- Bitcoin rose 4.5% in a week, but altcoins posted more substantial gains.

- Ethereum, Solana, and Dogecoin outperformed Bitcoin with double-digit increases.

- Frontier and Hifi Finance each surged more than 600% in a seven-day period.

Top altcoins are outperforming Bitcoin this week while smaller-cap tokens are delivering even more monumental gains.

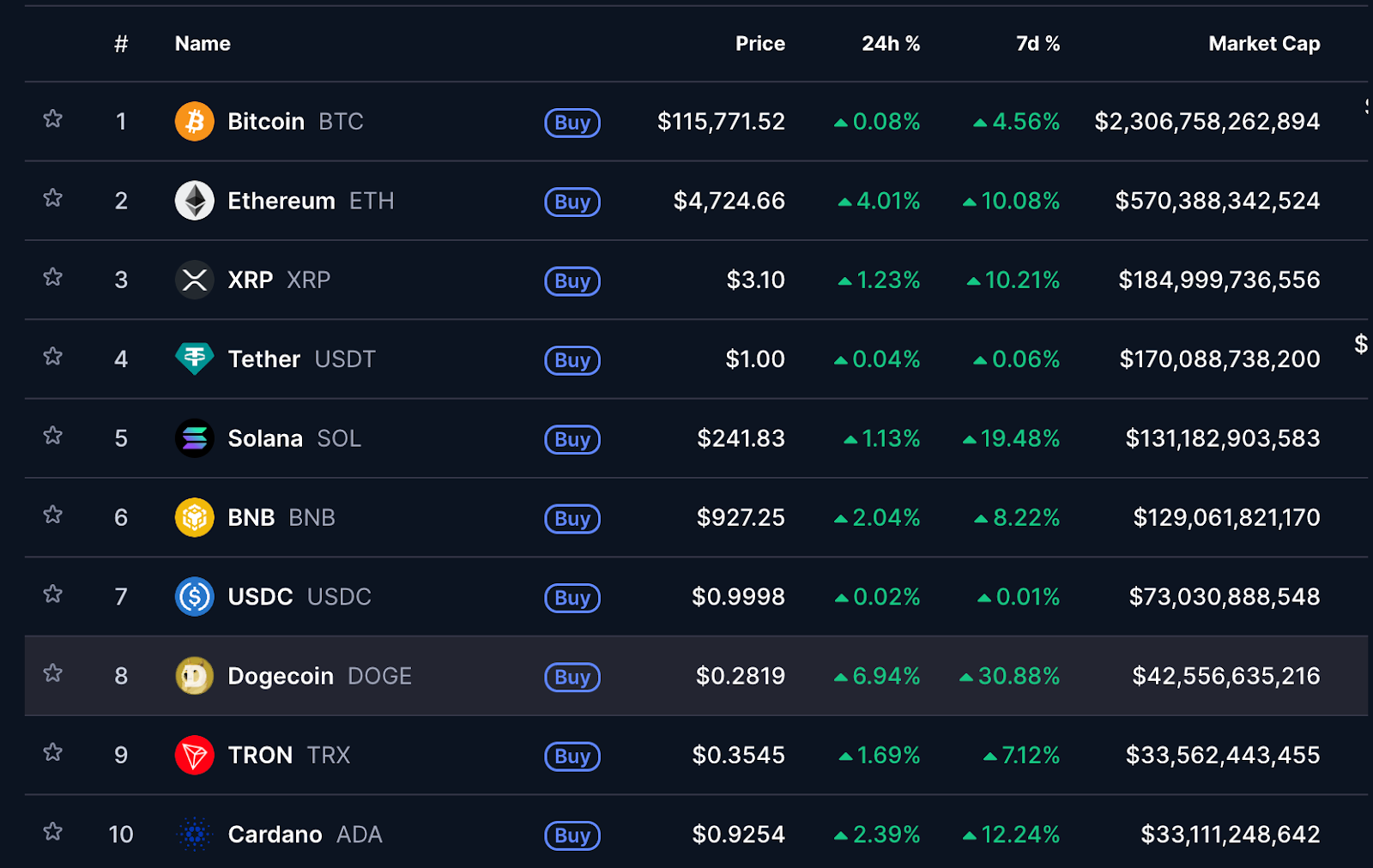

Bitcoin added about 4% this week, trading near $116,000 with a market cap above $2.3 trillion. The move was solid but underwhelming compared to the broader altcoin complex, where flows and volumes rotated into higher beta names.

Ethereum, Solana, and Dogecoin set the pace

Ethereum surged 10% in the same period, reaching $4,724, pushing its market cap toward $570 billion.

XRP climbed 10% to $3.07, BNB advanced 8.5% to $695, and Cardano gained 12% to $0.92, joining Ethereum and Solana in outpacing Bitcoin’s modest 4.5% rise.

Related: Altcoin Season Index Hits 71 as Ethereum and TOTAL3 Signal Breakout

Solana, however, advanced higher, delivering 19% in the past week to $241. Its monthly gain stands at 16.5%, showing a balance and consistent uptick despite occasional volatility. Notably, Dogecoin delivered the highest gain among the top 10 altcoins, climbing 31% to $0.28.

Meanwhile, the broader market sentiment remained neutral, with the Crypto Fear and Greed Index at 53. The sentiment is slightly tilted toward greed as traders are cautiously optimistic but not yet showing the excessive enthusiasm that often comes before sharp pullbacks.

Frontier and Hifi Finance Lead Weekly Gains

The week’s top performers were Frontier (FRONT) and Hifi Finance (HIFI). Frontier surged 641% in 24 hours and 741% in seven days, reaching $1.31 with a market capitalization of $10.2 million. Its daily trading volume crossed $755,000.

Hifi Finance mirrored those results, jumping 603% in 24 hours and 741% across the week. The token traded at $0.56 with $715 million in 24-hour volume, making it one of the most liquid among the top gainers.

Both projects drew attention for their outsized growth compared to the broader altcoin market, where double-digit weekly gains were more common.

A wave of speculative assets also featured in the top gainers ranking. Turbo (TURBO) rose 180% in 24 hours and nearly doubled its weekly value, trading at $0.05. Beers (BEER) also climbed 510% in the same period.

CAT (NOT) advanced 573% in 24 hours but only 11% weekly, pointing to rapid short-term price swings. Robinhood (HOOD) posted a 420% daily gain, reporting a $5.8 billion market cap despite trading volume of just $108,000. A token labeled Tesla (TSLA) rose 615% daily to $64.17.

Is Altcoin Season Here?

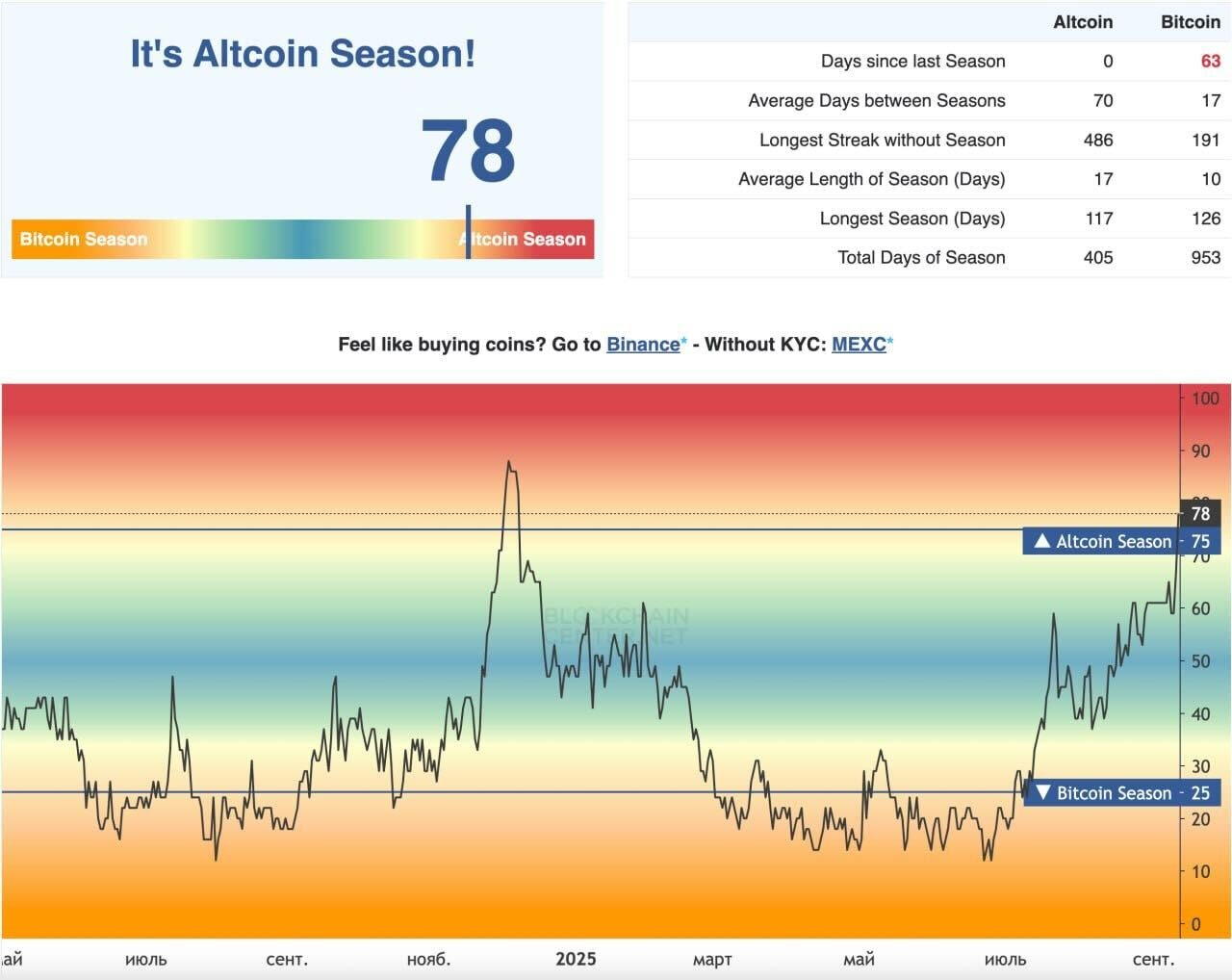

The Altcoin Season Index printed in the high-70s this week, its strongest reading of 2025. By definition, that means more than 75% of the top 50 coins have outperformed Bitcoin over the past three months. Analysts say that confirms altseason is underway, though the depth and duration remain uncertain.

Crypto analyst Cypher said the market is already in an altcoin season, with 78% of the top 50 tokens outperforming Bitcoin over the past three months. He added that sustained momentum could eventually extend to mid- and small-cap tokens, but not to the extent seen in 2017 or 2021.

Analyst Niels said the Altseason Index has risen above 75, signaling the start of altcoin season. He noted Ethereum has outperformed Bitcoin for two quarters, with capital now rotating into altcoins. Niels added that while the trend has shifted, corrections remain possible.

Related: Altcoin Season Index Jumps to 67 as Market Bets on Fed Rate Cut

Analyst Lau echoed a similar sentiment. She said altseason has officially started. She noted that past altseasons lasted an average of 17 days, with the longest running 117 days. Lau added that the length of the current cycle remains to be seen.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.