- Bitcoin’s market cap has doubled, while the altcoin market cap remains below its all-time high.

- Analysts predict a potential altcoin season following Bitcoin’s cycle peak.

- A golden cross in the altcoin market cap signals a possible breakout.

For the better part of 2024’s third quarter, Bitcoin has watched its market capitalization balloon, hitting new highs.

However, the altcoin market cap hasn’t kept pace, remaining below its previous all-time high, leading to concerns about capital rotation.

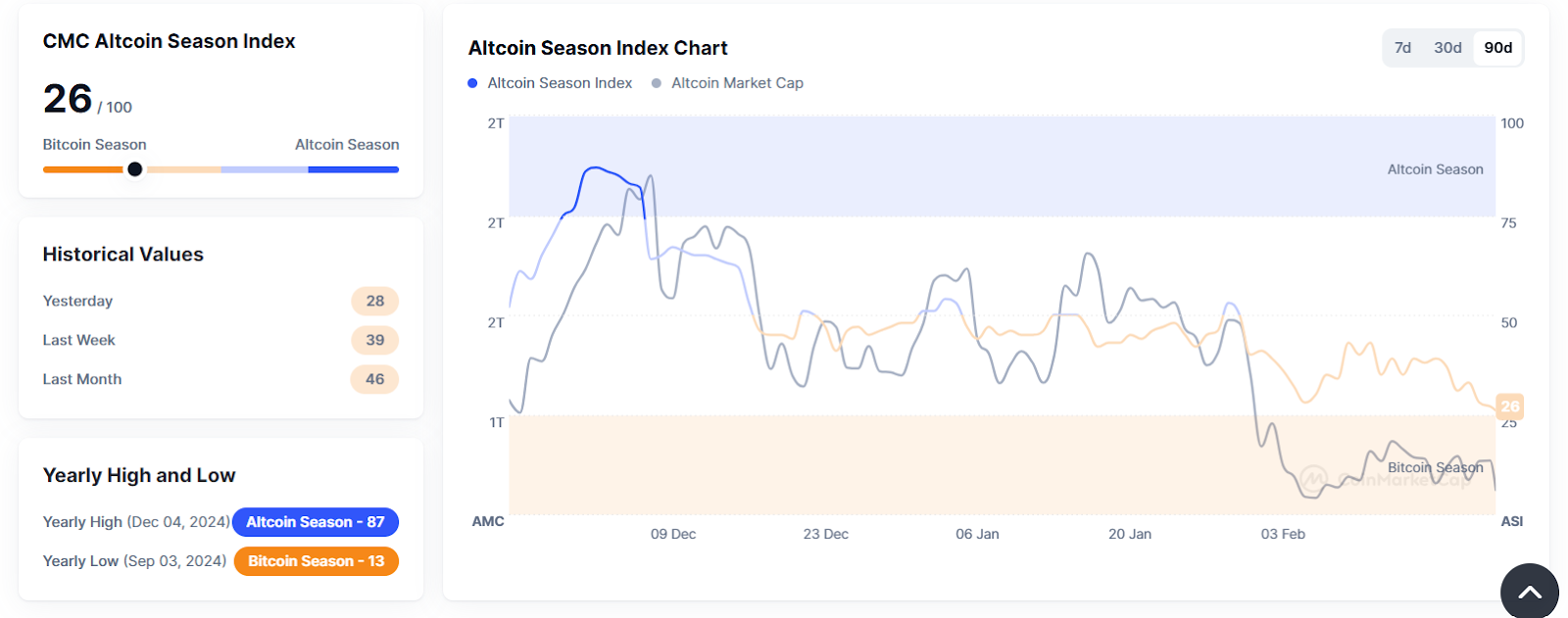

Altcoin Season Index: Not Yet in “Alt Season” Territory

Presently, the Altcoin Season Index, which tracks market cycles, currently sits at 26. This is below the threshold of 75 needed to confirm an altcoin-dominated phase. While this indicates that Bitcoin is still dominant, a shift toward altcoin season could occur if Bitcoin begins to stabilize or decline.

Is Altcoin Season Imminent?

In a tweet, CryptoQuant CEO Ki Young Ju described the altcoin market as a “zero-sum PvP game,” with assets rotating among themselves without fresh capital inflows.

In his view, only a handful of projects with real-world use cases will make it big and reach new peaks in this cycle.

Related: Is Altcoin Season Coming Feb 2025? A Look at the Bullish Signs

Despite this, some analysts believe an altcoin breakout is imminent. Crypto Rover stated that Bitcoin’s bull run is “80% completed,” with the next 20% expected to be the most volatile. Historically, altcoins tend to rally after Bitcoin reaches its cycle top, indicating that a shift may be on the horizon.

Golden Cross: A Historically Bullish Sign for Altcoins

Crypto analyst Ted pointed out that the altcoin market cap recently experienced its first golden cross since early 2021. A golden cross occurs when the 50-day moving average crosses above the 200-day moving average.

Historically, this cross signals a strong uptrend. In 2021, the last golden cross preceded a 500% surge in altcoin market capitalization within months.

Meanwhile, Crypto Goos reinforced this sentiment, stating that “altcoin season will make a huge comeback” and predicting that investors could see significant gains soon.

Why is the Altcoin Season Deviating from Usual Pattern?

However, the debate over altcoin season continues. Even though technical indicators suggest a bullish outlook, Ki Young Ju’s observation about the lack of new capital entering the altcoin market raises concerns.

Crypto analyst Miles Deutscher believes that the introduction of Bitcoin ETFs has altered the traditional market cycle. Historically, Bitcoin’s halving cycle led to wealth accumulation, prompting investors to reinvest in altcoins.

Related: Altcoin Season MIA? Raoul Pal Reveals Crypto Portfolio, Puts Sui Ahead of Solana

However, Deutscher notes that this cycle is weakening because Bitcoin ETF investors primarily hold BTC through traditional financial markets rather than crypto exchanges. Since these ETFs settle in U.S. dollars, there is minimal capital rotation into Ethereum and other altcoins.

Glassnode data backs up this claim, highlighting a sharp $234 billion decline in the altcoin market capitalization over the past weeks. This marks one of the most significant drawdowns in recent history, though it remains less severe than the May 2021 miner migration crash or the late 2022 LUNA collapse.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.