- Mempool data reveals Antpool and Foundry USA hold the majority of the total Bitcoin hashrate.

- Foundry USA has been holding over 30% of the total hashrate for several weeks now.

- 80% of Bitcoin’s total mining power is controlled by just five pools.

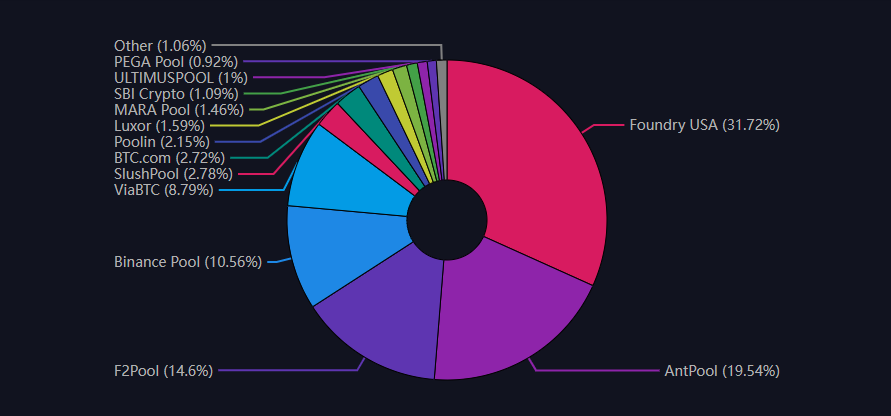

Bitcoin hashrate is becoming increasingly centralized, with a few mining pools controlling the majority of blockchain mining power. The recent data published by Mempool indicates that Antpool and Foundry USA hold the majority of the total hashrate, or around 55%.

For several weeks now, Foundry USA has maintained a hashrate of over 30% of the entire Bitcoin network. In fact, following China’s ban on Bitcoin mining in the middle of the same year, it became the first mining pool of non-Chinese origin to lead the list in November 2021.

Foundry USA contributed approximately 17% of the total Bitcoin hashrate at the time. However, the US-based pool currently accounts for approximately 32% of the mining power, which equates to roughly 94% EH/s when the Bitcoin hashrate is around 300 EH/s.

Antpool, on the other hand, comes in second place with about 23% of the total hashrate, or 65.91 EH/s. The China-based pool was previously the largest Bitcoin pool, but it was impacted by the crypto mining ban, which caused several miners in the region to migrate.

The graph reveals that about 80% of Bitcoin’s mining power is concentrated in just five pools. This is in stark contrast to the beginning of 2022 when these five mining pools barely surpassed 60% of the hashrate.

The location of the servers for the aforementioned pools is one of many elements that can explain this upsurge. The information transfer latency decreases with increasing server proximity to mining facilities and pools.

The financial incentives offered by these major mining pools can be considered another reason that influenced the rise. Larger mining pools consistently distribute profits to their members, who pay a commission for mining with their resources, attracting more miners to their ecosystem.

Contextually, on January 29, 2023, the Bitcoin blockchain experienced another difficulty increase at the block height of 774,144. The difficulty of the network increased by 4.68%, from 37.59 trillion to an all-time high of 39.35 trillion. The next adjustment is scheduled for February 11, 2023.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.