- Bitcoin dominance has dropped to 55%, signaling potential altcoin season.

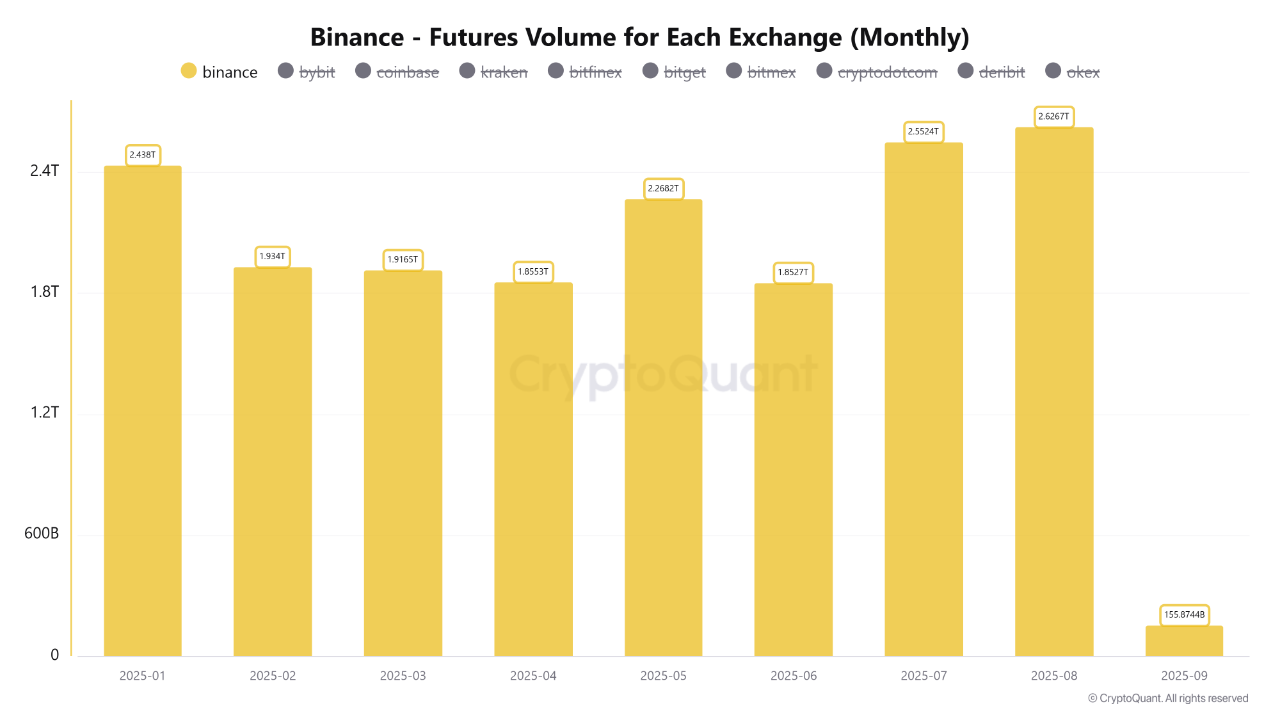

- Binance futures hit a record $2.6 trillion in August, driven by institutional flows.

- Gold’s rally may be peaking, opening the door for stronger altcoin momentum.

Bitcoin’s market share has dropped to 55% from highs of over 62% this summer, marking a seven-point decline similar to past cycles where altcoins such as Ethereum and Solana captured investor attention.

According to the Altcoin Season Index, which now stands at 63, conditions are tipping closer toward the altcoin season than a Bitcoin-led cycle.

This shift has been accompanied by renewed institutional flows. Networks like Solana are drawing treasury allocations, while Ethereum continues to drive gains across the altcoin sector.

Analysts warn that Bitcoin now faces two psychological thresholds, i.e., dominance could rebound if it pushes back to 63%, or slip further if it falls to 53%, a scenario that would likely favor an altcoin rally.

Bitcoin’s market share has dropped to 55% from highs of over 62% this summer, marking a seven-point decline similar to past cycles where altcoins such as Ethereum and Solana captured investor attention.

Related: What Is a Good Price to Buy Solana? Analyst Points to $187 & $179 Support Zone

Institutional Futures Activity Surges

According to CryptoQuant, fresh evidence of institutional appetite is coming from Binance, where total futures volume in August hit a record $2.626 trillion, surpassing July’s $2.552 trillion.

The increase suggests that hedge funds and other institutional players are building new long and short positions.

Extreme price volatility in Bitcoin, coupled with slowing spot activity, pushed many traders toward derivatives markets.

Open interest also rose sharply, suggesting new capital inflows rather than mere liquidations. However, without stronger spot inflows and stablecoin reserves, futures-driven rallies may struggle to hold.

Macro Factors: Fed and Gold in Focus

Broader macroeconomic factors are also shaping market trajectory. Analysts point to the upcoming Federal Reserve meeting, where a potential rate cut could boost risk assets.

Meanwhile, gold’s steady 8% return in September has underscored investor caution, with many remaining in risk-off mode.

Crypto analyst Michael van de Poppe argues that gold’s rally is nearing a local top, a development that could unlock risk appetite for altcoins.

Related: Solana’s “15x Multiplier” Model Predicts a Price Target of $274

He stated that Ethereum, which posted 15% gains in September, has already outperformed gold and is leading the altcoin recovery.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.