- Ali Martinez predicted that if XRP loses $2, a retest of $1.60 is likely.

- XRP has also failed to reclaim the resistance at the 20-EMA of $2.33.

- Pro-XRP lawyer Bill Morgan believes that drawing out the SEC vs. Ripple case will hurt XRP.

XRP finds itself in a crucial price band as it hovers around the $2.28 mark (currently trading slightly higher at $2.30). After touching a low of $2.23 in the past 24 hours, XRP is now facing a significant hurdle: the 20-day Exponential Moving Average (EMA) at $2.33, according to data from CoinMarketCap.

Crypto analyst Ali Martinez has warned that a price drop below $2 could trigger a significant decline, stating, “Below $2, a gap with no significant support could pull it to $1.60.”

The $2 Line in the Sand: A Potential Drop to $1.60?

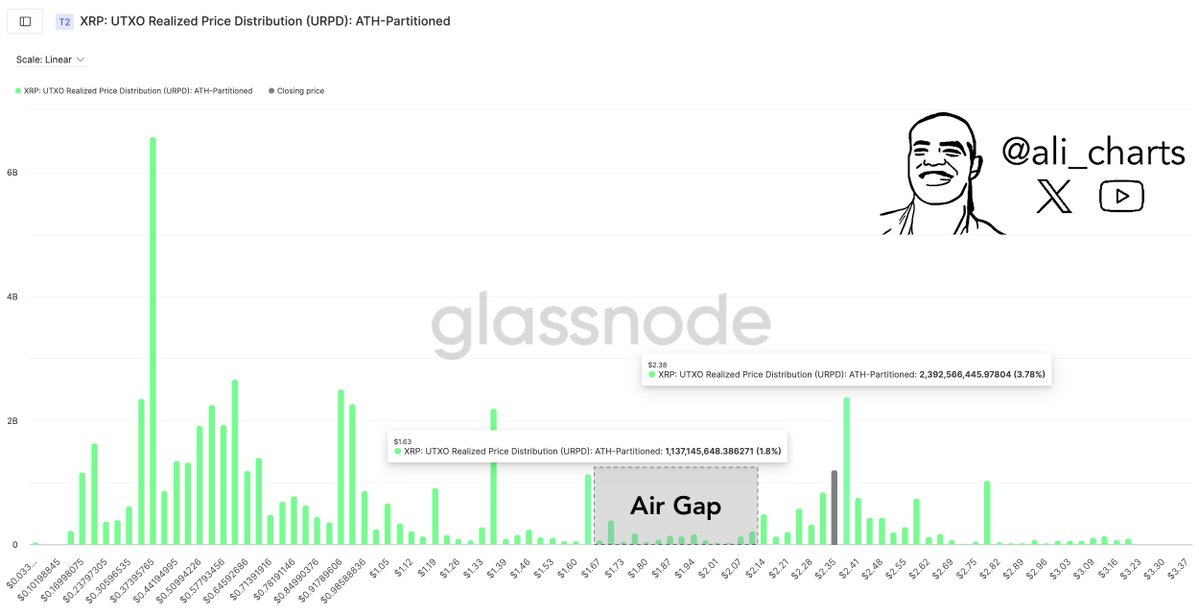

A look at a chart from Glassnode reveals a concerning “air gap” in the UTXO Realized Price Distribution (URPD) between $2 and $1.60. This “air gap” essentially means there hasn’t been much significant buying activity in this price range.

Consequently, if XRP loses its footing at $2, there isn’t much in the way of support to stop a rapid fall to the next major demand zone around $1.60.

Historically, when an asset dips into an area with very little trading volume, it tends to move quickly towards the next level where there’s strong buying or selling interest.

The fact that a significant number of realized prices are clustered near $1.60 reinforces Martinez’s view that this level could act as the next critical support if sellers continue to dominate.

Related: XRP Price Alert: Support Test, Bearish Signals, Bullish Hopes

SEC Lawsuit Clouds Over XRP

It’s impossible to discuss XRP without mentioning the ongoing SEC lawsuit. Back in January, speculation that the SEC might withdraw its appeal in the Ripple case sparked a rally that saw XRP’s price soar to nearly $3.40. However, the lingering uncertainty surrounding this legal battle remains a significant factor contributing to XRP’s price swings.

Pro-crypto lawyer Bill Morgan has voiced concerns that the SEC’s prolonged silence on the matter could put increasing downward pressure on XRP’s price.

Additionally, broader economic factors, including President Trump’s tariff policies and developments in Crypto Strategic Reserve Assets, have also played a role in shaping XRP’s trajectory, adding another layer of uncertainty to the market.

Analyzing XRP’s Price Action

As per the XRP daily chart below, the Relative Strength Index (RSI) is currently around 46.24, indicating neutral momentum. However, the direction of the RSI line suggests a downward trend, with bullish strength appearing to weaken. If the RSI continues its decline, XRP could indeed slip further.

Related: XRP Price Check for March 19: Analyzing Key Support and Resistance Levels

Additionally, the upper Bollinger Band is currently sitting at $2.71, while XRP’s price continues to trade below the midline (the 20-day Simple Moving Average) at $2.33. Notably, there’s significant support at the lower Bollinger Band, down at $1.95.

XRP could very well retest the lower band, potentially losing the crucial $2 price level in the process. A clear break below $2 could, however, confirm Martinez’s bearish prediction of a slide to $1.60.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.