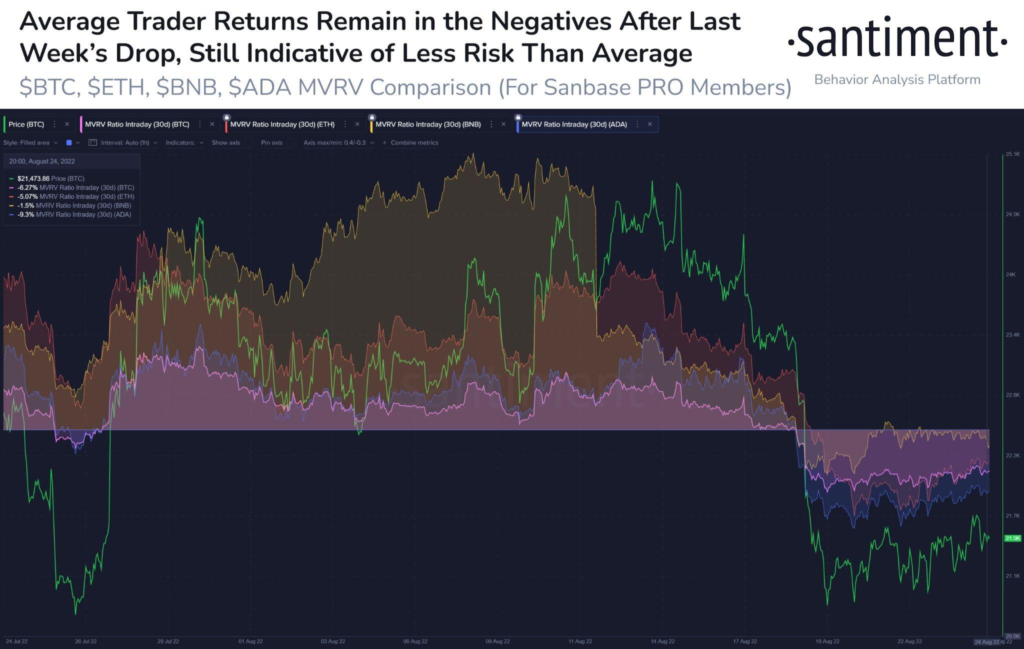

- Cardano’s MVRV is notably lower compared to other cryptocurrencies.

- The further downside may reduce the asset’s MVRV moves into negative territory.

- ADA is currently trading at $0.4678.

Earlier today, blockchain analysis firm Santiment posted on Twitter that 30-day crypto trading returns “continue to point to mid-term losses for the average portfolio”. Santiment also referred to findings from backtests done on the MVRV of the asset and the risks of further losses. The analysis platform also highlighted the fact that Cardano’s (ADA) MVRV is notably lower compared to other cryptos.

📊 30-day trading returns continue to point to mid-term losses for the average portfolio. The further into negative territory an asset’s MVRV, the lower the risk of further downside, based on backtests. $ADA is notably low compared to other top caps. https://t.co/J5FDAj05bL pic.twitter.com/9AcIqbX9wg

— Santiment (@santimentfeed) August 25, 2022

The data from the backtests revealed that the risk of further downside or losses reduces as the asset’s MVRV moves into negative territory.

In addition to this, Santiment mentioned that ADA’s MVRV is way lower when compared to the rest of the cryptos in the market. This could suggest that the potential for continued losses for ADA could be less.

According to the crypto market tracking website, CoinMarketCap, ADA is currently trading at $0.4678 and was able to reach a high of $0.4682 over the last 24 hours. This means that ADA is 2.57% in the green over the last day, but still down by 13.59% over the last week.

Looking at the daily chart for ADA, the price of ADA has made a small move towards the 9 and 20 EMA lines and now looks to test the 9 EMA line that is positioned below the longer 20 EMA line.

The relative position of the 9 and 20 EMA lines is bearish, howeve,r the daily RSI is a positive sign as the RSI is sloped positively towards the RSI SMA line. Things could turn bullish for ADA if it can break above the 9 EMA line and the RSI line rises above the RSI SMA line.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.