- Bitcoin dominance breaks long-term trendline as altcoin season index rises to 60.

- Altcoin market cap hits $1.6T with MACD turning bullish, signaling momentum shift.

- Glassnode data shows falling profits and low volatility, hinting at sudden market moves.

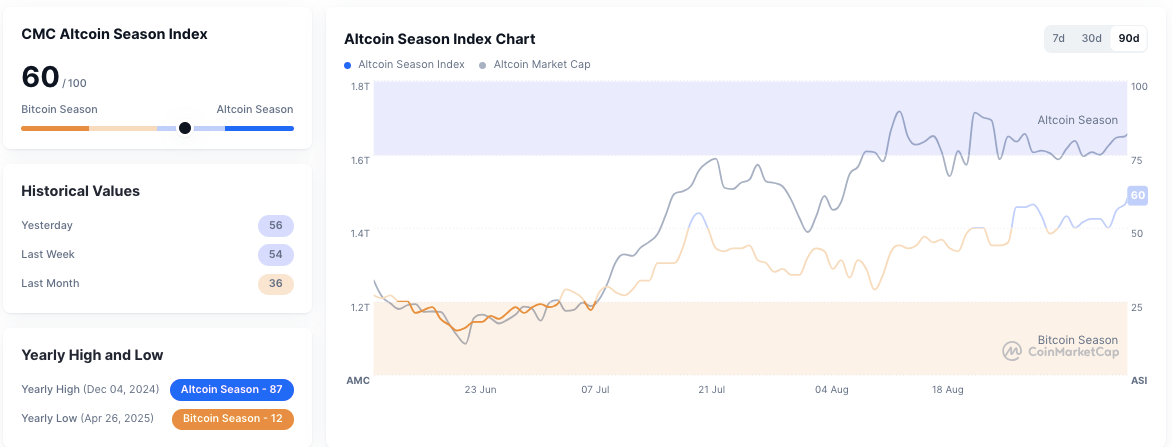

Bitcoin’s market dominance has dropped to about 57%, a move analysts say could mark the start of a new cycle favoring altcoins. The decline comes alongside a surge in the CMC Altcoin Season Index, which climbed to 60 out of 100, up sharply from 36 a month ago. The index’s rise suggests that investor demand is rotating away from Bitcoin into alternative cryptocurrencies.

Over the past three months, altcoin market capitalization expanded from $1.2 trillion in June to nearly $1.6 trillion by late August. The index peaked in July, saw a brief pullback, and has since resumed its upward climb. Historical readings highlight the momentum: 54 one week ago, 56 yesterday, compared with just 36 last month.

Related: Is Altcoin Season Here? Bitcoin Dominance Drops as Institutional Futures Volume Hits Record High

Why Bitcoin’s Break in Dominance Trendline Matters

Charts tracking Bitcoin’s share of the crypto market show a break below a long-term upward trendline that had held since early 2023. Analyst Merlijn The Trader described the move as a turning point, noting Bitcoin dominance had surged to over 68% before reversing.

His chart issued a sell signal with projections pointing toward a possible drop into the mid-40% range if Bitcoin fails to recover.

Past cycles support this outlook. After extended rallies, Bitcoin dominance typically falls as capital rotates into altcoins. The higher highs and lows that defined Bitcoin’s strength through 2024 have now broken down, reinforcing the case for altcoin outperformance.

How Altcoin Market Structure Confirms the Shift

Monthly charts of the altcoin sector strengthen the case. Analyst CrypFlow noted that the altcoin market has broken above its 2021 cycle top, reaching about $1.6 trillion in total value.

This mirrors earlier market cycles where similar breakouts triggered sustained rallies across altcoins.

Related: Bitcoin Volatility Drops Under 30% While Bulls Eye $114K Resistance

Technical signals also align:

- The monthly MACD turned positive for the first time since the 2022 bottom, a rare event historically followed by strong upside.

- The RSI remains above the midpoint, signaling room for further gains before the market overheats.

What On-Chain and Volatility Data Reveal

Data from Glassnode and Bitcoin Vector show Bitcoin testing key support while volatility compresses. Realized volatility fell below 30%, a level last seen after the $107,000 bottom. Such calm phases rarely last and often precede sharp market moves.

Meanwhile, realized profits are trending lower. Daily realized profit has averaged $1.17 billion in recent weeks, down 47% from the June peak of $2.2 billion. While still above the bear-market floor of $800 million, the decline points to weakening momentum among Bitcoin holders, a setup that historically gives altcoins more room to run.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.