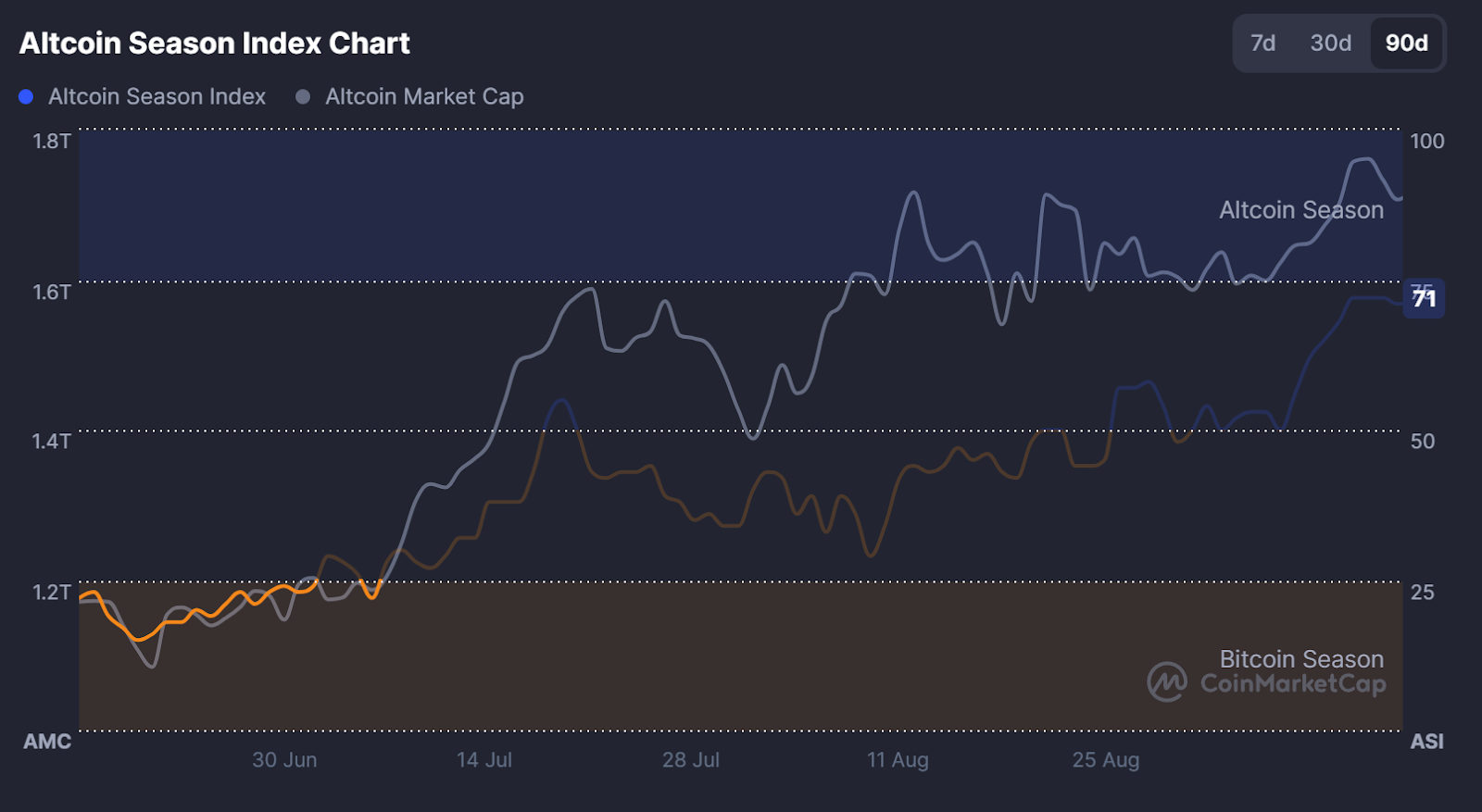

- Altcoin Season Index hit 71, just shy of the 75 “altseason” threshold.

- Bitcoin dominance slipped to 57.4%, the lowest since February.

- S&P 500 is outpacing BTC, raising odds of a Bitcoin catch-up rally.

The Altcoin Season Index has climbed to 71, closing in on the 75 mark that typically confirms the start of a full altseason.

For traders, that signals capital is rotating out of Bitcoin and into altcoins, where tokens like Solana (SOL) and XRP have been leading the pack

Altcoins Build Momentum as Bitcoin Stalls

The index measures how many altcoins have outperformed Bitcoin over the past 90 days. Once it clears 75, most traders declare “altseason.”

Right now, tokens like Solana (SOL) and XRP have led the charge, fueling the rally and dragging smaller caps higher.

Meanwhile, Bitcoin’s dominance, its share of the overall crypto market cap, has fallen to 57.4%, the lowest since February.

Related: Top Altcoins Are Outperforming Bitcoin: Is Altcoin Season Here?

The sharp decline signals capital rotating out of Bitcoin and into altcoins, a trend that historically precedes altcoin rallies.

Bitcoin Trails Equities and Rotating Capital

Bitcoin is lagging the S&P 500. CryptoQuant contributor and analyst Darkfost highlighted that while the S&P 500 just hit a record 6,600, BTC remains stuck below $116,000 after correcting from $108,000.

The last time such a decoupling occurred, Bitcoin later surged past $100,000. If history repeats, a strong reaction could be on the horizon, said Darkfost.

Macro Tailwinds Could Reignite BTC

Despite the current rotation into altcoins, Bitcoin may not stay quiet for long. Fundstrat’s Tom Lee expects a “monster move” in both Bitcoin and Ethereum in Q4, driven by easing US monetary policy.

In the “next three months,” Lee expects a massive surge in BTC and ETH. Meanwhile, spot exchange-traded funds (ETFs) attracted the highest inflows in the past 30 days at 80,768 BTC according to SoSoValue data.

Related: Crypto Market Update: ETH Holds $4,700 While Bitcoin Dominance Tests Multi-Month Support

With the Federal Reserve widely expected to cut rates this week and institutional money flowing in spot ETFs, liquidity conditions could improve significantly, similar to past cycles when rate cuts sparked powerful rallies.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.