- Liu believes that now is a great time to be bullish on altcoins for as long as BTC dominance remains below 62%.

- The upcoming Fed’s Quantitative Easing (QE) amid an improved geopolitical outlook is bullish for the crypto market.

- Heavy liquidation of long traders in recent days has weighed down on midterm bullish sentiment.

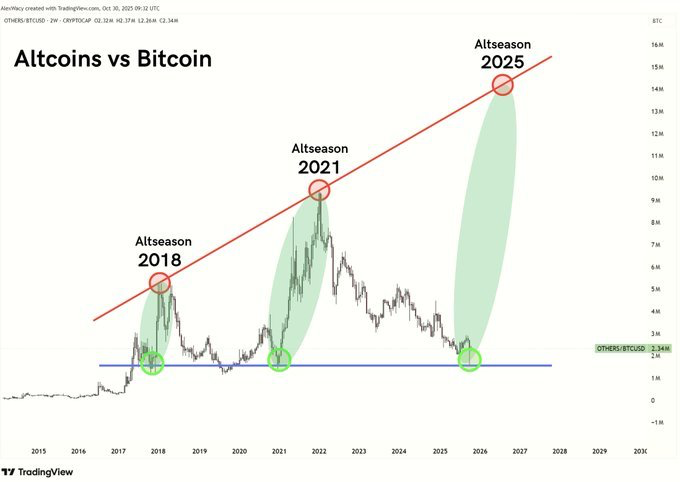

The crypto bull market 2025 is still in favor of an altseason in the near term despite the indicators showing otherwise. According to Dennis Liu, a popular quantitative crypto analyst, for as long as the Bitcoin dominance remains below the range of between 62% and 65%, the altseason 2025 is not yet over.

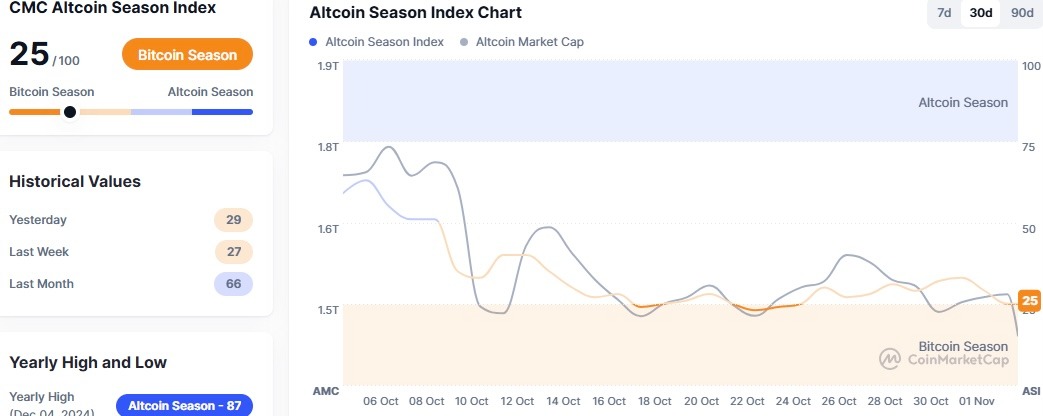

According to CoinMarketCap data analysis, its Altcoin Season Index has dropped to 25/100, thus suggesting now is a Bitcoin season.

Source: CoinMarketCap

Why is Liu in Favor of an Altseason Now?

Bitcoin Dominance Topping Out

From a technical standpoint, Lie believes that the BTC dominance, in the weekly timeframe, is in the process of forming a lower high, which will kickstart the next phase of altseason 2025. Although some traders have turned bearish on altcoins in the midterm, Liu has argued that the odds of altseason in the coming weeks remain high.

Furthermore, Bitcoin dominance has remained below the weekly 50 Simple Moving Average (SMA) since mid-July.

The Rising Global Liquidity as Fed Pivots to Quantitative Easing (QE)

The altcoin market is well-positioned to regain a bullish outlook in the near term, fueled by the Fed’s monetary policy changes. After the second rate cut last week, Fed chair Jerome Powell confirmed that its Quantitative Easing (QE) will begin early December.

The end of the Fed’s Quantitative Tightening (QT) is expected to boost global liquidity, which has been on the rise. As such, Liu highlighted that the Bitcoin dominance will top out once the global liquidity begins to rise again.

The crypto analyst noted that he will remain in favor of altseason for as long as the Bitcoin dominance does not rally above 65%.

Rising capital rotation from Bitcoin to altcoins via the spot alts ETFs

The crypto analyst is bullish on altcoins now due to their improving fundamentals in major jurisdictions, led by the United States. Amid the ongoing U.S. government shutdown, several spot Altcoins exchange-traded funds (ETFs) have already been listed on NASDAQ and NYSE for trading.

Some of the altcoins with their spot ETF already trading include Solana (SOL), Litecoin (LTC), Hedera (HBAR, and XRP. With more spot altcoin ETFs expected to go live in the near term, institutional investors will have a regulated rail to rotate their BTC gains to altcoins.

Technical tailwinds on selective Altcoin pairs against Bitcoin

According to Liu, not all altcoins will record a rally in the 2025 altseason. Despite most altcoins hovering in oversold levels of their respective weekly and daily Relative Strength Indexes (RSI), Liu urged crypto traders to focus on projects with robust fundamentals.

Notably, the ALT/BTC pair in the weekly timeframe has signaled a potential market reversal after being trapped in a multi-year falling trend.

Related: Altseason Signs Form as ETH/BTC Hits 5-Year Support – Analyst

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.