- Bitcoin dominance near 59% left most altcoins rangebound in December.

- Analysts watched reserves and Treasury cash flows for a liquidity turn.

- Federal Reserve QT ended December 1, but risk appetite stayed selective.

Altcoins stayed rangebound as Bitcoin dominance climbed toward 59% and liquidity stayed tight. Analysts tied the drift to liquidity, not headlines, with Bitcoin absorbing most fresh demand.

Interestingly, analysts claim that this stagnation is not driven by sentiment or weak projects, but by a lack of liquidity across the broader crypto market.

Market data and historical patterns indicate that this phase is not unusual but is a familiar part of the crypto cycle where Bitcoin leads and altcoins wait for conditions to change.

Related: Should You Buy the Dip? Analyzing the Crypto Market Crash After Fed’s 25 bps Cut

Liquidity, Not Sentiment, Is Holding Altcoins Back

Crypto trader VirtualBacon said the main reason altcoins have not moved is simple, there is no excess liquidity. When liquidity is flat, Bitcoin dominance tends to rise while altcoins stay stuck.

This does not signal weakness in the market, but rather a phase where capital remains concentrated in Bitcoin.

Historically, major altcoin rallies have followed the same sequence. Bitcoin breaks out first, then enters a period of consolidation. Only after liquidity expands do altcoins begin to outperform.

Rotating into altcoins too early often leads to slow losses, while rotating too late risks missing the strongest part of the move.

VirtualBacon pointed out clear signals that usually mark the shift, including rising bank reserves, drawdowns in the US Treasury General Account, and accelerating ETF inflows. None of these signals have yet shown up.

What the Fed’s QT Cycle Say About Altcoins

Another analyst, Matthew Hyland, explained the long-term relationship between altcoins and Bitcoin dominance during periods of quantitative tightening, known as QT.

He shared a chart comparing altcoin dominance against Bitcoin dominance over more than a decade, segmented by times when QT was active or inactive.

The data shows that when QT is active, liquidity tightens and Bitcoin dominance tends to rise. During these phases, altcoins usually underperform and remain capped.

On the other hand, when QT is inactive and liquidity conditions improve, altcoin dominance has historically increased for extended periods, often lasting several years.

The chart also shows that each major altcoin cycle began only after QT pressure eased.

Altcoins Are Weak, but Support Is Holding

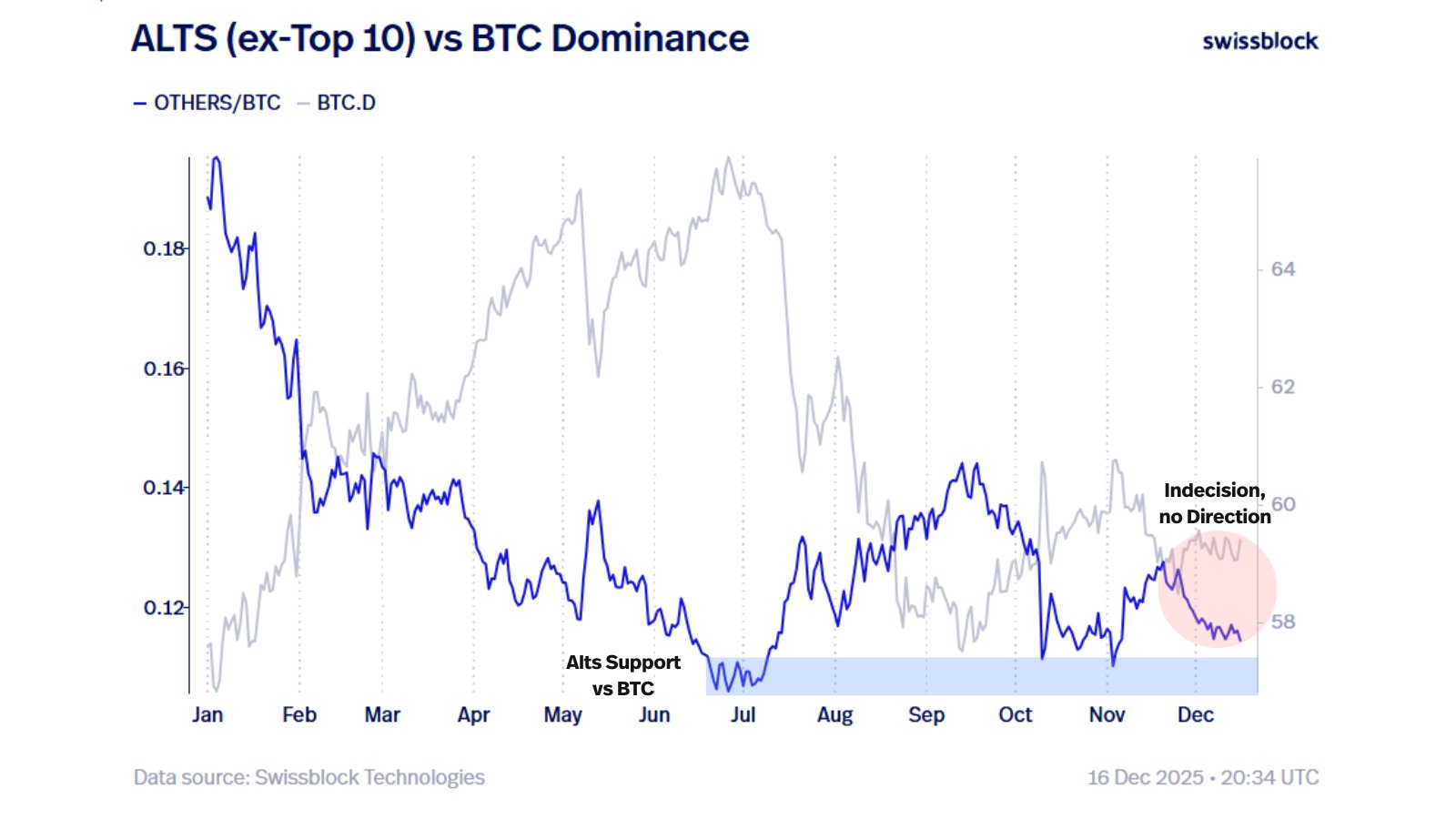

Meanwhile, Altcoin Vector said that the current market is defined by indecision. Bitcoin has not fully reclaimed leadership, while altcoins remain reactive and unable to break out of established ranges.

However, altcoins continue to hold a multi-month support level against Bitcoin that has been forming for roughly six months. Each pullback has found buyers at similar levels.

According to analysts, this structure means that altcoins do not need a major shift to move higher. A single catalyst tied to liquidity could be enough to restart momentum.

Related: Bitcoin and Altcoins Enter High-Risk Week as Delayed US Jobs Data Meets BoJ Hike Fears

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.