- Sam Bankman-Fried took to Twitter to jot down his thoughts on various topics.

- SBF says for crypto or any commerce to perform it requires peer-to-peer transfers and freedom.

- FTX in the US and Fried are under investigation by Texas’ securities regulators for offering unregistered securities.

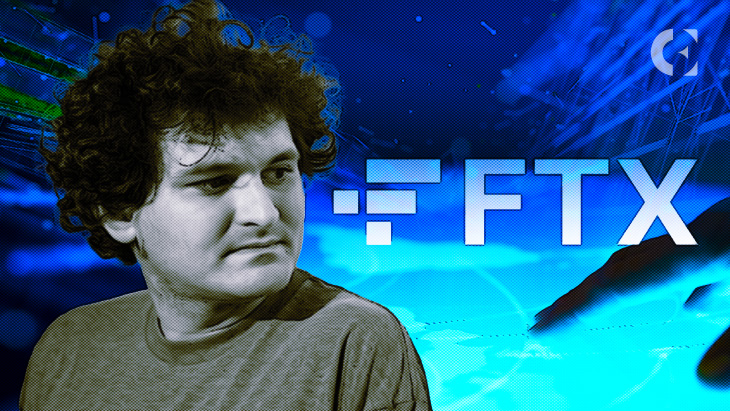

Sam Bankman-Fried (SBF), the CEO of FTX, took to Twitter to pen down his thoughts on various disbeliefs revolving around topics from crypto to Stabenow-Boozman’s bill.

Fried states the thumb rule for crypto or any commerce to perform requires peer-to-peer (P2P) transfers and a presumption of freedom. Moreover, he emphasized the primary function of validators, which is to validate and not micromanage.

In particular, Fried believes that the Stabenow-Boozman law will protect customers on centralized crypto exchanges while not jeopardizing the viability of software, blockchains, validators, DeFi, etc.

The Stabenow-Boozman Bill offers little practical advice on determining what is covered by the Commodity Futures Trading Commission’s (CFTC) exclusive jurisdiction since it does not resolve the ambiguity that exists in the digital asset market over which digital assets are securities and which are commodities.

By giving the CFTC sole authority over digital commodities, the Stabenow-Boozman Bill adds to the expanding number of legislative proposals aiming to clarify the regulations surrounding digital assets.

Conversely, FTX in the US and Fried are under investigation by Texas’ securities regulators for offering unregistered securities in the form of yield-bearing accounts in the US.

Joseph Jason Rotunda, Director of Enforcement of the Texas State Securities Board, alleges that the yield program appears to be an investment contract and should be regulated as a security.

Rotunda further added in the filing:

These products appear similar to the yield-bearing depository accounts offered by Voyager Digital LTD et al., and the Enforcement Division is now investigating FTX Trading, FTX US, and their principals, including Sam BankmanFried.

Additionally, Rotunda has objected to the acquisition of bankrupt Voyager Digital stating that in order for the Securities Commissioner to ascertain whether FTX US and all the businesses run by Fried are in compliance with the law.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.