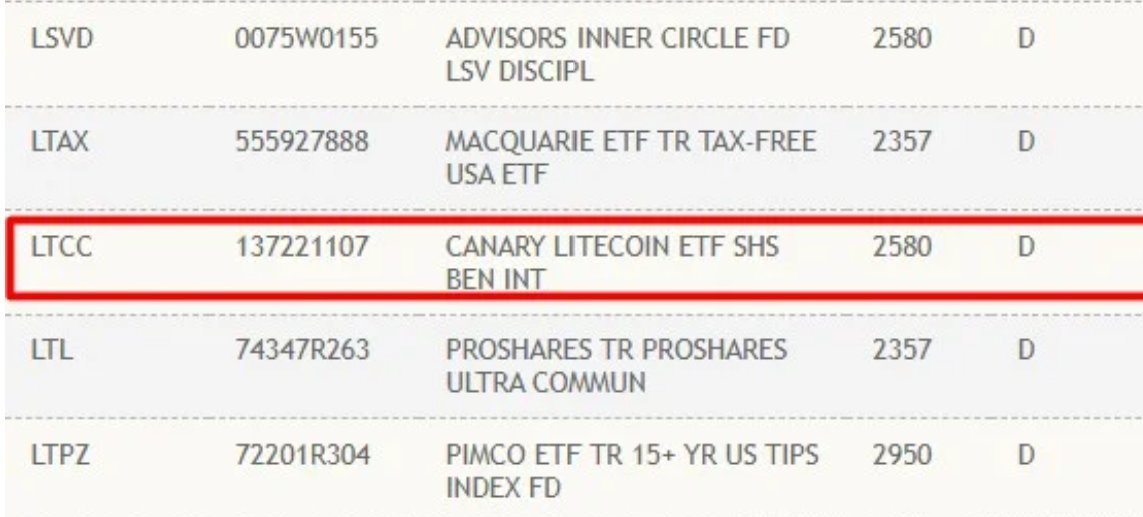

- Spot Litecoin ETF by Canary Capital has been listed on the DTCC website

- The ETF has been listed under the ticker LTCC, as per Litecoin Foundation

- Litecoin price soared 4% in the past day as the cryptocurrency faces resistance at $142

The spot Litecoin exchange-traded fund (ETF) by Canary Capital has appeared on the official website of the Depository Trust and Clearing Corporation (DTCC). This listing, under the ticker LTCC, can potentially impact the price of the LTC token for sure.

Litecoin Foundation, the group focused on Litecoin’s growth, confirmed this news on their X handle.

The firm shared an image of the ETF listed on DTCC under LTCC (seen below). In their statement, the Foundation noted that DTCC is a key part of global financial markets. They added that it “processes trillions of dollars in securities transactions each day.”

Mainstream Adoption Beckons for Litecoin ETF

By getting listed in this system, the Canary Capital Litecoin ETF moves closer to mainstream adoption. And If the Litecoin ETF is approved for broader trading, increased institutional demand can positively impact price and improve liquidity.

Reflecting market optimism, in the past 24 hours, LTC soared over 4%. It reached a daily high of $139.09. Currently, as of this report, the cryptocurrency trades at $135.81. It now faces resistance at the $142 price tag. Should the altcoin break above this level with substantial volume, investors can expect even higher prices.

Related: Altseason Watch: XRP, ADA, SUI Lead Price Surge Plus Five More to Watch

LTC Price Analysis: Bullish Momentum Building

To understand the price dynamics, the RSI (Relative Strength Index) reads a value of 61.26. This reading suggests that LTC is in bullish territory. Importantly, it’s not yet overbought, meaning further upward movement is possible.

Adding to this bullish outlook, the gradient of the RSI line indicates a similar situation for LTC in the near future. Therefore, a retest of $142 is likely. Following this retest, a breakout could occur if the broader market also rallies.

MACD Indicator Reinforces Bullish Outlook

Further supporting the bullish analysis, the MACD (Moving Average Convergence Divergence) is positive. This positive MACD is because the MACD line (blue) remains above the signal line (orange).

Related: Altcoin Season MIA? Raoul Pal Reveals Crypto Portfolio, Puts Sui Ahead of Solana

This positioning is a key indicator of growing bullish momentum. In conclusion, the approval of the Litecoin ETF could put the cryptocurrency on the path to new all-time highs this cycle.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.