- Bitcoin’s sharp drop hurt market confidence and delayed momentum toward a real altseason.

- ISM PMI at 48.2 shows manufacturing weakness, preventing strong crypto liquidity growth.

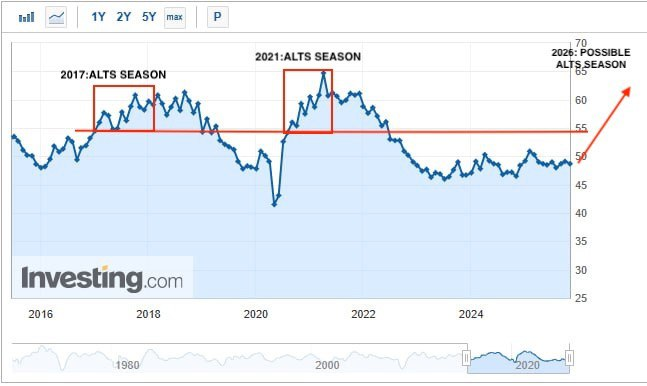

- Previous altseasons only started when ISM rose above 55.

The elusive Altseason; a period of parabolic growth for non-Bitcoin assets, has been effectively cancelled for the remainder of 2025 by the U.S. industrial sector. Fresh economic data released Monday indicates that the macroeconomic liquidity required to fuel such a rally simply does not exist.

Analysts pointed to a mix of factors behind the sell-off: normal price reversion after months of gains, record-breaking gold prices, a quiet but tense stock market, and concerns over the unlimited supply of competing crypto assets.

With all this volatility, experts have come up with an answer as to why altseason 2025 has been delayed based on the new economic data.

Related: Bitcoin Slides Below Key Levels as Short-Term Holders Face Deep Losses

The Indicator That Predicted Every Previous Altseason

A new analysis shows the U.S. ISM Manufacturing PMI as one of the most reliable indicators of an upcoming altseason. The latest reading for November came in at 48.2, undershooting expectations and confirming contraction in the manufacturing sector.

This figure reflects responses from over 400 companies on the state of new orders, production activity, hiring trends, inventory levels and delivery speeds. A reading below 50 signals economic slowdown, and November’s number confirms that the U.S. industrial sector has yet to begin a meaningful recovery.

Why This Matters for Crypto

Historical data shows that altseasons tend to emerge only when the broader economy is expanding. In both 2017 and 2021, the ISM index was above 55 at the time altcoins began their biggest rallies.

This also explains why many altcoins continue to struggle despite isolated rallies and occasional optimism on social platforms.

Despite the current weakness, predictions for 2026 include interest rate cuts, improved liquidity and a more supportive policy environment. These factors may gradually push the ISM index back toward expansion territory.

Market Sentiment and Technical Outlook

The crypto community remains divided. Some investors criticize the habit of labeling every minor bounce as altseason, arguing that many tokens dropping more than 90% and doubling off the bottom does not qualify as true recovery.

Others say altcoins have been suppressed for too long and that a major rotation is inevitable.

Technical analysis shows Bitcoin dominance rejecting its 50-week moving average, a pattern similar to the one seen before the 2021 altseason. Analyst Michael van de Poppe says that early-month sell-offs may be part of a final shakeout phase before a rebound.

He wrote, “The upcoming month will be no different, with a lot of macroeconomic events coming up that are going to influence the direction of the markets. Overall, my personal opinion is that we’re going to go up rather than down with $BTC and $ETH.”

Related: Here’s the Main Reason Bitcoin Dipped 5% to $85,000 on December 1

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.