- Centralized perpetual exchanges hit $58.5 trillion in 2024 trading volume, doubling 2023’s figures.

- Hyperliquid dominated decentralized perpetuals with over 55% market share in Q4.

- Bitcoin led open interest at 45%, while Solana saw a significant volume spike in 2024.

The crypto perpetual futures market went into overdrive in 2024, moving past previous trading figures.

The latest report from market tracker CoinGecko shows that the top 10 exchanges recorded $58.5 trillion in trading volume, more than double the $28 trillion recorded in 2023. This makes 2024 the most active year ever for perpetuals trading, driven by a massive surge in Q4, with volume jumping +79.6% from $11.8 trillion in Q3 to $21.2 trillion.

CEXs: Binance Still Leads, But Loses Ground

Despite the impressive volume, Binance—long the market leader—has seen its dominance wane. The exchange’s market share dropped from 43% in January to 34% by December. However, Binance continues to lead the sector by a wide margin.

Related: Binance Crackdown: Bans Market Maker & Compensates Users in $GPS, $SHELL Case

Meanwhile, a notable development in the centralized exchange market was Coinbase International’s rise into the top 10 for the first time. The platform’s volumes quadrupled in December, securing it a place among the leading players in the perpetuals space.

DEXs: Hyperliquid’s Rise and dYdX’s Fall

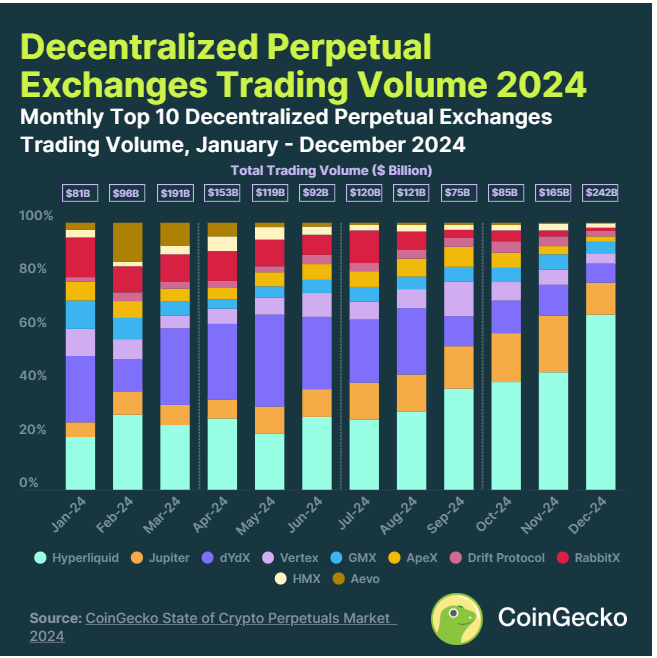

On the decentralized side, the top 10 decentralized perpetual exchanges collectively saw their trading volume soar to $1.5 trillion in 2024. This is a remarkable +138.1% increase from 2023’s $647.6 billion. Q4 alone accounted for $492.8 billion, reflecting a +55.9% increase from the previous quarter.

A standout performer in the decentralized exchange space was Hyperliquid (HYPE). It captured more than 55% of the total market share in Q4. This surge was fueled by a successful airdrop, which saw Hyperliquid peak at a dominant 66% of market share in December.

While Hyperliquid thrived, dYdX, a former market leader, saw a sharp decline in its market share for 2024. At the start of the year, dYdX held a commanding 73% of the market share. However, by December, this had fallen to just 7%.

Solana’s Role: Growing, But Still Behind

Solana-based decentralized exchanges also saw notable growth, with Jupiter emerging as the second-largest player in the space. However, Solana as a whole accounted for only 15% of total perpetual trading volume in 2024.

This indicates that while its ecosystem expands, it still lags behind other major blockchains in the perp trading sector.

Related: Solana Community Rejects Inflation Overhaul While Backing Staking Rewards Reform

Bitcoin’s Dominance in Open Interest

When it came to open interest (OI), Bitcoin continued to dominate the centralized perpetuals market, consistently making up around 45% of OI in 2024.

Related: Bitcoin Open Interest Reaches $18.2B Following BTC’s Surge Above $72K

Ethereum followed with 21%, while Solana held a smaller 4% share. OI hit a major milestone in November 2024, crossing the $100 billion mark for the first time, driven by bullish market sentiment following the U.S. presidential election.

Meanwhile, Solana also saw a sharp spike in perpetual trading volume at several points during the year. Notably, these spikes occurred around the launch of pump.fun in early 2024. introducing celebrity-themed tokens like Caitlyn Jenner (JENNER) and Mother Iggy (MOTHER), further amplified Solana’s presence in the market.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.