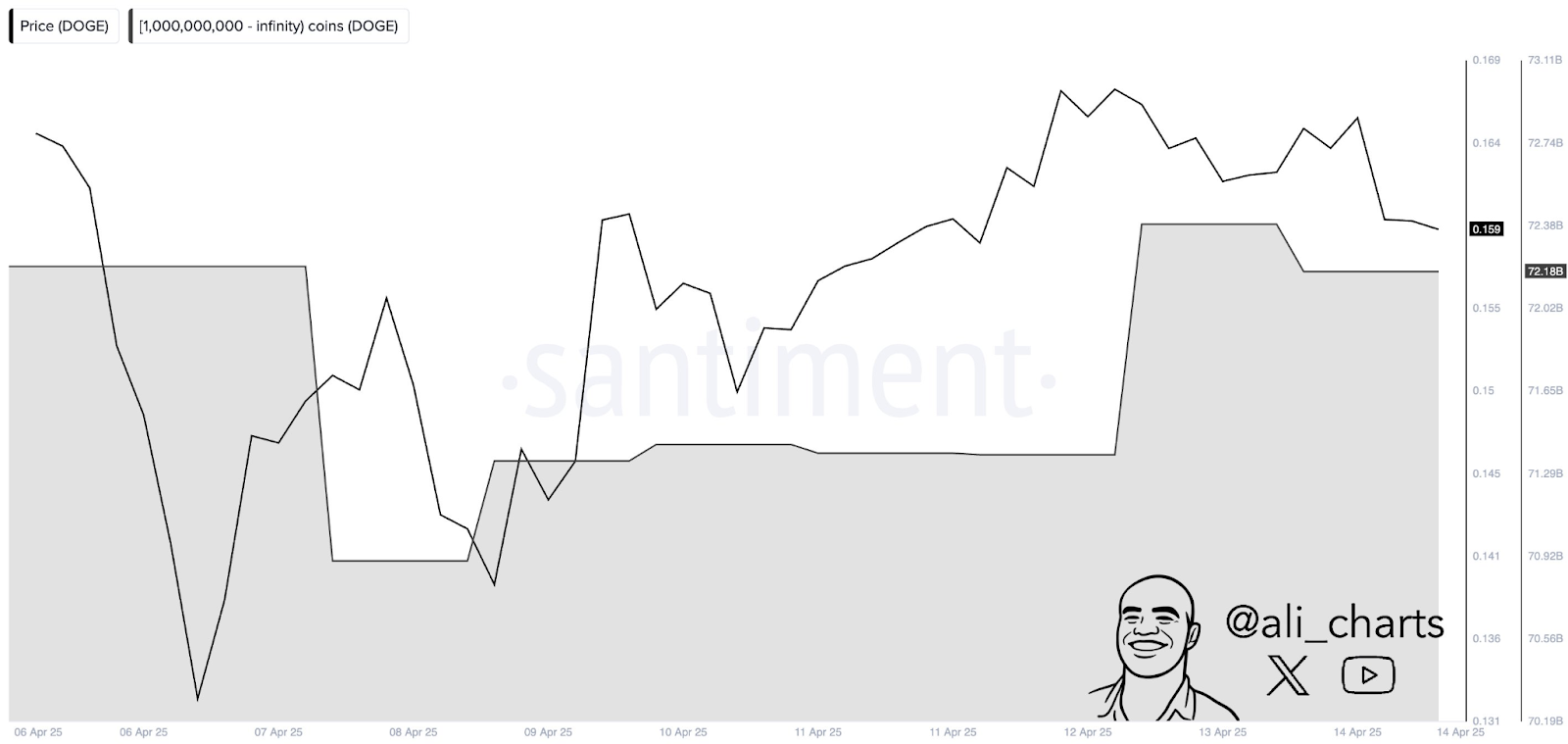

- Whale wallets added 800M DOGE, pushing total holdings to 72.18B in 48 hours.

- DOGE holds strong support at $0.1580; resistance remains near the $0.1660 zone.

- RSI and MACD indicators hint at a potential bullish reversal forming this week.

Dogecoin (DOGE) shows renewed strength after a recent correction, fueled by a sharp price rebound and large buys from whale wallets.

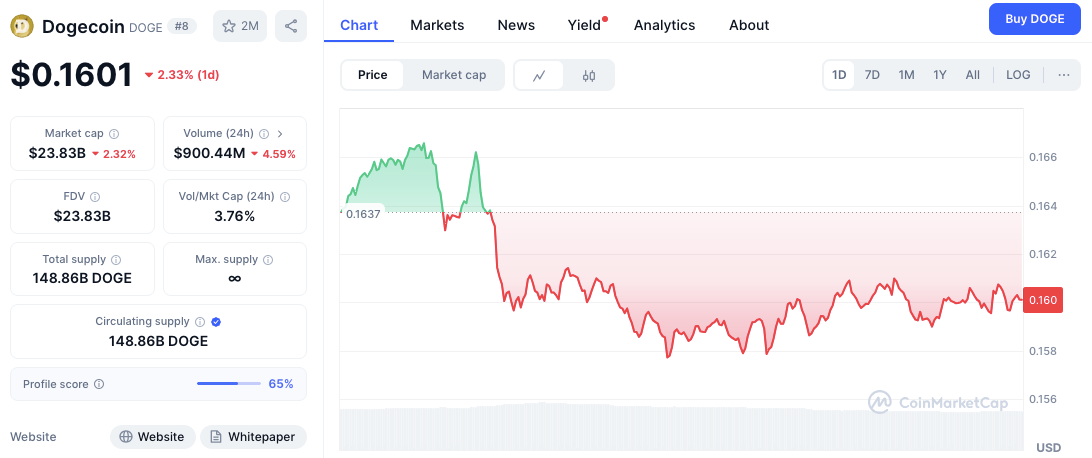

The cryptocurrency, which recently dipped after peaking near $0.169, has seen a significant uptick in investor interest.

Why Are Dogecoin Whales Accumulating DOGE Now?

A key factor in this resurgence is from the whale wallets amassing over 800 million DOGE in the past 48 hours.

Ali Martinez reported that large holder’ wallets with over 1 billion DOGE have collectively boosted their holdings to 72.18 billion DOGE. This aggressive buying aligns with the recent DOGE price rebound. Because whale activity often precedes larger price moves, this accumulation is viewed as a bullish signal by many traders.

Significantly, the surge in whale accumulation has helped DOGE recover from its earlier downturn. Price dropped until April 7 but reversed course shortly after, climbing to nearly $0.169 before pulling back slightly. As of now, DOGE is trading around $0.1603, holding onto key support zones.

Related: Dogecoin Comeback? Whales Accumulate as Charts Signal Potential Rally

DOGE Price Holds Support, But What Resistance Blocks Rally?

Dogecoin’s technical chart presents near-term opportunities and hurdles. Immediate support rests at $0.1580, a level that has held firm under recent tests.

A deeper secondary support exists at $0.1565. These levels are critical for maintaining short-term bullish sentiment.

On the upside, resistance is clustered between $0.1635 and $0.1660. A minor hurdle also exists near $0.1650. A decisive break and hold above the $0.1660 area could clear the path for a retest of the $0.169 peak and potentially higher levels.

Momentum Indicators Show Subtle Strength

The Relative Strength Index (RSI) stands at 45.62, reflecting neutral momentum but hinting at a possible shift. Interestingly, a bullish divergence seems to be forming, where the RSI gradually rises despite flat or lower prices. If RSI climbs above 50, it would signal strengthening buyer momentum.

Related: On-Chain Data Shows Dogecoin User Engagement Spiking: 400%

Additionally, the MACD shows signs of a potential bullish crossover. The MACD line is nearing a move above the signal line, supported by a slightly positive histogram. If confirmed, this crossover could validate the early bullish trend suggested by price and volume dynamics.

Dogecoin (DOGE) Price Outlook for April 16?

For April 16, Dogecoin’s outlook depends on holding support and breaking resistance. As long as whale accumulation continues and support levels hold, Dogecoin could maintain its bullish stance.

Investors should watch volume and the $0.1635-$0.1660 resistance zone closely. A breakout above $0.1660 could trigger another rally, while a drop below $0.1565 would challenge the current bullish setup.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.