- Bitcoin (BTC) is trading at $20,628.11 according to CoinMarketCap.

- The percentage of BTC in profit is now between 55% and 60%.

- BTC’s price could fall if it is unable to maintain a position above $20,400.

The crypto market leader, Bitcoin (BTC), is trading at $20,628.11 at press time according to CoinMarketCap. This is after its price rose by 0.61% over the last 24 hours. BTC’s price is now up 6.74% over the last 7 days as well.

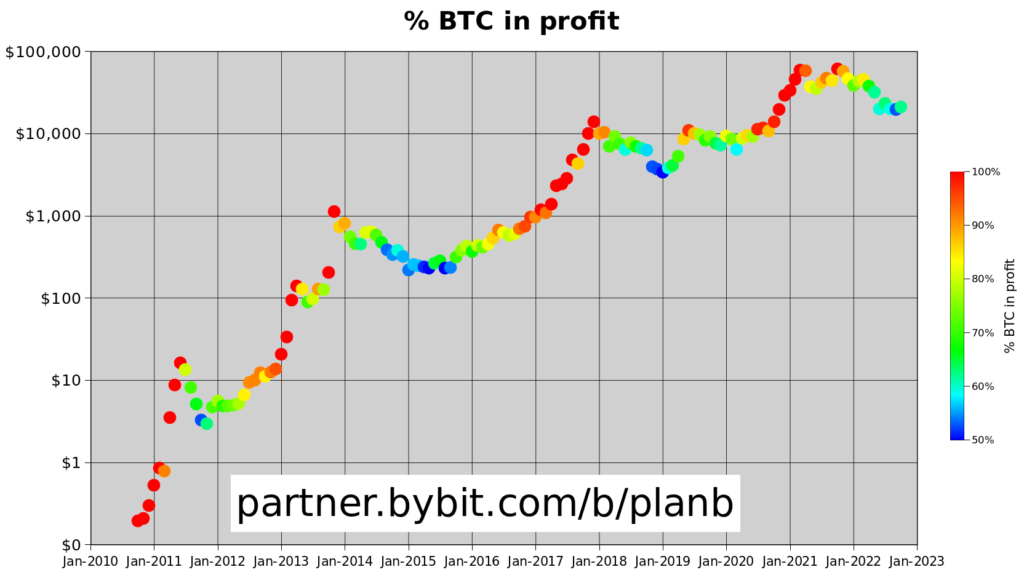

In related news, the Twitter crypto analyst who goes by the username @100trillionUSD shared a chart on Twitter on 30 October 2022 which shows that the percentage of BTC that is in profit has risen to between 55% and 60%.

Looking at the daily chart for BTC/USDT, the price of BTC is sitting just above the daily support level at $20,400 currently. The daily 9 Exponential Moving Average (EMA) line crossed bullishly above the longer 20 Exponential Moving Average (EMA) on October 23, 2022. Since then, the 9 EMA has maintained its position above the 20 EMA line.

The 9 EMA line is now acting as support, together with the support level at $20,400. The daily Relative Strength Index (RSI) indicator suggests that BTC’s price will pump slightly as the RSI line is bullishly positioned above the RSI Standard Moving Average (SMA) line. In addition to this, the RSI line is sloped positively toward overbought territory.

Should BTC close below the $20,400 level, then investors and traders should brace for a potential retracement to the 20 EMA level. If the 20 EMA level fails to hold, then the next target will be the closest support at around $19,500.

On the other hand, if the $20,400 level is able to hold over the course of the next 2 days, then BTC will likely target the $21,000 mark.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.