- Canada to debut world’s first spot Solana ETFs with staking on April 16, 2025

- Solana price consolidates between $130–$134 ahead of ETF launch momentum

- Bullish MACD crossover and rising RSI signal strengthening upward price trend

Canada is all set to launch the world’s first spot Solana (SOL) exchange-traded funds (ETFs).

Following the approval by the Ontario Securities Commission, major issuers including Purpose, Evolve, CI, and 3iQ are set to debut these new funds on April 16, 2025.

Why Are Canada’s Solana ETFs Groundbreaking?

Unlike typical spot crypto ETFs, these Canadian funds uniquely combine direct asset holding with yield generation.

The ETFs will hold physical Solana and actively stake the SOL tokens. This structure provides investors not only with SOL price exposure but also potential income through staking rewards, simplifying access to yield compared to self-custody staking. With Ethereum staking already popular, these potentially higher-yielding Solana staking ETFs could attract broad investor interest.

How Is SOL Price Reacting Before the ETF Launch?

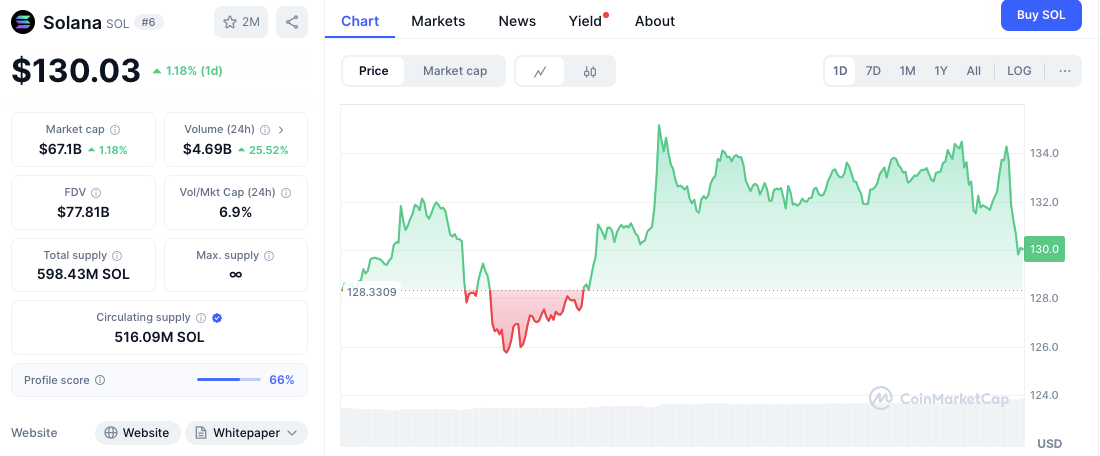

As of press time, Solana is trading at $130.78, showing a 1.91% daily gain as anticipation builds. After briefly dipping below $128, the price quickly recovered, signaling strong support at lower levels. SOL entered a short-term consolidation phase between $130 and $134.

Related: The Solana Squeeze: Multiple Pressures Push Price Below Critical $100

Support lies around $128.33, where a sharp bounce recently occurred. Another strong support is at the $130 mark, a level that has held firm over the past sessions.

Key resistance sits near $134.00, a level that has previously capped rallies, with a minor hurdle around $132.50.

Technical Indicators Show Positive Momentum

Solana’s current technical indicators support a bullish short-term outlook. The Relative Strength Index (RSI) currently sits at 52.02, signaling building momentum while avoiding overbought conditions. A notable crossover above its moving average indicates rising investor confidence.

Related: Positive News Barrage Hits Solana: Analyzing ETF and PayPal Moves

Meanwhile, the MACD recently flashed a bullish crossover, a reliable indicator of growing upward pressure. The MACD line has moved above the signal line, with a positive and expanding histogram.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.