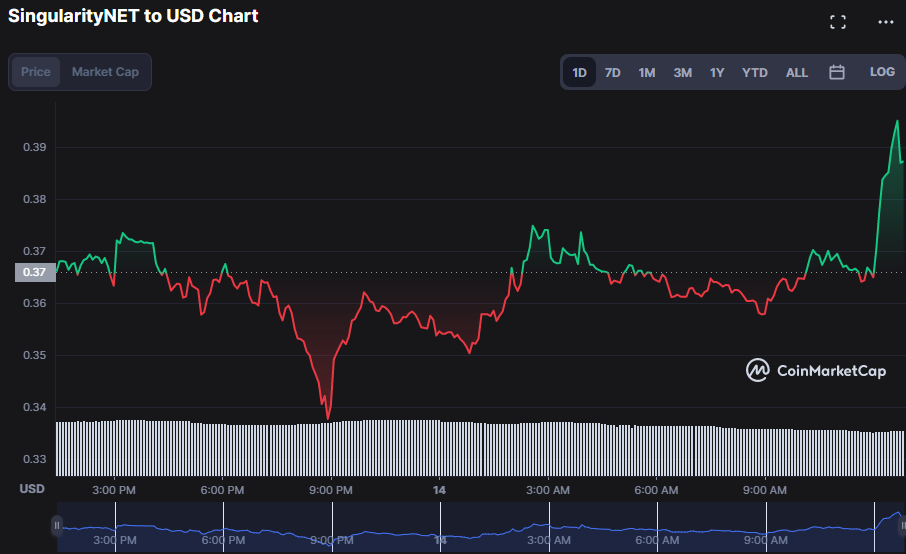

- AGIX Bulls recover from bear reign after finding support at $0.3377.

- Indicators reveal market has room for further price growth soon.

- Bullish control propels AGIX price by over 15% as of press time.

SingularityNET (AGIX) bullish strength has regained control after establishing support of around $0.3377 in the previous 24 hours. As a result of the bulls’ efforts, the AGIX price has increased by 15.78% to $0.4239 as of press time.

In reaction to the positive power, the market attitude altered substantially, and many investors started to invest in AGIX, viewing it as a chance to profit. As a result, market capitalization increased by 6.35% to $472,316,985, while 24-hour trading volume decreased by 16.88% to $145,847,361. Although market mood had improved and investors were anxious to buy AGIX, this drop demonstrates that demand is insufficient to support the recent significant price gain.

On the AGIX price chart, the Bollinger bands are linear, with the upper band at 0.044565495 and the bottom bar at 0.34862090, indicating that a breakout in either direction is possible. However, since a green candlestick emerges when the price movement exceeds the middle band, showing a positive emotion, and the Bollinger Bands have been tightening for some time, prices will probably break out to the upside.

A bullish breakout seems likely as the Elder Force Index (EFI) moves into positive territory, with a value of 12.455K, indicating significant purchasing pressure in the market.

This action lends credence to the bullish outlook provided by the Bollinger bands, raising the odds of an upward breakout. Due to the price action going upwards and the Fisher Transform’s signal line being above the price, a breakthrough above the upper band is more likely.

A rising Rate of Change (ROC) of 0.71 indicates that the current bullish trend may continue for the foreseeable future, suggesting a promising market picture. Moreover, investors’ willingness to keep pouring money into the markets and pushing higher prices indicates that demand is robust.

With a stochastic RSI reading of 55.76, the market’s ability to continue its upward trajectory indicates a high degree of momentum. This level also reflects an overall feeling of balance, suggesting that buyers and sellers are in relative equilibrium, preventing the market from being too overheated.

If the bulls maintain control, indicators hint at an increasingly positive momentum in the AGIX market.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.