- XRP trading volume dropped 25% to $1.8 billion amid weakening market participation.

- Options open interest plunged 53.69%, while options volume spiked 73.58%.

- Traders remain cautious ahead of the SEC’s decision on Grayscale’s spot XRP ETF.

XRP has registered a 24-hour trading volume drop of 25% to $1.8 billion amid weakening market interest. Despite a slight uptick in the past day, XRP is moving sideways, caught between support at $2 and resistance at $2.1 as traders await a decisive breakout.

Trading Volume Falls as Market Cools

XRP’s falling trading volume reflects declining short-term momentum and reduced trader participation. The 25% drop in volume suggests fewer investors are entering new positions, as the token trades in a tight range.

Related: Analyst Eyes XRP Breakout With Resistance at $2.30 and Falling Inflows

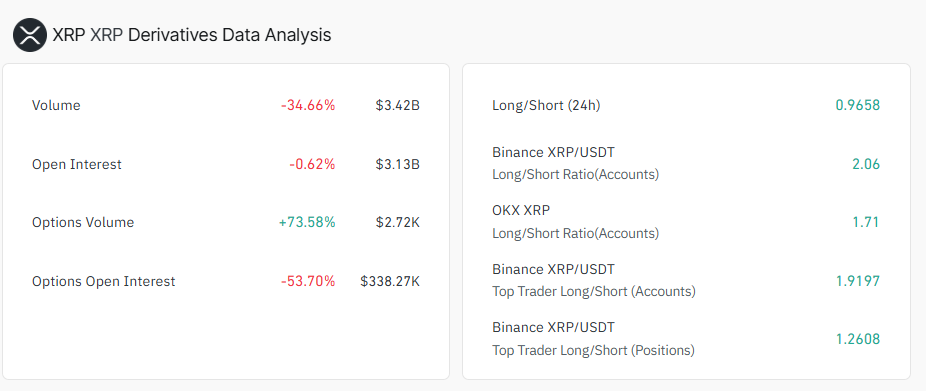

Similarly, XRP derivatives trading volume dropped sharply by 34.53% to $3.43 billion, signaling waning market activity. Open interest slipped slightly by 0.47% to $3.14 billion, while options open interest plunged 53.69% to $339,100, indicating a significant reduction in existing positions.

However, options volume spiked 73.58% to $2,720, suggesting some traders are actively repositioning to hedge or speculate amid mounting uncertainty.

Why Are XRP Traders Cautious?

Traders are treading carefully as the SEC’s May 22 deadline to respond to Grayscale’s application for a spot XRP ETF approaches. This uncertainty is driving defensive positioning, with market participants wary of a potential delay or denial from the agency.

Notably, asset manager Teucrium recently established a 2x leveraged XRP ETF. This has raised questions about the SEC’s willingness to approve a higher-risk product while potentially delaying or denying a standard spot ETF.

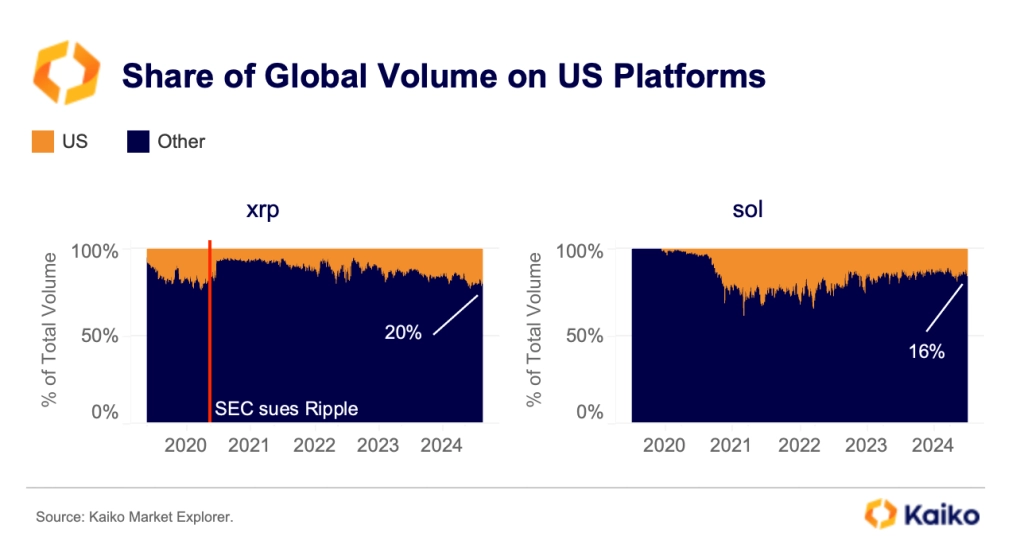

Meanwhile, the absence of a strong U.S. futures market for XRP complicates matters. Much of XRP’s trading activity still takes place on overseas exchanges. However, XRP volume on U.S. exchanges has been improving in recent times, data from Kaiko shows.

Key Levels Defining XRP’s Short-Term Outlook

According to TradingView, the Relative Strength Index (RSI) for XRP now sits at 48, well within the neutral zone. This suggests that the asset is neither overbought nor oversold. The RSI has hovered around this midpoint for more than a week, pointing to a lack of momentum in either direction.

As of this press time, it trades at $2.08, a 0.8% rise in the past day. Until a breakout occurs, the price is expected to remain range-bound.

Related: Garlinghouse Shoots Down 2025 IPO Rumors; Analysts Still Bullish on XRP

If XRP breaks below the $2.03 support, the next downside target is $1.96. A more aggressive sell-off could push the price toward $1.61, the support level from which it bounced off on April 7. On the upside, a confirmed breakout above $2.09 could open the path toward $2.5.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.