- Another debate erupted about ETH’s status as a security with Twitter’s former CEO at its center.

- Bulls defended ETH at $1800, leading to another hike in value.

- The CMF indicator pointed out that ETH could soon be overbought.

Twitter’s former CEO and co-founder affirmed his position that Ethereum (ETH) is a security. Dorsey, who shared his opinion about the SEC’s action of labeling several cryptocurrencies as unregistered securities, initially mentioned three assets that were censorship resistant.

Jack is on opposing sides with Gary

As expected, his list included Bitcoin (BTC). However, Dorsey left out the second-largest cryptocurrency in market value. When asked if he mistakenly left out Ethereum, Dorsey replied, “No, I didn’t.”

This statement sparked a significant debate within the cryptocurrency community and raised questions about the regulatory classification of Ethereum. The issue became contentious but the Bitcoin maximalist didn’t bulge. In fact, he responded sarcastically to another user who called him a “clown” for his earlier opinion, saying, “ETH is not a security? Teach me wizard.”

Before the recent debacle, there have been debates about ETH being a security or otherwise. But on April 28, Yahoo Finance reported that SEC chair Gary Gensler did not consider the altcoin security. At that time, Gensler said, “It’s now sufficiently decentralized that we’ll consider it not a security.”

The struggle with compliance

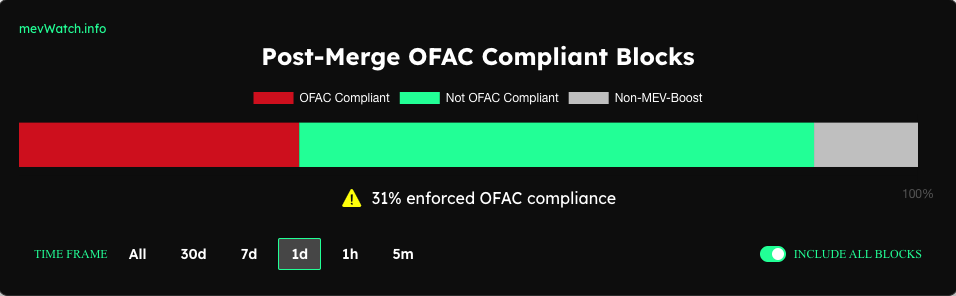

Amid the back and forth, MEV Watch revealed that only 31% of ETH’s post-Merge blocks were OFAC-compliant.

OFAC, which stands for Office for Foreign Assets Control, is an agency of the U.S. Department of the Treasury, responsible for trade and economic sanctions. Moreso, the treasury department began watching the blockchain after its switch to Proof-of-Stake (PoS).

For Ethereum to be OFAC-compliant, some MEV-boost relays need to censor some transactions on the network.

Therefore, the increase means that the majority of Ethereum blocks have not interacted with sanctioned applications. But the current state still raised eyebrows about the decentralization of the blockchain.

ETH: Fighting to fend off the bears

After its downtrend period on June 5, ETH established a bullish swing, rising to $1,874. This represented a 3.86% increase in the last 24 hours. The rise could be connected to the general crypto market bounce.

However, a bearish structure started to erase the gains after the price was rejected at the $1,905 resistance level. Despite a series of bearish candles, bulls eventually defended the $1,808 support. This bounced the price back up to $1,885 on the daily timeframe.

Bulls were, however, failing at supporting the current price level of $1,876. If this continues, then bearish superiority might appear, and the ETH price decreases.

On the other hand, the Chaikin Money Flow (CMF) trended skyward. This suggests that ETH had a positive liquidity flow. But with the indicator at 0.19, the cryptocurrency might hit an oversold region.

On a final note, ETH might require an increase in demand to keep up with the bullish movement. At the same time, the price risks reversal if the CMF eventually hits 0.20.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.