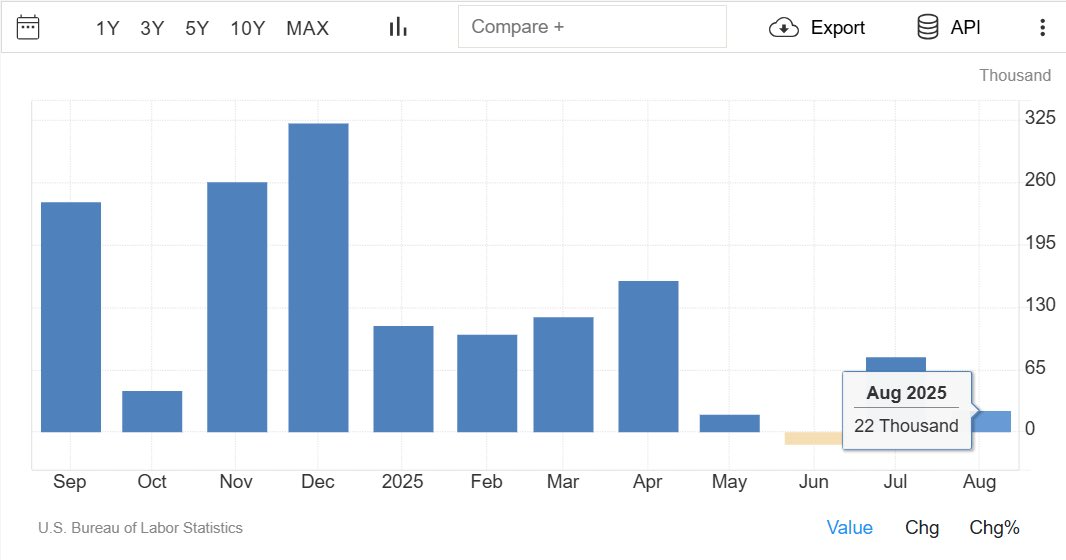

The U.S. economy just flashed its most troubling signal in years. The August jobs report showed the unemployment rate climbing to 4.3%, the highest level since late 2021. Non-farm payrolls rose by just 22,000 jobs, a fraction of the 75,000 expected.

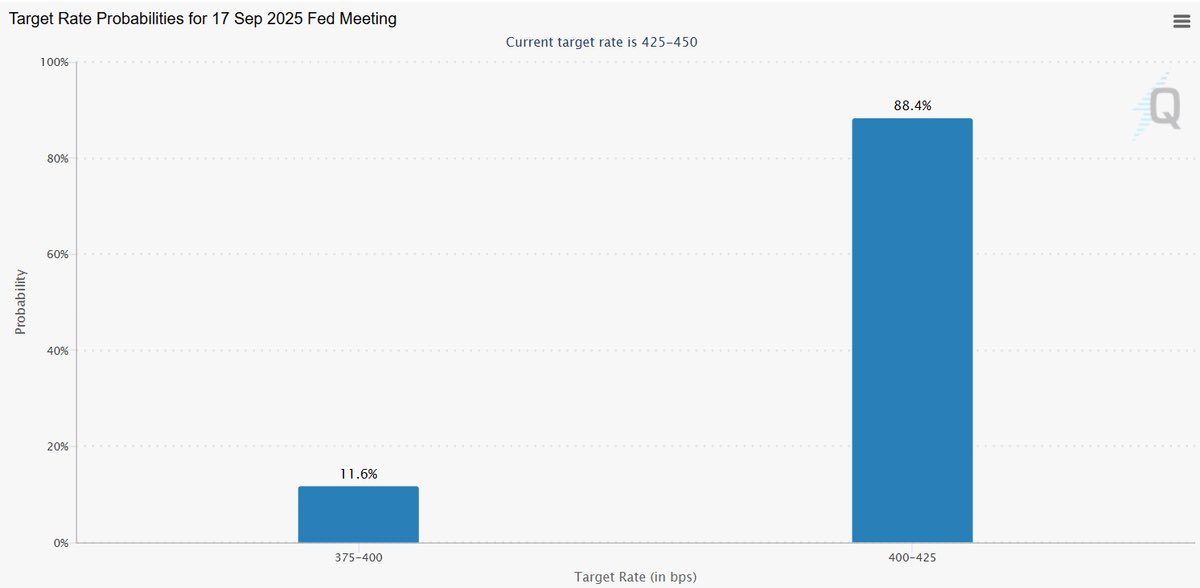

In a detailed analysis on X, Bull Theory points to a labor market losing its footing. For Wall Street, it suggests the business cycle has entered a softening phase. And for the Federal Reserve, it fundamentally alters the policy outlook: with inflation cooling and employment weakening, the case for rate cuts in 2025 is now undeniable.

The shift has already been priced into financial markets. Fed funds futures show a 100% probability of a September cut, with expectations for at least three reductions in 2025.

Beyond the immediate economic risks, this pivot has profound implications for asset markets. Stocks, bonds, and currencies will all react, but crypto may be positioned as the biggest winner of the next liquidity wave.

Labor Market Under Pressure

The details of the August jobs report reveal slowing momentum across the U.S. economy:

- Unemployment: Rising to 4.3%, marking a four-year high.

- Hiring: Just 22,000 new jobs, far below the consensus forecast.

- Participation: Labor force participation rates remain subdued, highlighting structural weakness.

This is more than statistical noise. Economists note that once unemployment breaches certain thresholds, it tends to move higher rather than stabilize. The risk is that a modest labor market cooling turns into a full-blown downturn without decisive policy support.

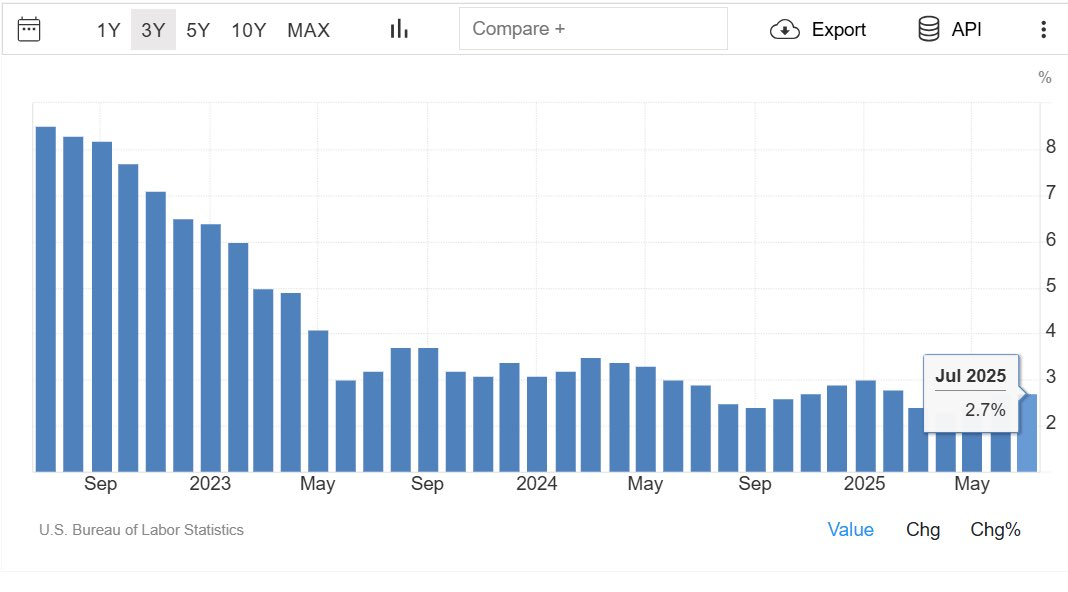

This is a critical data point for the Federal Reserve. Its dual mandate requires it to balance price stability with maximum employment. For much of the past two years, inflation was the priority. But with inflation steadily trending toward the Fed’s 2% target, the rapid deterioration in jobs is now forcing its hand.

Why the Fed Is Set to Pivot

The Fed’s policy dilemma is becoming clearer by the day. Inflation, once running above 7%, has cooled significantly thanks to tighter monetary policy, easing energy costs, and supply chain normalization. Headline CPI is hovering close to the Fed’s comfort zone.

Related: Chances for a September Rate Cut Surge to 90.4% After Weak Jobs Report

On the other side, unemployment is flashing a danger. A labor market at risk of contraction raises the specter of recession. This combination, falling inflation and rising unemployment, leaves the Fed little choice but to act.

Market pricing confirms this.

- Traders see an 88% chance of a 25 basis point cut in September, with a smaller 12% chance of a deeper 50 basis point cut.

- Looking ahead, there’s an approximately 75% probability of three cuts in 2025.

What This Means for Traditional Markets

Rate cuts ripple across every asset class, but the effects are uneven:

- Equities: Historically, stocks benefit when rates fall, as cheaper capital supports valuations and corporate earnings. However, gains tend to be gradual and sector-specific. Defensive stocks may lag, while growth and technology stocks often lead.

- Bonds: The initial reaction is typically a rally, as yields fall. But the upside is capped: the lower yields go, the less attractive bonds become as a long-term store of value.

- Commodities: Gold and oil often see tailwinds, though their performance depends on global demand conditions.

- Crypto: This is where the sharpest moves occur. With lower rates, the opportunity cost of holding Bitcoin, Ethereum, and other digital assets declines dramatically, making them more appealing than cash or bonds.

Related: FOMC Meeting: Why a September Rate Cut Looks Likely – And What Could Stop It

Why Bitcoin and Crypto React the Fastest

Crypto is uniquely tied to liquidity cycles. Unlike equities, which are driven by earnings, or bonds, which are tied to interest rate spreads, crypto’s value is anchored in two simple variables: liquidity and adoption.

- When liquidity expands, whether through lower interest rates, balance sheet growth, or an increase in the global money supply, crypto assets have historically surged. The mechanism is straightforward: excess capital looks for speculative, high-upside assets, and crypto fits that bill.

- Equities and bonds often take months to fully reflect policy changes. Crypto, by contrast, tends to reprice almost immediately. That speed and sensitivity make it the most direct barometer of shifting liquidity conditions.

A Look Back: Rate Cuts and Crypto Rallies

History offers a powerful playbook:

- 2020 Pandemic Response: Emergency rate cuts and massive quantitative easing lifted Bitcoin from $5,000 to $68,000 in 18 months.

- 2024 Fed Pivot: As soon as the Fed turned dovish, Bitcoin surged from $60,000 to $100,000 in under three months.

These aren’t coincidences. Every major easing cycle over the past decade has coincided with a powerful crypto bull market. Tops tend to align with peak global liquidity, while bottoms align with liquidity troughs.

The setup for 2025 fits that pattern. Global M2 money supply is already rising, and with the Fed preparing to cut, conditions are aligning once again.

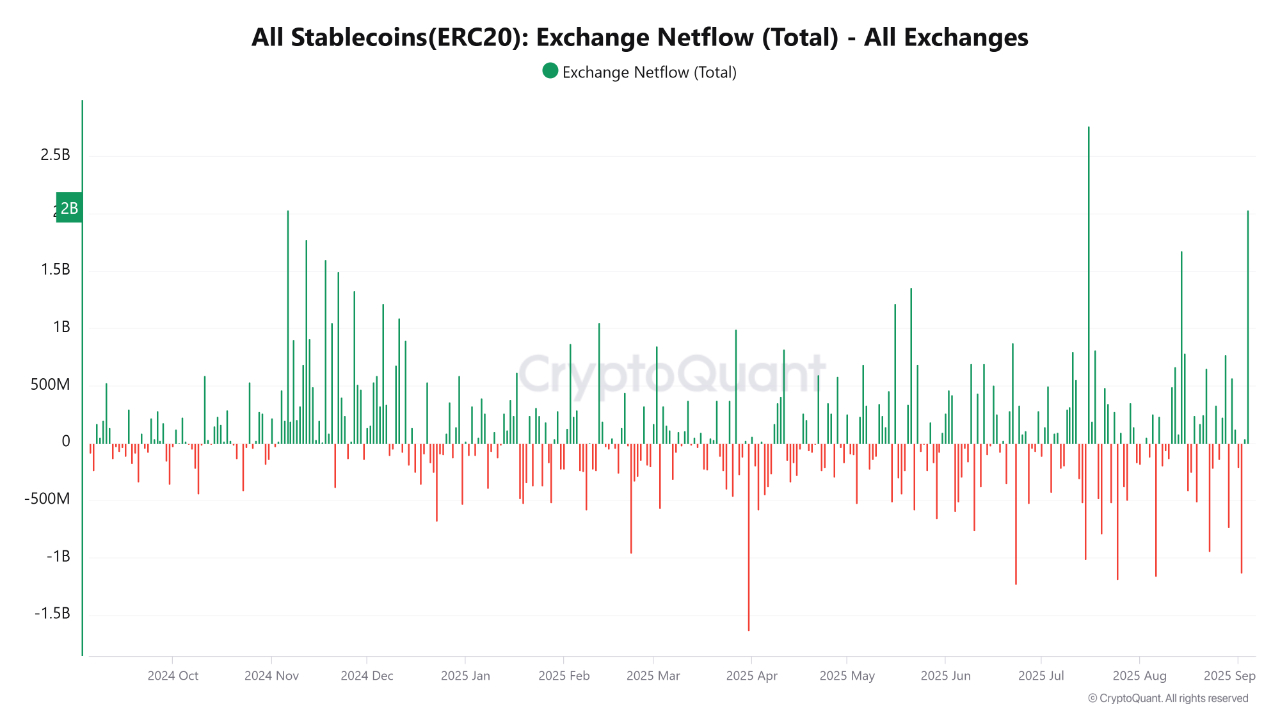

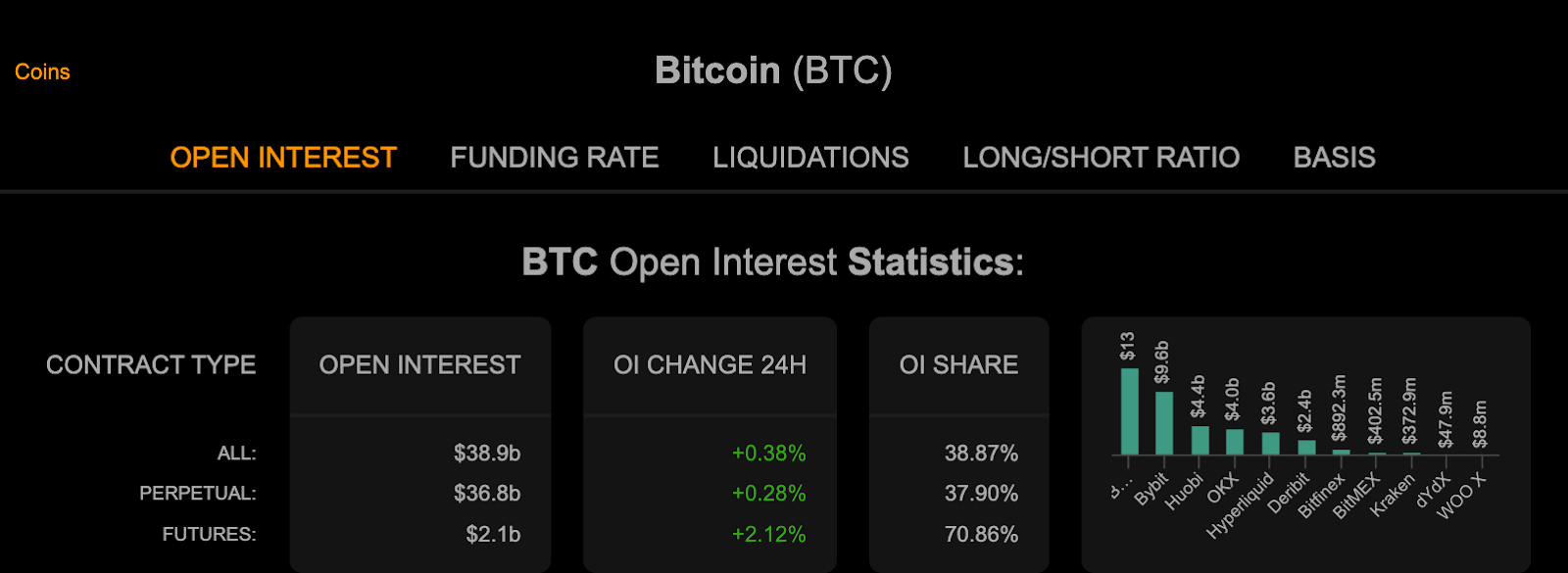

- On-chain data indicates that traders are anticipating the move, with $2 billion in stablecoin inflows and Bitcoin open interest exceeding $80 billion. This suggests a buildup of dry powder and leveraged positioning.

Why 2025 Could Be Different

While the liquidity cycle playbook suggests another rally, there are structural shifts in this cycle that could amplify the effects:

- Institutional Flows: Unlike 2020, today’s market has Bitcoin and Ethereum ETFs channeling institutional capital into crypto. Corporate treasuries are also adopting digital assets as part of balance sheet management.

- Regulatory Clarity: The U.S. Securities and Exchange Commission (SEC) is, for the first time, pursuing favorable regulations for crypto..

- Diversified Demand: In past cycles, retail speculation dominated. This time, the buyer base is broader, with pensions, hedge funds, and asset managers adding exposure.

This doesn’t eliminate volatility. Crypto remains a high-beta asset. But it does mean the next rally may be more profound, more liquid, and potentially longer-lasting than before.

- Notably, despite intraday volatility and liquidations, BTC’s short-term structure remains constructive, with a bullish bias above $109,500, though a confirmed bottom hinges on a weekly close above $112,500.

- Bitcoin’s open interest has surged 0.41% to $38.9 billion amid a 0.32% uptick in perpetual contracts, while futures rose 2.13% to $2.2 billion in weekend trading. This supports growing confidence in BTC’s longer-term trend.

Related: Bitcoin Price Prediction: Analysts Eye $113K Rebound As CME Gap Anchors Support

Weak Jobs, Stronger Crypto Outlook

The August labor shock has confirmed what many investors anticipated: the U.S. economy is slowing, and the Federal Reserve is preparing to respond with rate cuts. While unemployment climbing to a four-year high signals real weakness in the economy, for markets, it means fresh liquidity is on the way.

Equities and bonds are likely to benefit, but their upside remains capped by earnings uncertainty and falling yields. However, crypto has historically been the fastest and strongest responder to easing cycles, with previous Fed pivots sparking explosive rallies.

With inflation cooling, global liquidity rising, and institutional demand now adding depth to the market, Q4 2025 could mark the beginning of another major crypto bull run.

Disclaimer: This article is based on the insights and forecasts shared by market influencers and analysts. While CoinEdition has synthesized and contextualized these views, readers should treat the content as informational rather than financial advice.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.