- $650M in unlocks arrive next week across ASTER, PUMP, ARB, STBL, SEI, DBR, STRK.

- ASTER leads with $493.26M; its 61.5% volume-to-cap ratio flags speculation.

- Key bands: ASTER $1.30 support, ARB $0.38 resistance, STRK $0.15 pivot.

The coming week will see several major token unlocks releasing over $650 million in tokens scheduled for release. According to CryptoRank data, leading the list are ASTER, PUMP, ARB, STBL, SEI, DBR, and STRK. Unlocks add circulating supply, test liquidity, and often set short-term trading ranges. Mixed momentum across these names suggests choppy price action into and after the events.

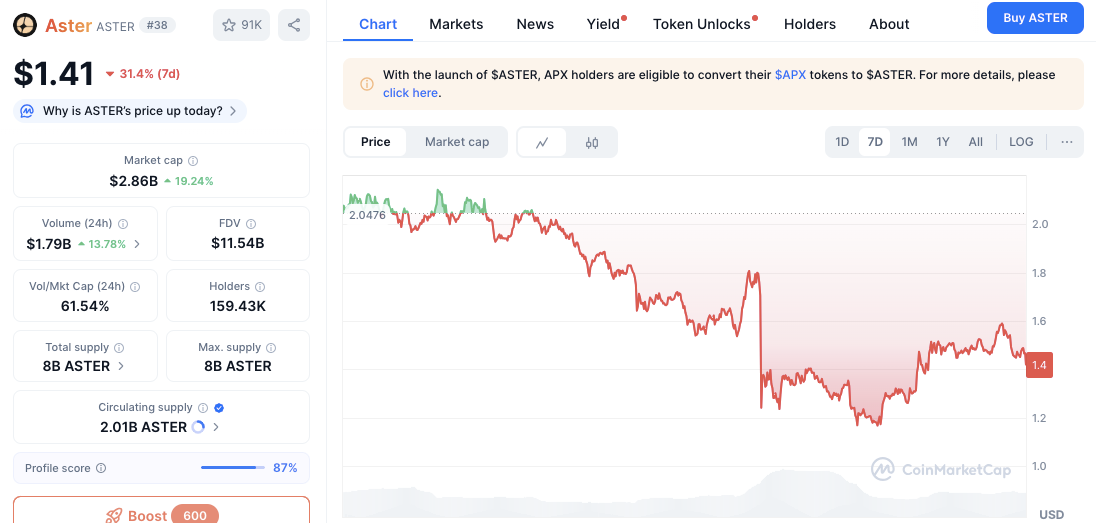

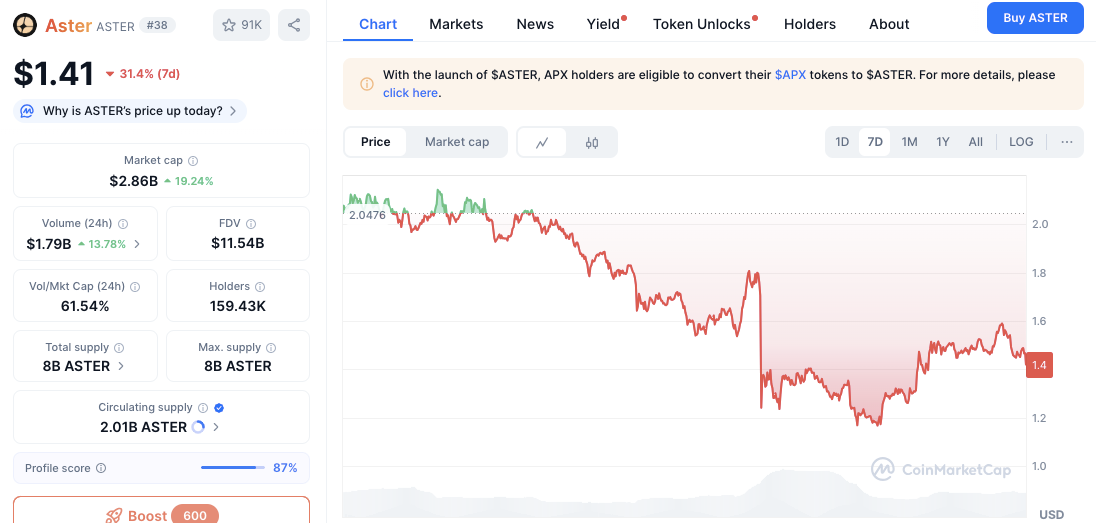

ASTER: $493.26 Million Unlock And Key Price Bands

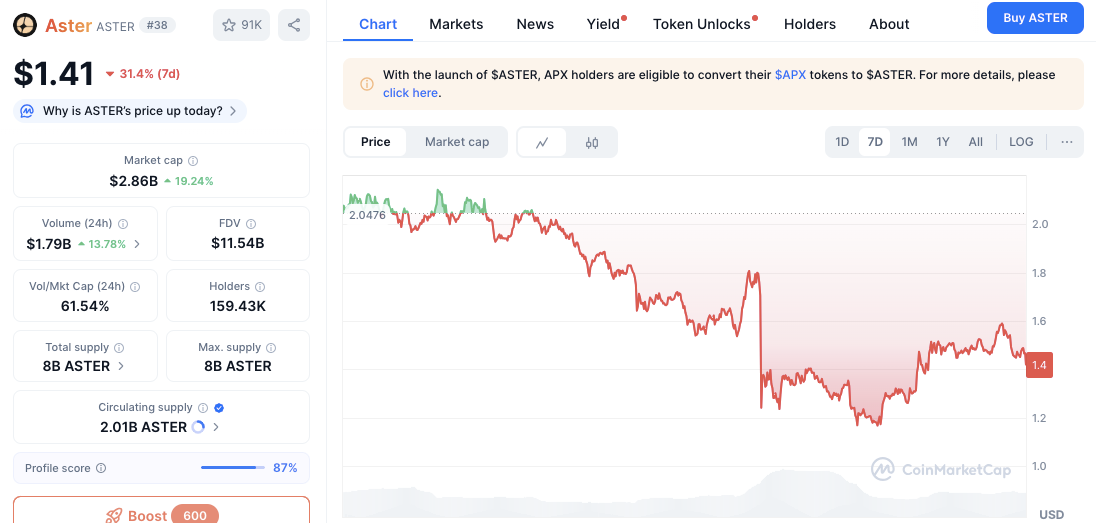

ASTER will release the largest portion of tokens, totaling $493.26 million. The token has faced a steep 31.4% decline over the past week, dropping from $2.04 to $1.41. Persistent selling pressure has capped recovery attempts near $1.80. However, a modest bounce from $1.30 suggests some buying interest around lower levels.

Immediate resistance lies between $1.60 and $1.65, while support holds near $1.30. A drop below this could expose $1.10. The token’s current market structure remains bearish, though the high trading activity reflected by a 61.5% volume-to-market-cap ratio — hints at ongoing speculation.

Additionally, investor repositioning following the APX-to-ASTER conversion has increased circulating supply to 2.01 billion tokens. Consequently, prices may remain under pressure unless ASTER regains $1.85, a key level for a potential trend reversal.

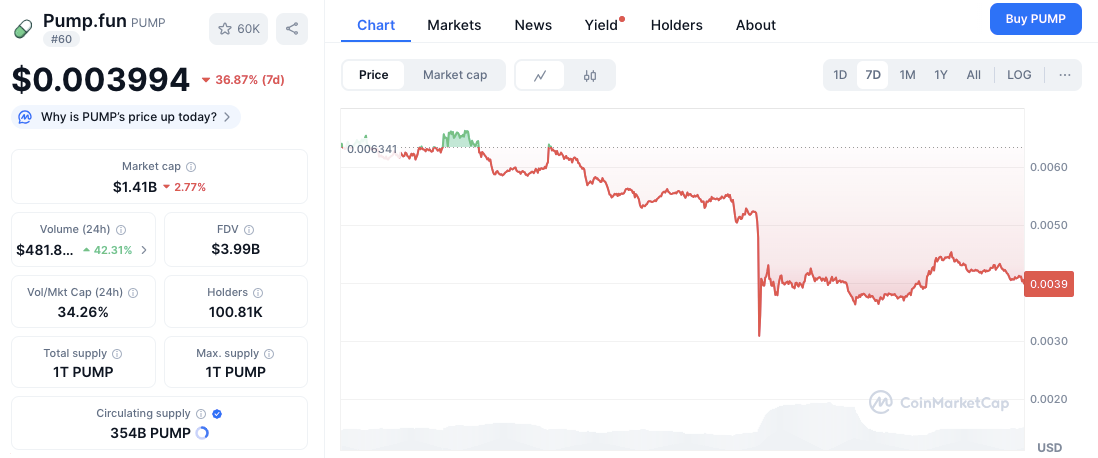

PUMP And ARB: $73.66 Million in Combined Unlocks

PUMP is next, with $41.57 million set to unlock. Its price fell 36.87% to $0.003994, extending its weekly downtrend. The token faces critical resistance between $0.0048 and $0.0063, where prior rebounds failed. Immediate support rests at $0.0036, with a breakdown risking further decline toward $0.0030.

Despite the correction, trading volume surged by 42.31%, suggesting active market participation. Hence, if buyers defend the $0.0036 zone, PUMP could attempt a short-term recovery.

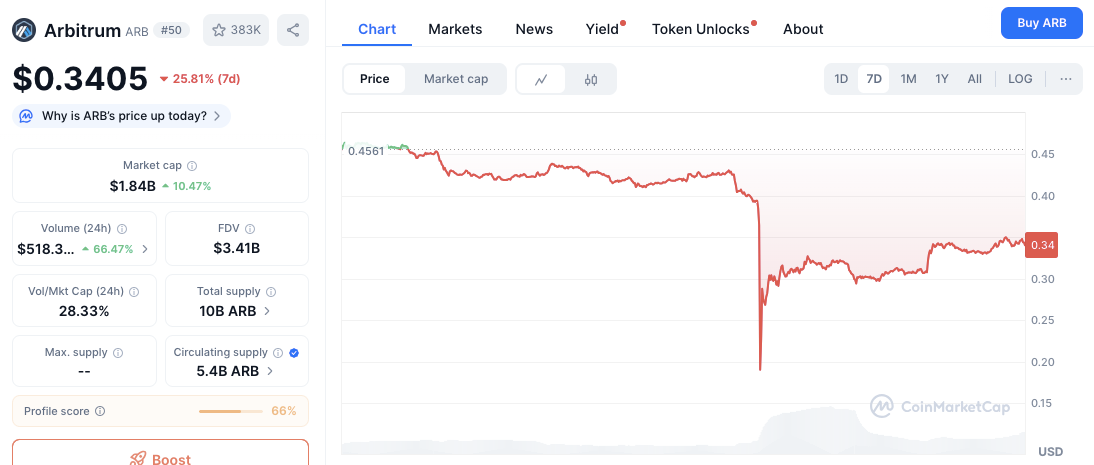

Arbitrum (ARB) follows with a $32.09 million unlock. The token lost 25.81% over the week, trading at $0.3405 after falling as low as $0.26. Support remains firm at $0.31, while resistance at $0.38 and $0.45 caps recovery efforts.

ARB’s 66.47% spike in daily volume indicates that accumulation may be forming near the lower range. However, any bullish reversal depends on a sustained breakout above $0.38.

Mid-Tier Unlocks: STBL, SEI, and DBR

STBL will release $30.30 million in tokens next week. The asset has declined 52.01% in seven days to $0.1403. The price remains trapped below $0.20, with strong resistance near $0.25. Immediate support stands at $0.12, while a breakdown could send prices toward $0.10. Despite 15.8K holders, a high fully diluted valuation of $1.4 billion continues to weigh on sentiment.

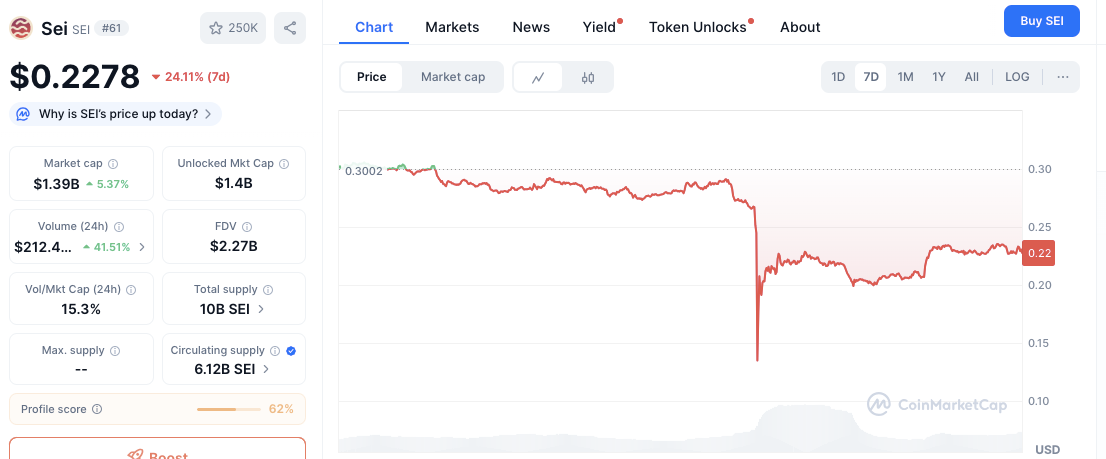

SEI’s upcoming $22.11 million unlock coincides with a 24.11% weekly drop to $0.22. The price is consolidating between $0.21 and $0.25 after sharp losses from $0.30. Trading volume has risen by 41.5%, suggesting potential accumulation. Sustained closes above $0.25 may enable a retest of $0.27–$0.29, while losing $0.21 could trigger a slide toward $0.19.

deBridge (DBR), with an $18.41 million unlock, traded within the $0.025–$0.035 range. After rebounding from $0.027, DBR’s 24-hour volume jumped 42.6%, indicating renewed interest. Resistance stands at $0.0325–$0.035, while a close below $0.027 may invite another correction. Holding above $0.030 remains key for short-term bullish stability.

STRK’s $16.86 Million Unlock Marks Key Test

Starknet (STRK) will unlock $16.86 million worth of tokens amid a 24.49% weekly slide to $0.1296. The token struggled to regain footing after a midweek crash that pushed it below $0.11. Support is holding near $0.12, while resistance lies at $0.15.

Moreover, a breakout above $0.15 could signal a short-term recovery, whereas a drop under $0.10 may attract fresh selling. Trading volume has climbed 40.69%, implying attempts at stabilization despite ongoing bearish sentiment.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.