- Talk of ‘altseason 2025’ intensifies as key catalysts align post-market consolidation

- Today’s CPI data and the latest CZ pardon seen as triggers for an October altcoin rally

- Anticipated Fed pivot (end QT/rate cuts) and capital rotation build underlying case

The drums forecasting “altseason 2025” are beating louder as the crypto market searches for direction following recent consolidation. Two immediate events – today’s U.S. Consumer Price Index (CPI) release and the political ripple effects of President Trump’s pardon of Changpeng Zhao (CZ), are being closely watched as the immediate sparks.

These catalysts arrive against a backdrop of growing anticipation for a dovish Federal Reserve pivot and signs of strengthening technicals, fueling speculation that a broad-based altcoin rally could ignite before year-end.

Furthermore, Bitcoin (BTC) led the wider altcoin market in a mild rebound, ahead of Friday’s Consumer Price Index (CPI), amid the ongoing U.S. government shutdown. According to aggregate market data from CoinMarketCap, the total crypto market cap surged 1% during the past 24 hours to hover around $3.74 trillion at press time, despite the notable fear of further crypto correction.

Main Reasons to Bet on a Full-Blown Altseason 2025

Why Today’s CPI Data Is Critical for Altcoin Momentum

The Consumer Price Index (CPI) serves as a key measure of inflation. Its release today is critical because it heavily influences the Federal Reserve’s upcoming decisions on interest rates and monetary policy, particularly Quantitative Tightening (QT).

Lower-than-expected inflation could solidify bets on impending rate cuts and potentially an end to QT, unleashing liquidity that historically favors risk assets like altcoins. Conversely, a hot CPI print could dampen hopes for easing and trigger further market consolidation or correction. Think of CPI as a gatekeeper as its reading can either open the floodgates for risk appetite or keep them closed.

Ahead of today’s CPI data release, JPMorgan analysts expect the Fed to end Quantitative Tightening (QT) next week. As such, analysts are anticipating the Fed to print $1.5 trillion following the October and November interest rate cuts.

CZ Pardon: A Political Signal Boosting Crypto Sentiment?

President Trump’s pardon of Binance founder CZ, framed by the White House as countering the previous administration’s “war on cryptocurrency,” acts as a significant political signal. While not directly tied to market mechanics, the pardon is interpreted by many as reinforcing the current administration’s relatively pro-crypto stance.

This perceived political goodwill can boost overall market sentiment, reduce perceived regulatory risk (at least temporarily), and encourage investment, potentially providing a favorable backdrop for an altcoin rally.

Anticipated Fed Pivot (QE/Rate Cuts) Sets Liquidity Stage for Altcoin Rally

Underlying the immediate catalysts is the growing expectation of a major shift in Federal Reserve policy. JP Morgan analysts anticipate the Fed might signal the end of QT as soon as next week’s FOMC meeting.

Combined with market pricing indicating high probability of rate cuts in late 2025, this potential pivot away from tight monetary policy is arguably the most significant bullish factor. Analysts speculate that upcoming easing could inject substantial liquidity ($1.5 trillion) into the financial system. Historically, such liquidity floods have disproportionately benefited altcoins, suggesting the stage is being set for a potentially explosive move once the Fed confirms its shift.

Capital Rotation From Bitcoin to Altcoins Fueled by High Institutional Adoption

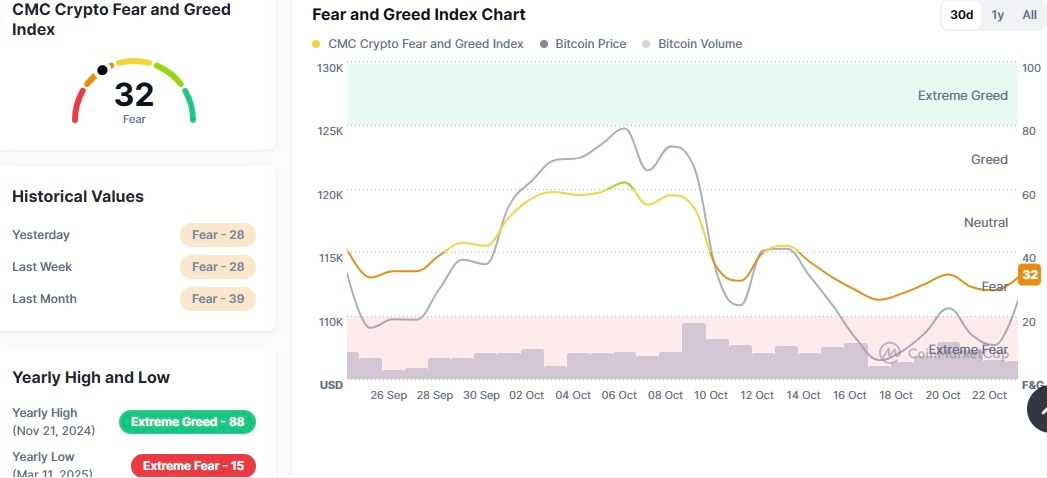

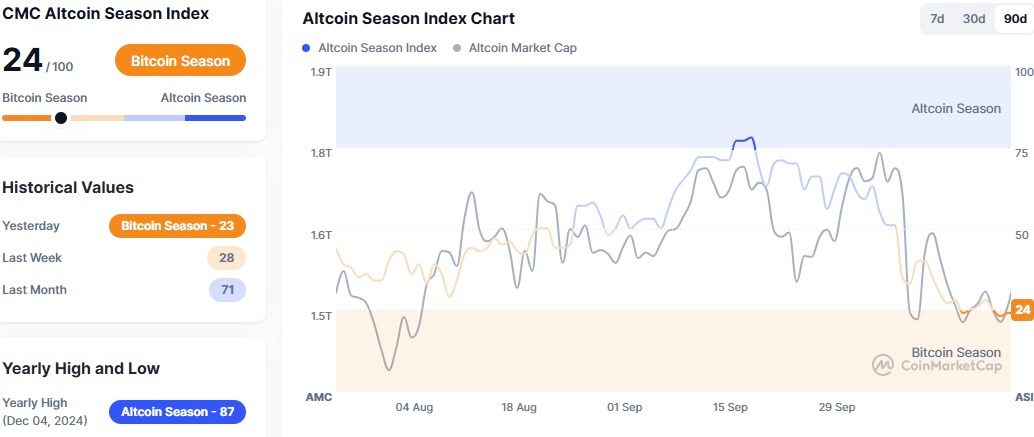

The Altcoin Season Index pendulum recently swung in favor of a Bitcoin season following high traders’ fear of crypto capitulation triggered by the October 11 crash. The CMC’s Altcoin Season Index hovered around 24 out of 100, which is in favor of the Bitcoin season.

However, the high demand for altcoins, as observed by over 155 crypto ETF filings in the U.S., majority being altcoins, favors an ultimate capital rotation from Bitcoin. Notably, Bitcoin has recently benefited from the weakening of Gold and Silver in the recent past.

As such, the altcoin market will significantly benefit from capital rotation from Bitcoin.

US Shutdown Adds Uncertainty: Potential Dollar Weakness a Factor?

The ongoing U.S. government shutdown adds a layer of complexity. While it can disrupt economic data releases and potentially dampen immediate risk appetite, prolonged shutdowns historically have sometimes weakened confidence in the U.S. dollar.

A weaker dollar can, in turn, make alternative assets priced in dollars, like cryptocurrencies, relatively more attractive, potentially adding another subtle tailwind for altcoins.

Technical Tailwinds

The altcoin market cap, excluding Ethereum, has been forming a bullish ascending triangle pattern in the last four years. In the monthly timeframe, altcoin’s market cap has approached the apex of its multi-year consolidation, thus signaling an imminent breakout.

Which Altcoins Could Lead the Charge? SOL, BNB, LINK Eyed

The altcoins with active ecosystems – led by Solana (SOL), BNB, Hyperliquid (HYPE), Dogecoin (DOGE), and Chainlink (LINK) – are well-positioned to lead in the anticipated altseason 2025.

Additionally, altcoins with high demand from whale investors, led by LINK and Pudgy Penguins (PENGU), are the best to consider in the upcoming full-blown altseason 2025. Furthermore, there are thousands of new altcoins in the crypto space, and not all will rally exponentially in the near future.

A. CPI (Consumer Price Index) measures inflation. It’s critical for crypto because high CPI can lead the Fed to keep interest rates high (tightening liquidity, bad for crypto), while low CPI can encourage rate cuts (easing liquidity, good for crypto).

A. CZ’s pardon is a signal that the U.S. government is still inclined towards the crypto market, and ending the war on crypto began by the Biden administration.

A. A full-blown altseason can start off once after September CPI data is released and the FOMC meeting scheduled next week.

A. The U.S. government shutdown has increased confidence in the crypto market since dollar debasement fears are on the rise.

A. Crypto assets with high active ecosystems, such as BNB, XRP, ADA, SOL, DOGE, PENGU, and LINK, are most likely to lead the altseason 2025 rally.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.