- Andrew Tate issues a stark Bitcoin $26K call, targeting overconfident ‘max long’ traders.

- Bitcoin price today plunges to a low of $104,000 as Spot Bitcoin ETFs bleed $530.9 million in one day.

- The crash, compounded by U.S. bank fears, wiped $230 billion and liquidated $556 million in leveraged positions.

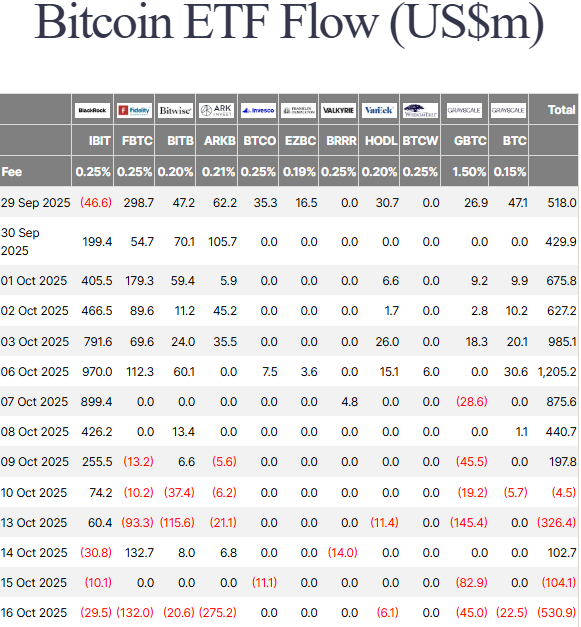

Bitcoin (BTC) price plunged to $104,000 today, rocked by a dual shock of macro fear and a massive flight from crypto-native products. The catalyst for the crash was a record-breaking $530.9 million net outflow from U.S. Spot Bitcoin ETFs on October 16.

Meanwhile, according to Andrew Tate, Bitcoin’s price could fall even lower, potentially down to $26,000.

It Can Always Get Worse

Tate suggests the price could drop further due to overconfidence among investors who believe the market has already bottomed out.

“Everyone is max-longing because they think it can’t go any lower,” Tate said in a recent video. “But that’s when it gets worse. The more you believe it won’t drop, the more likely it is to do so.”

According to Tate, many crypto investors are caught in a dangerous cycle of borrowing money to “max long,” convinced the price won’t dip further.

This over-leveraging is only contributing to the market’s volatility. While many investors have already lost substantial amounts, they hold onto hope that they can recover everything with one big trade.

For Tate, the more people believe this is a sure thing, the more they’re setting themselves up for disaster. “It can always get worse. And it will continue to get worse until all optimism is gone and everyone is out of money,” he said.

He believes that once the last bit of optimism is drained from the market, Bitcoin’s price will pump hard back to a new all-time high.

Market Liquidations Surge as Fear Grips Investors

The market is already feeling the effects of this growing fear. In just one day, over $230 billion was wiped from the crypto market, with major assets like Bitcoin and Ethereum dropping between 6% and 8%.

Altcoins, memecoins, NFTs, and ETFs have also suffered steep losses. More than $556 million in liquidations were recorded, primarily from long positions.

Related: Bitcoin’s Q4 Setup: $100K First, $88K Risk, $125K Breakout Clears Records

How Low Can Bitcoin Go?

As of the latest update, Bitcoin is trading at $105,154, after briefly plunging to $104,000 during a “second Black Friday” event. The drop coincided with rising risk aversion, sparked by financial instability in U.S. regional banks.

Bitcoin has now lost several key support levels, including the 200-day SMA at $107,520. Analysts warn that further downside is possible:

- Block_Diversity: Key downside levels to watch are $101K, $95K, and $88K.

- Sykodelic: Considers $104K critical support, citing historically low RSI levels. “The weekly close will be very important.”

With the Fear & Greed Index in “extreme fear,” some analysts suggest a short-term rebound may be on the horizon.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.