- Litecoin shows bullish momentum, holding key support at $70 and aiming to break $72.

- Bitcoin SV faces resistance at $52, with rising volume signaling potential upside.

- Solana consolidates between $152 and $156, awaiting breakout for bullish action.

Over the past 24 hours, several altcoins saw notable price movements, attracting the attention of traders and investors. Among the leaders of this surge were Litecoin (LTC), Bitcoin SV (BSV), Beam (BEAM), Solana (SOL), and Arbitrum (ARB). These altcoins displayed a range of price action, with some testing critical support and resistance levels.

The overall market sentiment for these altcoins appears cautiously bullish, as they show steady upward momentum, driven by increased trading volumes and growing investor interest. Let’s take a closer look at each coin to reveal their specific trends and potential future movements.

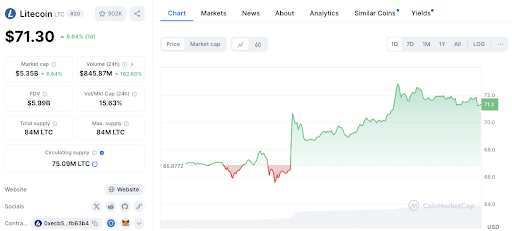

Litecoin (LTC) Rallies with Strong Support Levels

Litecoin (LTC) has shown a clear upward trend, increasing by 6.56% to $71.27. Significantly, the price is holding above the $70 mark, supported by key levels at $66.87 and $70.

This price stability encouraged traders, as LTC bounced back from these levels multiple times. Resistance around $72 proved challenging, with the price meeting selling pressure when attempting to break this level.

However, the 161.86% increase in 24-hour trading volume, now at $843.20 million, suggests continued interest in LTC. If the price breaks and sustains above $72, it may gain further bullish momentum. Otherwise, falling below $70 could lead to a retest of the $66.87 support.

Read also: Crypto Market Shake-up: Litecoin, FET, and TAO in Focus

Bitcoin SV (BSV) Holds Cautiously Bullish Position

Bitcoin SV (BSV) experienced a moderate price increase of 2.40%, bringing it to $50.78. The price is currently holding above $49.61, which has acted as a solid support level.

However, resistance remained firm at $52, where BSV faced multiple rejections. The increase in trading volume by 35.82% to $74.75 million suggests growing interest, though the price action remains cautious.

If BSV can break above the $52 resistance, it could signal stronger bullish momentum. Conversely, a drop below $49.61 might lead to a test of lower support around $48.

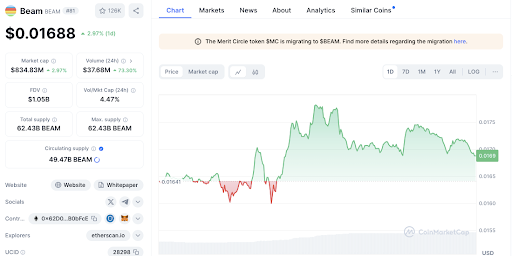

BEAM Gains Steady Momentum Amid Growing Interest

Beam (BEAM) has gained 3.11%, pushing its price to $0.01692. The price is holding above key support levels at $0.01641 and $0.0160, indicating strong buyer interest.

However, resistance around $0.0175 remains a barrier for further gains. The 72.21% increase in 24-hour volume to $37.60 million signals heightened market activity.

BEAM’s short-term outlook appears cautiously bullish, with a breakout above $0.0175 potentially leading to further upward momentum.

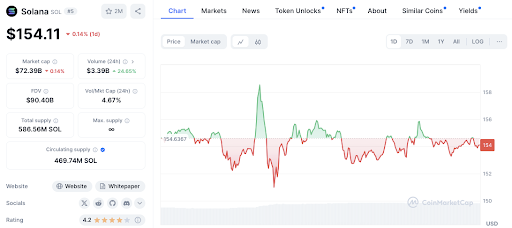

Solana (SOL) Faces Consolidation Phase Between Key Levels

Solana (SOL) is currently priced at $154.05, slightly down by 0.41% over the last 24 hours. The price action is fluctuating between $152 and $156, with both support and resistance levels being tested repeatedly.

The 24-hour volume increased by 24.08% to $3.39 billion, showing continued market engagement. However, the current trend indicates consolidation as SOL moves between these key levels. A breakout above $156 could signal further bullish action, while falling below $152 might push the price lower.

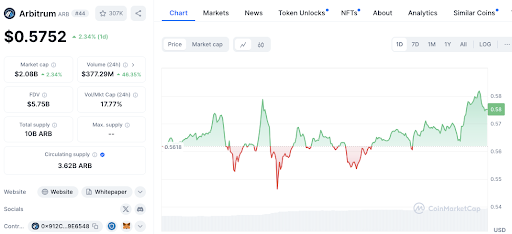

Arbitrum (ARB) Consolidates with Bullish Potential

Arbitrum (ARB) saw a 2.60% increase, bringing its price to $0.5763. It is currently moving within a tight range, with support at $0.56 and resistance at $0.58. A 45.09% spike in trading volume suggests growing interest.

A breakout above $0.58 may lead to further gains, while falling below $0.56 could signal a bearish trend. ARB’s next move will likely depend on whether it breaks this consolidation phase.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.