- ADA finds support at $0.2376, fueling hopes for a bullish breakout.

- Increased trading volume suggests strong demand for ADA on the dip.

- Technical indicators predict ADAUSD’s potential reversal as stochastic RSI signals oversold conditions.

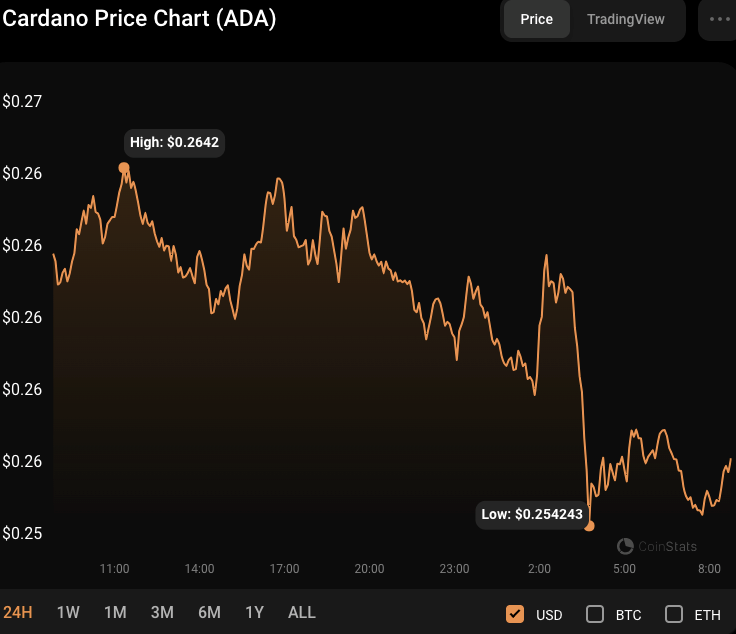

Early in the day, bullish momentum in the Cardano (ADA) market was robust, but the resistance above the intra-day high of $0.2642 proved too hard to overcome. As a result, the price fell, but it regained support above the $0.2546 level.

This level indicates that there is still a lot of buying interest in ADA, and if the bulls can generate enough momentum, they could break through the barrier and propel the price higher. ADA was trading at $0.2559 at press time, a 2.34% decline from its previous high.

If the bearish momentum breaks through the $0.2546 support level, the next level to watch is around $0.25. This level has provided solid support for ADA and might present a buying opportunity if it holds. However, if the selling pressure increases and the price falls below $0.25, ADA may face more negative potential to the next support level, around $0.24.

If the bulls can find enough strength to break beyond $0.2642, the next resistance level to watch is around $0.27, where selling pressure may mount.

ADA’s market capitalization and 24-hour trading volume declined by 2.38% and 20.81%, respectively, to $8,989,613,577 and $168,004,57, indicating a drop in market activity. This drop in trading volume shows that investors’ interest and engagement may wane, influencing ADA’s price movement. Furthermore, the decline in market capitalization suggests a reduction in overall value for ADA, which may lead to further selling pressure and significant negative concerns.

The stochastic RSI on the ADAUSD 4-hour price chart crossed its signal line with a value of 2.80, indicating that the ADAUSD is oversold. This pattern implies a reversal of the present downturn and an impending rebound. If the stochastic RSI shifts and moves toward the 50 mark, it might reinforce the positive momentum and give more evidence for an ADAUSD rally.

With a Money Flow Index score of 43.08, ADAUSD shows a mild negative sentiment. If the Money Flow Index begins to rise over 50, it might signal a change in market attitude toward buying pressure and significant upside chances for the ADAUSD. Furthermore, a break above the resistance level might bolster the case for an ADAUSD advance by signaling a shift in market sentiment and increased buying activity.

The negative Rate of Change (ROC) trend with a score of -2.29 indicates that the bearish momentum in ADAUSD is strong. As sellers dominate the market, this might put more downward pressure on prices. If the ROC continues to fall into negative territory, it may imply a developing bearish trend and a likely slide in ADAUSD.

However, if the ROC begins to move into the positive zone and rise in value, it may indicate a change in market mood and a probable movement toward bullish momentum. This trend might entice additional purchasers into the market, leading to a spike in the ADAUSD price.

With the Relative Strength Index at 45.19, below its signal line, the bearish trend in ADAUSD may persist in the near term. However, if the RSI rises above its signal line and into the overbought zone, it may suggest a likely reversal of the bearish trend and a shift toward optimism.

In conclusion, Cardano’s ADA shows resilience amidst challenges. Traders eye support at $0.2376, with potential for a bullish reversal indicated by key indicators.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.