- Ethereum’s price has dropped to $4,200, following an all-time high of nearly $5,000.

- Stablecoin supply and DeFi deposits are at multi-month lows.

- Analysts suggest that potential rate cuts in September could spark a resurgence in liquidity.

The price of Ethereum has recently come under pressure, dipping to $4,200 just days after reaching an all-time high of nearly $5,000. This price drop can be explained by recent on-chain data, which reveals a divergence in market behavior.

Liquidity metrics such as stablecoin supply and DeFi deposits have fallen to multi-month lows. Meanwhile, adoption indicators, including active addresses and transactions, are at record highs.

This suggests that Ethereum may be shifting from a yield-driven market to a utility-led ecosystem, with potential rate cuts in September possibly acting as a catalyst for the next price breakout.

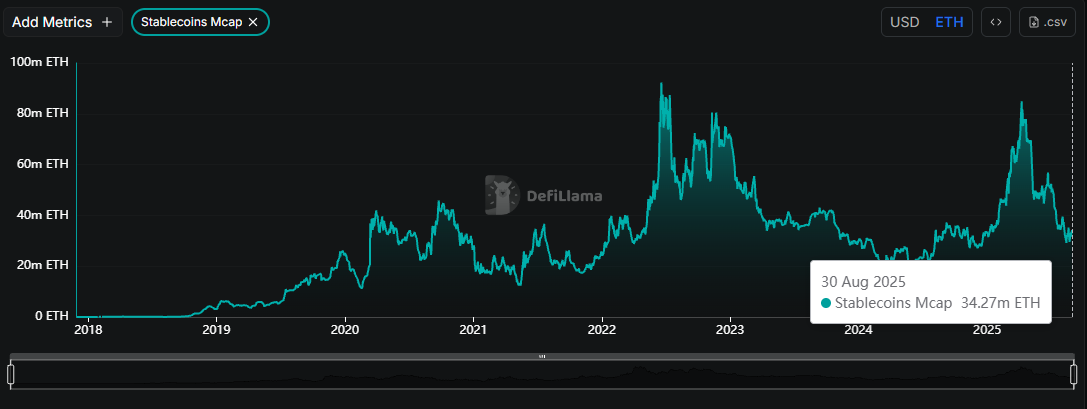

Stablecoin on Ethereum Drops 34.27M ETH

- The dollar market capitalization of stablecoins on the Ethereum network is currently $149.58 billion, representing an all-time high valuation, according to DeFiLlama

- However, when measured in ETH terms, today’s volume stands at 34.27 million ETH tokens, a low figure compared to the 80.24 million ETH seen in April.

- Stablecoins serve as the primary liquidity base for crypto trading, and a contraction in their supply often signals that investors are withdrawing capital from the ecosystem.

- The current divergence between the all-time high in the dollar value of stablecoins on Ethereum and the lower ETH volume can be explained by the high price of ETH tokens. A higher ETH price means the dollar value of stablecoins will be higher relative to the quantity of tokens.

Related: Corporate Treasuries and ETFs Now Control Nearly 8% of Ethereum’s Supply

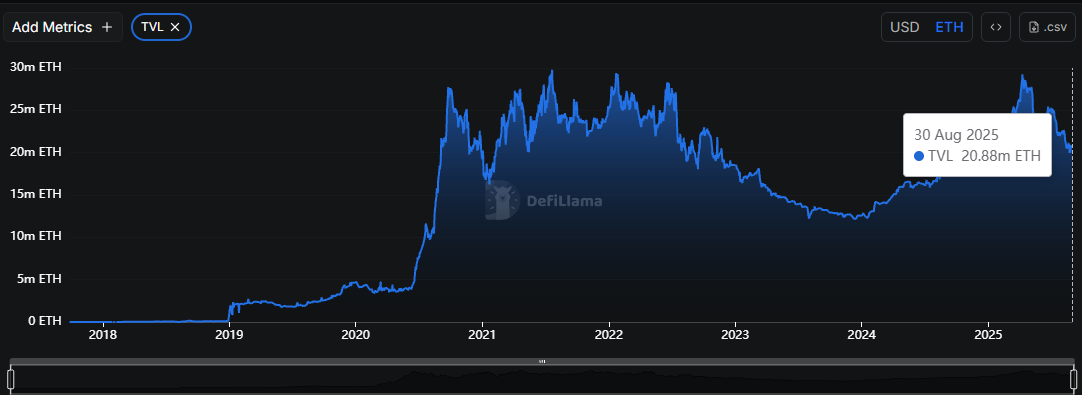

DeFi TVL Declines to 20.88M ETH

In the decentralized financial space, the total value locked on the Ethereum network is also seeing a dip in ETH volume. TVL is a measure of how much ETH is committed to protocols such as lending, staking, and farming.

- Ethereum’s DeFi TVL has dropped to 20.88 million ETH as of today, compared to 28.4 million in April.

- However, in dollar terms, Ethereum TVL is near its all-time high with a value of $91.59 billion.

- In July 2021, TVL was 29 million ETH with an all-time high value of $106.5 billion. It reached its lowest point in 2023, with just 12 million ETH worth around $20 billion at the time.

- This boom and bust cycle means investors pulled large amounts of ETH out of DeFi during the downturn, but have since returned, showing renewed trust and activity in Ethereum’s ecosystem.

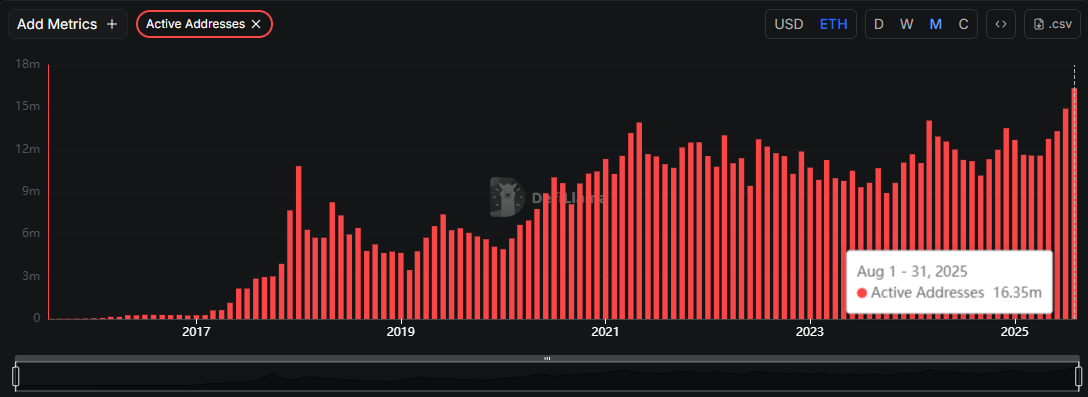

Active Addresses Reach 16.35M

In contrast to liquidity outflows, network usage has surged.

- Ethereum recorded 16.35 million active addresses, the highest level on record.

- This milestone reflects unprecedented wallet activity, driven by the adoption of Layer-2 payments and broader institutional interest in blockchain settlement.

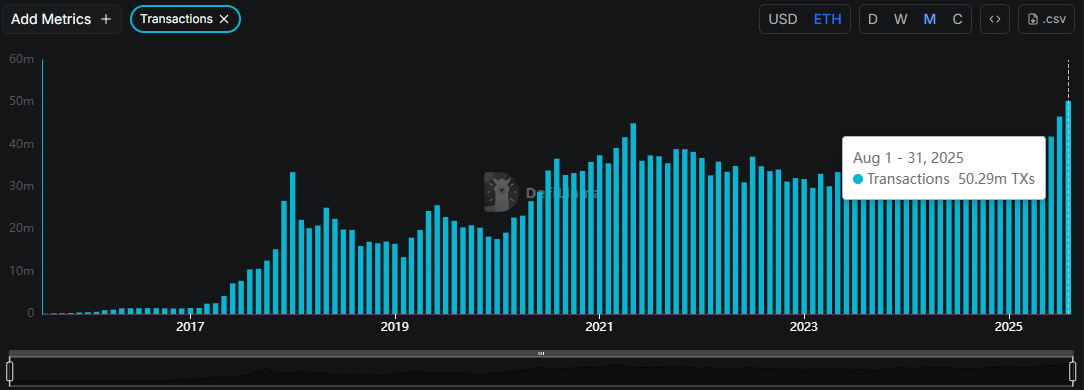

Daily Transactions Hit 50.29M

- Ethereum’s activity levels are further highlighted by 50.29 million monthly transactions, marking another all-time high.

- This figure represents transactions from August 1 to August 30. Notably, ETH daily transactions sit at 1.61 million.

- This sharp increase comes as Layer-2 solutions enable cheaper and faster transfers, making Ethereum more accessible for high-frequency activity.

- Stablecoin transfers, small-value payments, and speculative trading have fueled transaction growth.

Eyes on September Rate Cuts

- Ethereum’s price remains near its old all-time highs but has yet to establish a decisive breakout. Ethereum is roughly 11% below its all-time high of $4,954 reached earlier this month.

- Analysts note that on-chain momentum alone may not be enough to drive a rally without a return of liquidity.

- If September 2025 brings rate cuts, as many expect, capital could flow back into stablecoins and DeFi, restoring liquidity alongside record-high activity.

- That combination could provide the conditions for Ethereum to surpass its previous peaks and set new price records.

Ethereum ETF Outlook

- Ethereum ETFs have seen $13.53 billion in total inflows since launch, led by BlackRock’s ETHA ($13.1 billion) and Fidelity’s FETH ($2.8 billion), while Grayscale’s ETHE recorded $4.52 billion in net outflows.

- Daily flows remained volatile. BlackRock registered zero flows on Friday, while Fidelity saw $51 million outflow. Grayscale ETFs also posted negative flows of $28.6 million and $61 million.

Related: Corporate Treasuries and ETFs Now Control Nearly 8% of Ethereum’s Supply

Is Ethereum Ready to Surge in September?

Ethereum’s short-term outlook remains uncertain, with its price fluctuating between $4,650 and below $4,500. As of now, Ethereum is trading at $4,393, showing a 0.5% increase in the past 24 hours but a 6.8% loss over the past week. Trading volume has surged to $43.68 billion, reflecting a 10% increase in the last day.

Related: Tom Lee Sees Bitcoin Hitting $1M, Ethereum $60K as Institutions Pile In

Together, these metrics show a clear divergence. While liquidity is exiting from stablecoins and DeFi, usage is accelerating across the network. This highlights a structural shift: from a capital-heavy, yield-chasing market toward a utility-driven ecosystem where activity, not locked funds, is the growth engine.

Looking ahead, if September 2025 delivers the expected rate cuts, liquidity could flow back into the system. Combined with record-high network activity, this environment has the potential to trigger a major impulse move above previous all-time highs.

Disclaimer: This article is based on the insights and forecasts shared by market influencers and analysts. While CoinEdition has synthesized and contextualized these views, readers should treat the content as informational rather than financial advice.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.