- Bitcoin shot up almost 4% after Metaplanet bought 150 BTC.

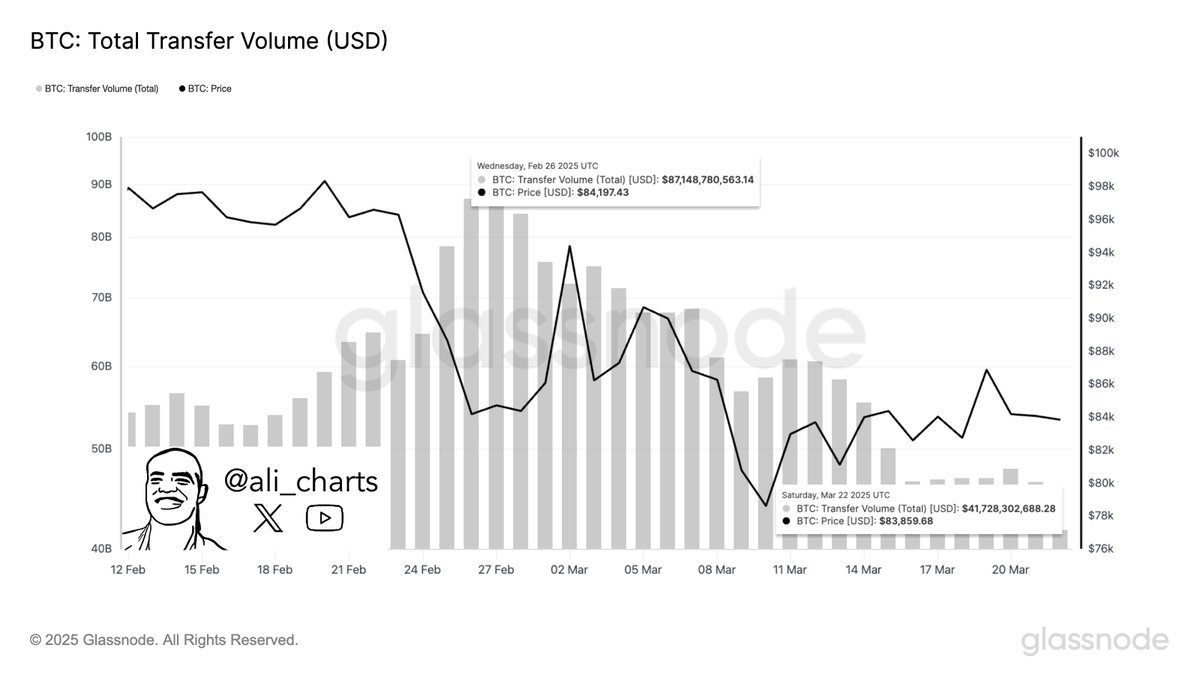

- Bitcoin total transfer volume declined from $87 billion to $42 billion in the past month.

- BTC also reclaimed the 20-day Exponential Moving Average (EMA) at $85,515.

Bitcoin (BTC) has investors watching closely after recent developments suggest a strong move back toward $90,000.

The leading digital asset has successfully climbed back above its 20-day exponential moving average at $85,515 and is currently trading at $87,339.80, marking a 3.57% increase over the last 24 hours, according to CoinMarketCap data.

What’s Driving the Latest Bitcoin Accumulation?

The price jump followed Tokyo-based investment firm Metaplanet increasing its Bitcoin holdings with an additional purchase of 150 BTC, bringing their total to 3,350 BTC. At today’s market prices, this is roughly $292 million.

Adding to the bullish signals, Metaplanet recently appointed Eric Trump, son of US President Donald Trump, to their strategic advisory board. This high-profile move could further enhance Bitcoin’s standing among institutional investors.

Related: Arizona House Committee Greenlights Bitcoin Reserve Bill

Is Declining Transfer Volume a Concern?

Despite Metaplanet’s bullish stance, Bitcoin’s transfer volume has significantly declined in the past month. According to analyst Ali Martinez, BTC transfer volume dropped from $87 billion to $42 billion in the last 30 days.

While this decrease might initially worry some about short-term liquidity, Martinez points out key support and resistance levels to watch. Bitcoin’s main support area lies between $82,590 and $85,150, where 1.16 million investors bought 625,000 BTC. On the upside, the primary resistance is between $95,400 and $97,970, where 1.77 million investors hold 1.44 million BTC.

How Are Macroeconomic Factors Helping Bitcoin

US President Donald Trump’s recent indication of a more flexible approach to the upcoming April 2 reciprocal tariffs has boosted market sentiment. This shift, along with the Federal Reserve’s apparent willingness to look beyond short-term inflation worries, has created a more welcoming environment for risk assets like Bitcoin.

Related: Bitcoin Spikes to 87K: This One’s on the Fed for Keeping Rates Steady

Markus Thielen, founder of 10x Research, has noted that Bitcoin appears to be forming a price bottom, supported by these macroeconomic adjustments.

Bitcoin Price Analysis

Bollinger bands currently show Bitcoin trading near the middle band, with upper resistance around $90,250 and lower support at $78,823. A move above the middle band could propel BTC toward $90,000, while a drop below $84,536 might signal further downside.

Analysis of the Relative Strength Index (RSI) shows BTC’s RSI at 51.96, indicating neutral momentum. However, if the RSI climbs above 55, it could suggest increasing bullish strength, potentially driving prices higher.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.