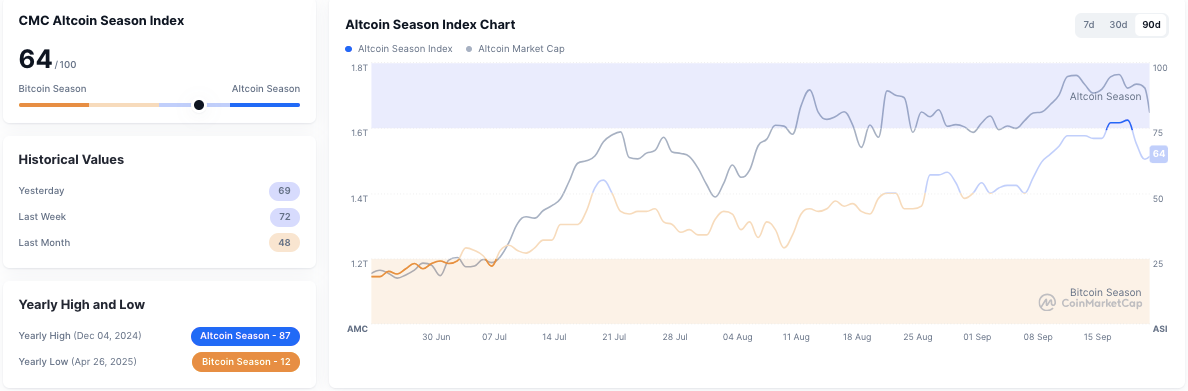

- Altcoin Season Index slips to 64 from last week’s 69, signaling cautious investor behavior.

- Ethereum fell over six percent as whales moved $72.8M off exchanges before the pullback.

- Altcoin market cap still rose to $1.7T over 90 days, showing longer-term resilience.

The momentum that drove altcoins through September is starting to cool. Fresh CryptoQuant data shows the Altcoin Season Index sliding from 69 to 64 in the past week, a sign that the rotation into riskier tokens is losing strength. Traders are shifting gears, looking for safer ground after weeks of heavy speculation.

Ethereum Whales Trim Exposure

Ethereum, which carried much of the altcoin rally earlier this month, has given back more than 6% in recent sessions, dropping under $4,200.

CryptoQuant flagged a whale that offloaded $72.88 million worth of ETH just before the dip. At the same time, more than 420,000 ETH left exchanges last week, a move that reduces near-term sell pressure but also shows large holders stepping to the sidelines.

Related: Fed Rate Cuts May Spark Altcoin Losses, Schiff Flags QE Threat to Dollar

This dual behavior i.e., selling size into rallies and moving the rest into cold storage, shows you how cautious big players have become as volatility ramps back up.

Altcoin Season Index Pullback

The Altcoin Season Index still sits firmly in “altseason” territory at 64 out of 100, but the downtrend from recent highs is clear. In mid-September, the index tapped 75. One month ago, it was 72.

For context, the index reached 87 in December 2024, then cratered to 12 in April 2025, showing just how volatile altcoin cycles can be. The current decline suggests traders are de-risking, but the number remains high compared to earlier this year, keeping altcoins in the broader conversation.

Market Cap Growth Masks Short-Term Caution

Altcoin market capitalization has climbed from $1.2 trillion to $1.7 trillion in the last 90 days, peaking mid-September before pulling back. That rise mirrors the index’s trajectory, confirming broad participation across majors like ETH, SOL, and ADA, but also newer narratives.

CryptoQuant’s latest read shows that while capital is still cycling into the sector, investor behavior is shifting. Traders are pocketing gains, hedging with safer assets, and preparing for more turbulence as the fourth quarter begins.

Related: Which Altcoins Should You Be Watching? Analysts are Focused on ETH and ADA

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.