- Binance leads with 40% Bitcoin reserve share amid growing trust and market demand.

- Bitcoin nears $100K, boosting institutional adoption and Binance’s market leadership.

- Regulatory scrutiny fails to slow Binance’s growth as crypto adoption accelerates.

The crypto market has seen a shift in power, with Binance emerging as a dominant player in the global exchange network.

Despite challenges like regulatory scrutiny and market volatility, Binance has solidified its position, capturing an increasing share of the Bitcoin reserve market among Proof-of-Reserve (PoR) exchanges.

Binance’s Bitcoin Reserve Market Share Grows Since 2017

Data from CryptoQuant founder Ki Young Ju highlights Binance’s growth from mid-2017 to late 2024. Starting with a small share in 2017, Binance expanded rapidly, reaching about 10% of the market share by early 2018.

After a decline phase from 2018 to 2020, the exchange began to increase its dominance in 2021, coinciding with a surge in global crypto-asset adoption.

From mid-2021 onward, Binance’s market share steadily climbed, surpassing 40% in 2024. This growth reflects its ability to attract users through broad liquidity, an expanding user base, and competitive services.

Binance’s rise also occurred during intense market competition and heightened demand for transparent reserve management.

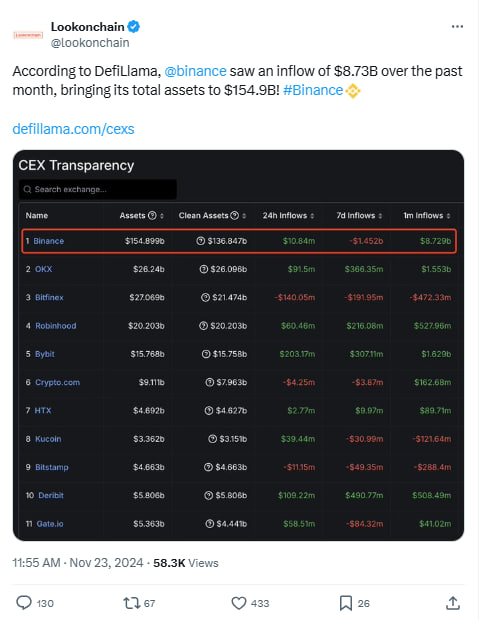

Binance Records $8.73 Billion Asset Inflows in 2024

In November 2024, Binance recorded an asset inflow of $8.73 billion, raising its total holdings to $154.9 billion. Amid economic uncertainties, users are moving toward platforms that offer reliable solutions, with Binance reportedly attracting users with services like staking, crypto loans, and institutional asset management.

Read also: Bitcoin Surges, CZ is Released, and Binance is Raking it in!

The company attributes its growth to a diverse product lineup tailored to crypto investors’ needs. Despite facing regulatory scrutiny, Binance remains a leading choice for managing digital assets.

Meanwhile, analysts remain positive about Bitcoin’s performance, believing that Bitcoin could reach $500,000. This upward outlook has gained momentum from increasing institutional adoption and Bitcoin’s reputation as a scarce asset in high demand.

As of press time, Bitcoin (BTC) was priced at $97,808.07, with a trading volume of $58.52 billion. While its price has dropped 0.47% in the past 24 hours, it shows a 7.93% increase over the past week, reflecting continued investor interest.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.