- Altcoin Season Index signals a potential rebound as altcoins lag behind Bitcoin.

- AI and meme coins lead altcoin narratives, capturing traders’ attention and growth.

- Breaking $644B resistance could trigger a powerful altcoin rally up to $740B.

The altcoin market may be gearing up for a significant rally, with signs pointing to the potential start of a new altcoin season. After a period of lagging performance, several indicators suggest that altcoins are poised for a resurgence. Traders and investors are watching closely as the Altcoin Season Index reaches its lowest point since early September, signaling a possible shift in momentum.

Moreover, the rising popularity of narratives around artificial intelligence (AI) and memes and the potential breakout of key resistance levels in the total crypto market cap excluding Bitcoin (BTC) and Ethereum (ETH) further fuel optimism about the altcoin market.

Altcoin Season Index Nears a Rebound

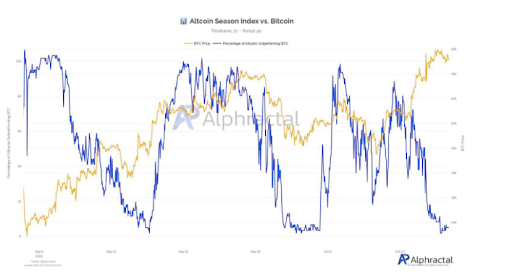

The Altcoin Season Index, which measures the percentage of altcoins outperforming BTC, has dropped to a low not seen since early September. This decline, despite Bitcoin’s recent rally from $60,000 to $68,000, creates an opportunity for altcoins to stage a comeback.

BTC Price vs Percentage of Altcoins Outperforming BTC.

Historically, whenever BTC experiences a surge, the Altcoin Season Index also rises. The current divergence, where Bitcoin’s performance has outpaced altcoins, might indicate that the altcoin market is overdue for a rebound.

A similar pattern in mid-September saw the index jump from below 5% to over 90%, sparking hopes of a potential repeat. If altcoins begin to outperform BTC again, a strong rally could follow.

Rising Narratives: AI and Memes Lead the Charge

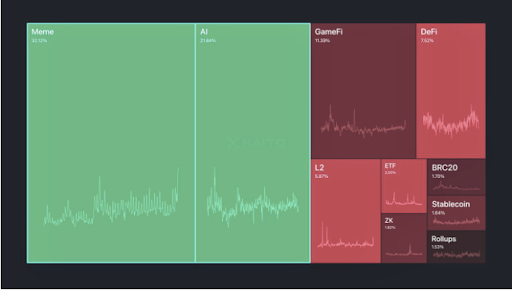

Two significant themes drive the current altcoin landscape: artificial intelligence (AI) and meme coins. Memes hold 32% of market attention, while AI captures 21.84%, signaling that traders are seeking culturally resonant coins that can generate viral enthusiasm.

Beyond these, other narratives like GameFi and DeFi remain relevant, though they account for smaller shares of mindshare, at 11.39% and 7.52%, respectively. As these narratives gain popularity, they point to a market that is exploring new opportunities and experimenting with high-potential projects. This growing interest in unique altcoin projects over more established assets like BTC and ETH highlights the sector’s potential for applications and significant returns.

Read also: Altcoin Accumulation and Distribution Trends Revealed

Altcoin Season Hinges on Market Cap Movements

The crypto market cap, excluding BTC and ETH, currently stands at $624.013 billion, down from a high of $777 billion in April. However, this contraction opens the door for a reversal.

The total market cap is approaching key resistance at $644 billion, a level it failed to break in late September. If this resistance is breached, the altcoin market could see a rally, with the potential for the market cap to rise to $660 billion, $709 billion, or even $740 billion.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.