- Versan Aljarrah claims XRP’s neutral, instant-settlement system could reduce financial friction between the U.S. and China.

- He suggests faster, cheaper cross-border payments might ease trade tensions.

- However, analysts say that no single digital asset can resolve the geopolitical, policy, and security issues driving the trade war.

Versan Aljarrah, founder of Black Swan Capitalist, has claimed XRP could effectively bring an end to the U.S.–China trade tensions. His argument centers on XRP’s design as a neutral, fast-settlement reserve asset capable of removing friction from global trade.

While the idea gained traction among some community members, others stressed that geopolitical conflict involves far more than settlement rails.

XRP as a Neutral Bridge Between Two Economic Giants

In his tweet, Aljarrah claimed that XRP’s instant cross-border payment system could help remove many financial barriers behind the U.S.–China trade dispute. As a neutral digital asset not controlled by either country, XRP could transfer value directly between them without using the dollar or the yuan.

According to this perspective, faster settlement, reduced intermediary costs, and the elimination of currency frictions could streamline trade at a scale large enough to soften tensions between the world’s two biggest economies.

Notably, this idea has been circulating in the XRP community for months. Earlier this year, analysts like Egrag suggested the U.S. could gain a competitive advantage over China through its indirect proximity to Ripple’s 35 billion XRP escrow.

The Pushback: “XRP Can Reduce Friction, But Not End a Trade War”

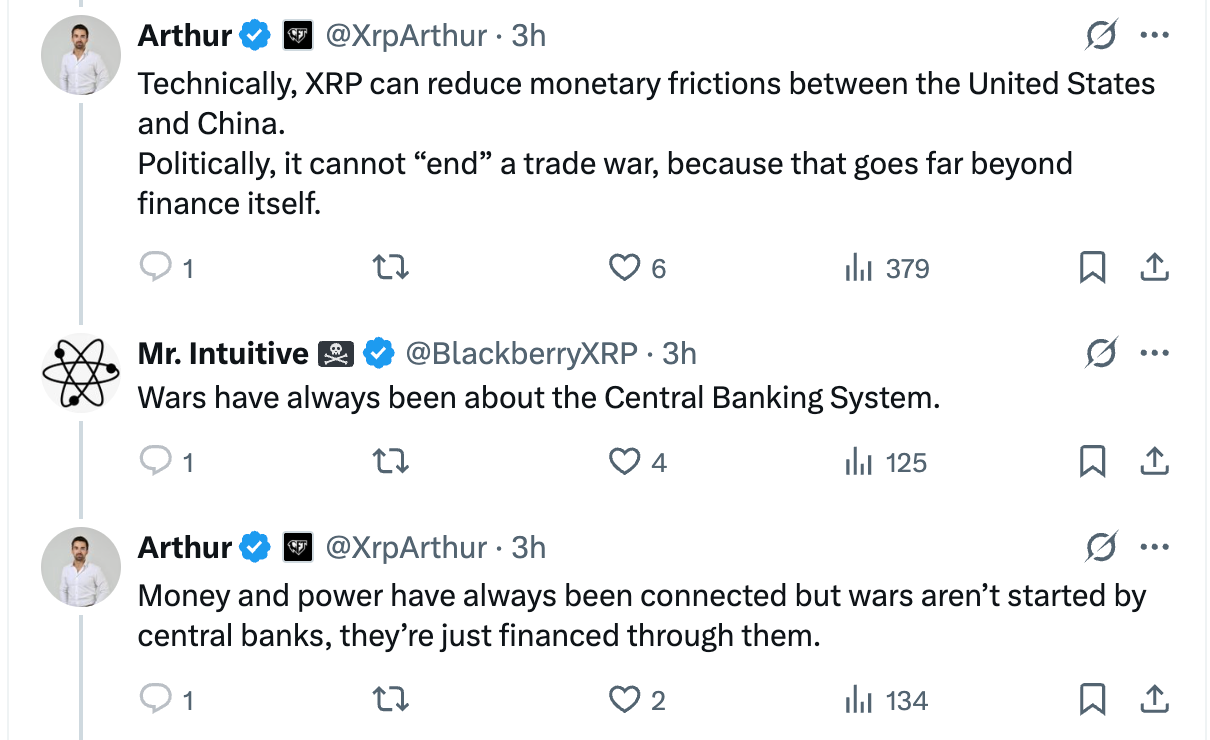

Meanwhile, community member Arthur argued that while XRP might help reduce financial friction between the U.S. and China, it can’t “end” a trade war. He explained that such conflicts stem from government policies, security concerns, tariffs, supply chain issues, and politics—not just money flow problems.

In other words, even a flawless payment system couldn’t fix the deeper geopolitical tensions driving U.S.–China rivalry. The discussion expanded further when another community member, Mr. Intuitive, claimed that wars have always been linked to central banking systems.

Arthur replied that while money and power are connected, banks don’t start wars—they just finance them. He emphasized that the real causes of geopolitical conflict run much deeper than currency systems.

The Bottom Line

Ultimately, while no digital asset can single-handedly end a trade war, analysts agree that XRP could still have a meaningful role in global finance if adoption increases.

XRP’s strength lies in its role as a bridge asset on the XRP Ledger, allowing instant settlement without pre-funded accounts. This setup reduces costs and improves liquidity flow across borders.Related: XRP Used for International Remittances in Key Asian Markets

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.