- SUI shows strong recovery, forming a fractal pattern that suggests a potential rally.

- XLM maintains stability with a bullish flag pattern and long-standing institutional partnerships.

- The market cap battle intensifies as SUI gains momentum, but XLM holds an advantage with deeper liquidity.

SUI and XLM compete for supremacy as SUI gains speed in scalability and interoperability while XLM leverages strong institutional ties.

With SUI just behind XLM in token rankings, the question of who will reclaim the top spot remains open. A close look at market dynamics, technical setups, and growth potential reveals an exciting race ahead.

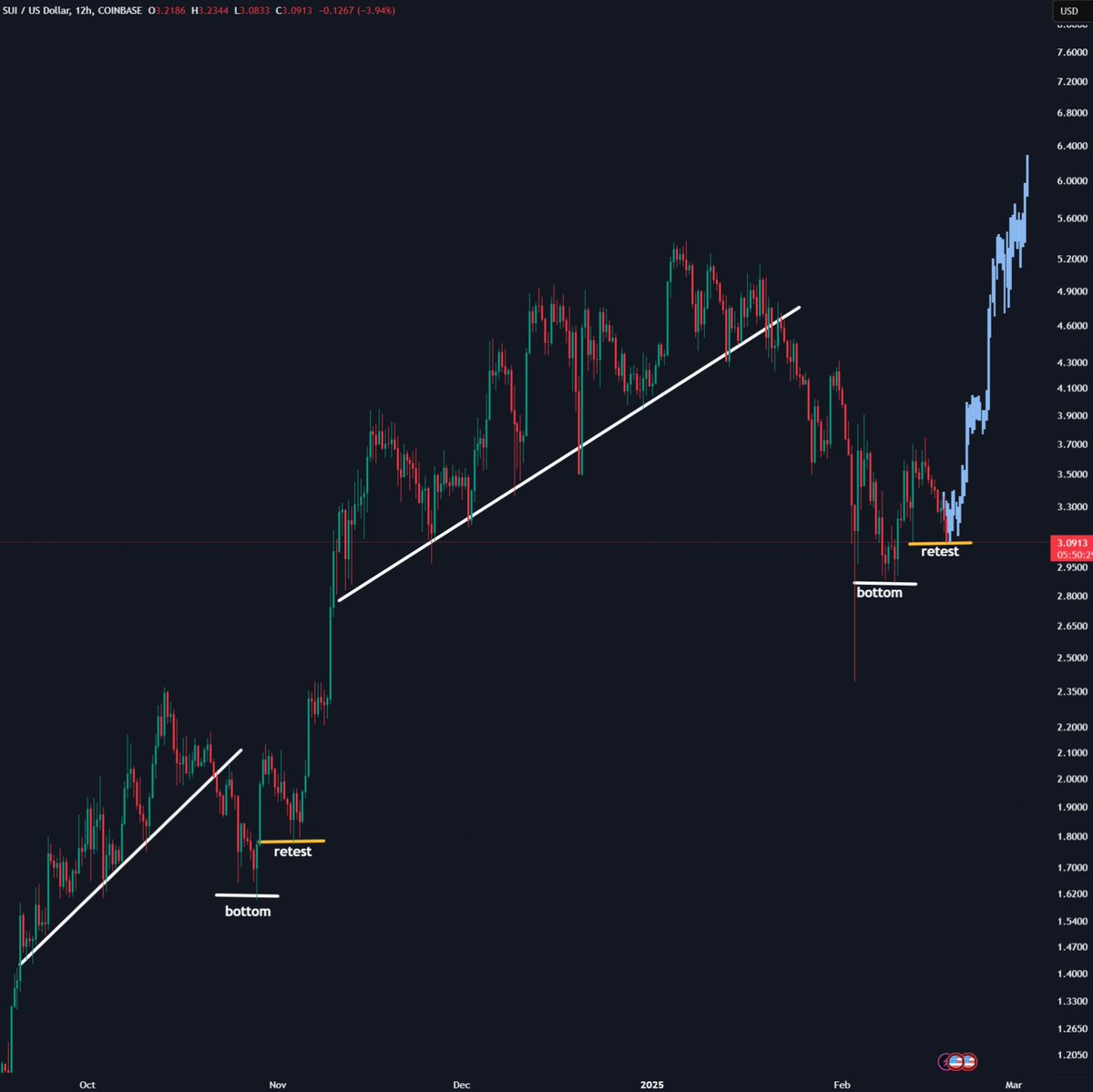

SUI’s Comeback: A Bullish Revival?

SUI shows impressive scalability, processing 297,000 transactions per second with sub-second finality. Recent updates include a USDC launch on the SUI network, Phantom wallet integration, and Grayscale’s launch of an SUI trust for institutional investors.

Its most notable move could come from the Axelar MDS integration, which connects SUI to over 70 chains.

Related: Massive $3.9B Crypto Token Unlock in March: Top Tokens to Watch

A technical review of SUI shows a fractal pattern in Q4 2024, with analysts identifying $2.8 as a potential support level. Historical data from similar setups points to 2-3x price gains, making SUI an asset worth watching.

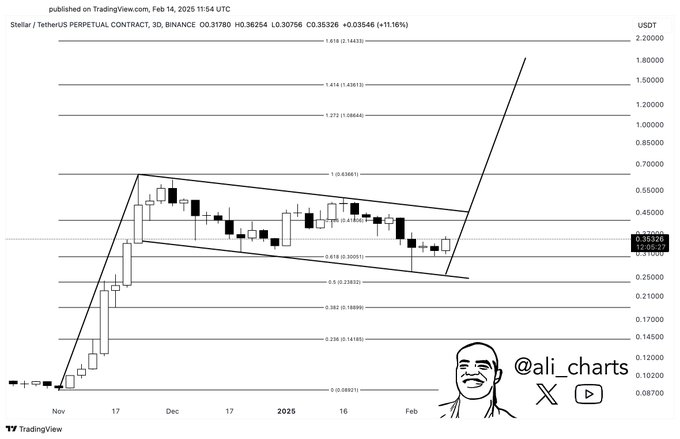

XLM’s Strategic Advantage

XLM capitalizes on its deep-rooted institutional connections. The Stellar network’s partnerships with firms like Franklin Templeton, Stripe, and ties to Elon Musk’s SpaceX strengthen its credibility.

Technical analysis identifies a bullish flag pattern, with analysts predicting a breakout towards $1.80—a 4x potential from current levels.

XLM’s higher liquidity and longer market presence offer more stability compared to SUI’s volatility.

Related: Altcoin Season Heats Up: XRP, HBAR, XLM, and ADA on the Rise

Even though both SUI and XLM appear to be in consolidation phases. XLM’s bullish flag strongly suggests an upward breakout while SUI’s fractal pattern is less directional; it could break either way.

Market Cap Showdown: Who Takes the Lead?

Currently, XLM ranks 12th in market cap, with SUI close behind at 13th, according to CoinMarketCap. SUI’s recent momentum and its potential boost from interoperability could drive its rise, but XLM’s established trust and institutional support keep it in a strong position.

Both altcoins project bullish trends—SUI may rally quickly, while XLM’s growth appears steadier and more sustainable. The coming weeks will reveal whether SUI overtakes XLM or if XLM solidifies its lead.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.