Altcoin Season Index from CoinGlass has been teasing the entrance of altseason in the recent past. Following the crypto pump during the past 24 hours, the Altcoin Season Index from CoinGlass surged from 65 to 73, signaling rising odds of altseason.

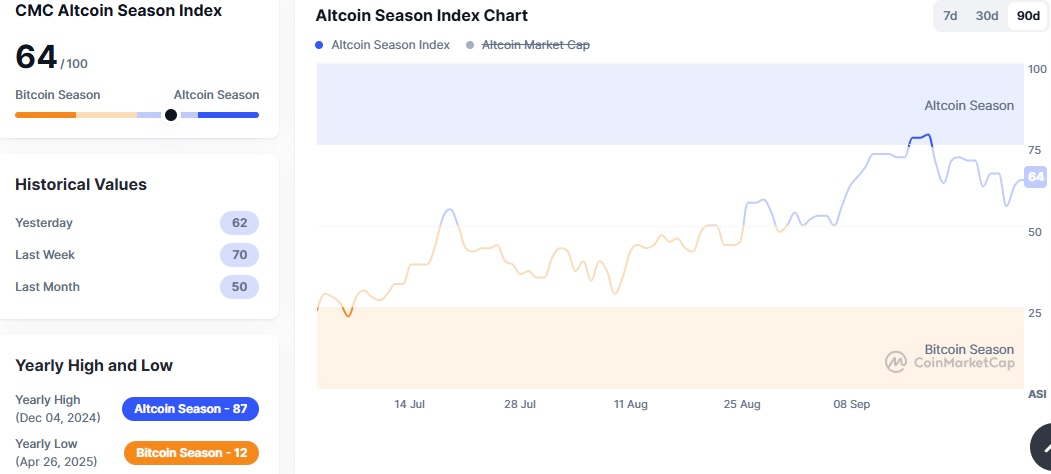

Similarly, the Altcoin Season Index from Binance-backed CoinMarketCap surged from 56 to 64 during the last 24 hours.

Analysts Debate Timing of the Altcoin Q4 Rally

Crypto analyst Benjamin Cowen recently cautioned traders anticipating altseason to kickstart in October that Bitcoin dominance is likely to explode higher. Cowen previously predicted that altseason 2025 will likely begin in early November.

Crypto analyst Kevin on X stated that the TOTAL3 market cap has been consolidating in an ascending triangle, and has approached its apex in the monthly timeframe. As such, the crypto analyst thinks that a major explosion in the altcoin market is on the horizon.

Macro Uncertainty and ETF Delay Risks

The altcoin market recorded a mild bullish outlook during the past 24 hours partially influenced by the ongoing shutdown of the United States government. Confidence in the wider crypto market has surged amid indications of a potential prolonged shutdown of the U.S. government.

However, Nate Geraci, a popular ETF analyst, warned that a prolonged shutdown of the U.S. government will likely delay the much-anticipated approvals of spot crypto ETFs. Furthermore, the U.S. SEC has already signaled that some of its key services are likely to be closed if the shutdown continues in the coming days.

Institutional and Whale Demand Builds in Altcoins

The highly anticipated parabolic altcoin rally before the end of this year has gradually been influenced by high demand from whale institutional investors. For instance, crypto capital rotation from Bitcoin to altcoins has been recorded through more institutional investors implementing altcoin treasury amid low cash inflows to BTC’s investment products.

Solana has led in large altcoins getting implemented as treasury tools. On Thursday, SOL Strategies announced its acquisition of 80k extra SOLs and Beijing-based VisionSys AI unveiled a plan to purchase $2 billion worth of Solana starting with $500 million.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.