- NFT activity on OpenSea saw a significant surge in January 2023.

- The NFT loans reached an all-time high in January.

- Polygon overtook Ethereum in terms of NFTs sold last month.

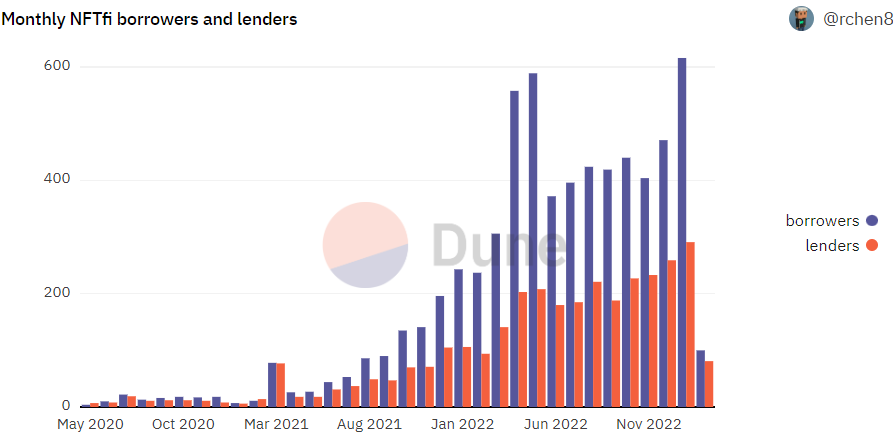

The NFT lending ecosystem saw significant growth during the first month of 2023. NFT activity on popular chains like Ethereum and Polygon reached record highs in terms of lenders and borrowers, monthly loan volume, and the number of loans processed in January.

On-chain data derived from Dune Analytics provided insight into the NFT lending metrics from January. The NFT loan volume in USD came in at $26.3 million, the highest since May 2022. At 4399, the number of monthly NFT loans reached an all-time high. January saw more borrowers than any month before.

A chain-wise breakdown of the NFT sales volume on NFT revealed that Polygon beat Ethereum in terms of monthly NFT sales. Polygon users bought 1.5 million NFTs in January, compared to Ethereum users, who bought 1.1 million NFTs. The average loan size was nearly $6,000.

However, Ethereum users took the lead in terms of sales volume. After five months of declining sales, the month of January saw a resurgence with more than $446 million in NFT sales reported on OpenSea, the highest since August last year. Polygon NFT sales on OpenSea accounted for $15.3 million.

The NFT lending ecosystem has been on the rise since June last year. The timing suggests that the increasing loans through NFTs were likely due to the crypto contagion that started right around that time. Investors were likely cashing in or borrowing against the NFTs they accumulated during the bull run of 2021. The number of borrowers consistently grew from June.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.