- Bitcoin price has dropped to a six-month low as traders signal bullish exhaustion.

- On-chain data analysis shows institutional investors are still bullish as retail traders capitulate.

- The BTC/USD pair may drop as much as $66.9k if the expected liquidity fails to flow soon.

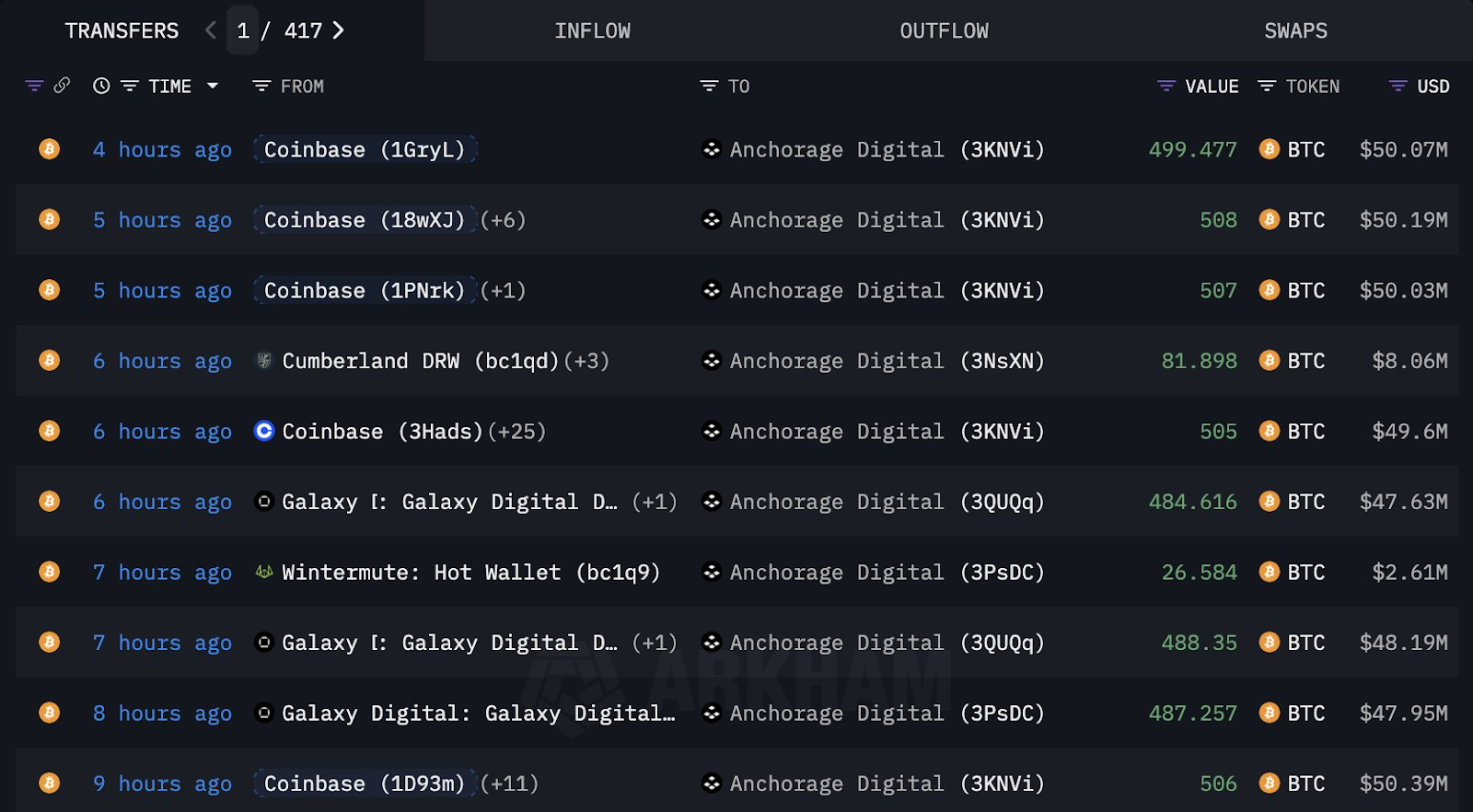

A “great disconnect” is splitting the Bitcoin market. As “paper” traders and technical analysts signal “Extreme Fear” and a potential crash to $66K, “smart money” is aggressively buying the dip. On-chain data shows Anchorage Digital just scooped up 4,094 BTC, valued at $405 million, from major desks like Coinbase, Cumberland, and Wintermute.

The “Smart Money” Bid: Anchorage and Central Banks Buy In

This institutional bid is not isolated. Anchorage’s $405M purchase is part of a wider trend of accumulation. According to BitcoinTreasuries, the number of entities holding BTC for treasury management has grown to 355, with 4.05 million BTC now held by institutions hedging against uncertainty.

This conviction is now mirrored by sovereign entities. During the Bitcoin Amsterdam 2025 conference, Luxembourg’s Finance Minister Gilles Roth stated the country has allocated 1% of its sovereign wealth fund (about €7 million) to Bitcoin.

This follows the Czech National Bank’s (CNB) announcement that it is also creating a test portfolio of digital assets, primarily Bitcoin.

Related: Bitcoin (BTC) Analysts Predict $170K Peak ‘Within 6 Weeks,’ Ignoring ‘Extreme Fear’ Now At 15

The “Paper” Panic: Retail FUD and BTC Bearish Technicals

This institutional buying flies in the face of collapsing retail sentiment. As Bitcoin dropped below $97K for the first time since May, the Fear & Greed Index plunged to 22/100, signaling “Extreme Fear.”

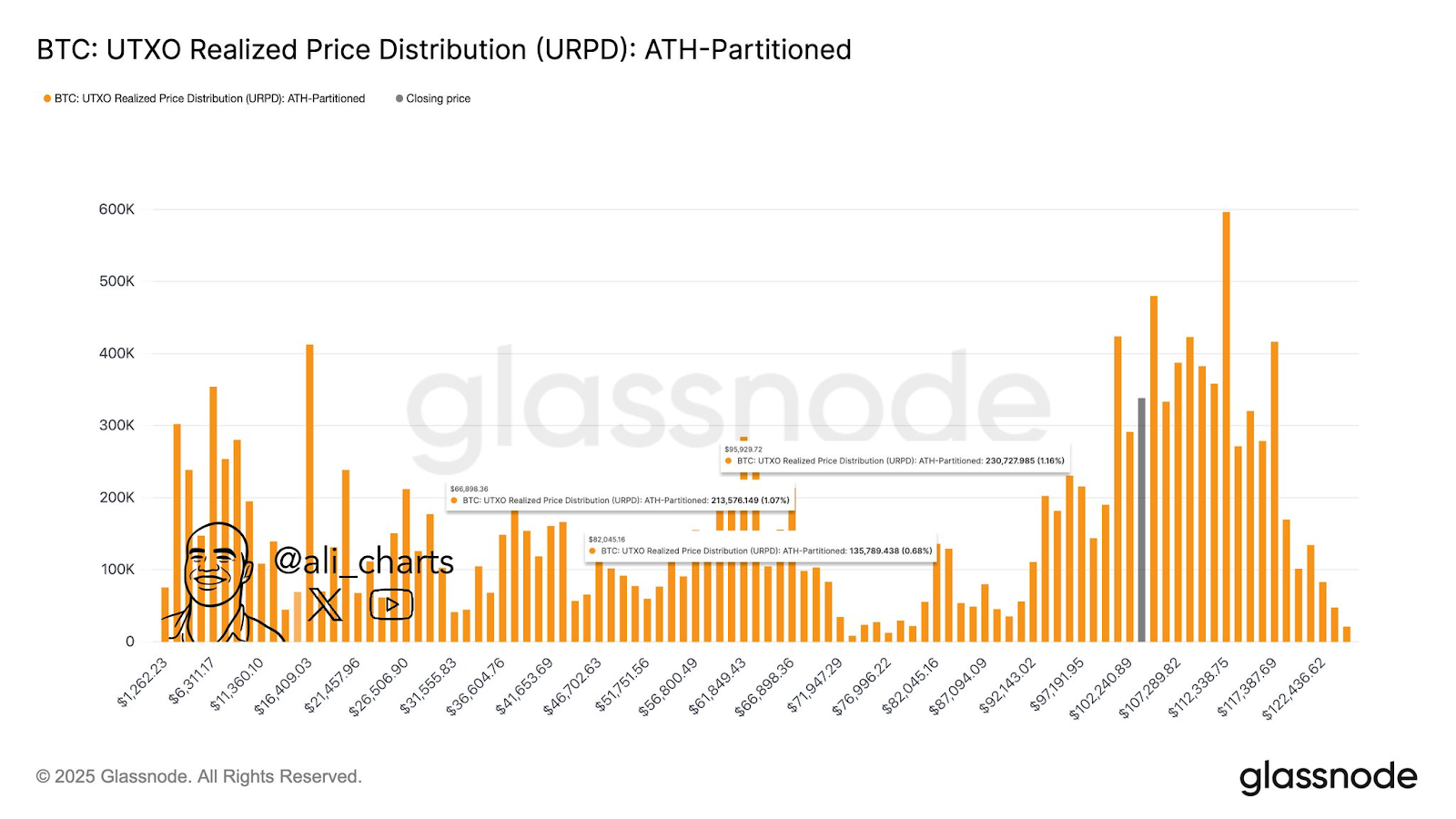

Technical analysis supports this panic. After losing the $100K support level, traders are bracing for a drop to the $92K-$94K support range.

A key CME gap also sits around $92K, a common target for such pullbacks. Furthermore, analyst Ali Martinez warned that if the $95.9K and $82K support levels fail to hold, a much deeper capitulation sweep to $66K is possible.

Related: Bitcoin Plunges to $100K as US ‘Data Blackout’ Prices Out Fed Rate Cut Hopes

The Rationale: Why “Smart Money” Is Buying the Panic

So why is “Smart Money” buying while “Paper” is selling? Institutional investors are looking past the short-term FUD, betting on positive midterm fundamentals.

Analysts expect a new wave of liquidity to enter the market following the U.S. government reopening, potentially fueled by Federal Reserve Quantitative Easing (QE). On-chain firms like Santiment also note that capital may be rotating from Gold, which is showing a reversal pattern, and that this level of retail capitulation is a classic contrarian “buy-the-dip” signal.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.