- Crypto Tony tweets about 150K ETH transactions from an unknown wallet to Coinbase.

- Ethereum fluctuates inside a bearish flag, since late 2022, it could break out at any moment.

- Bollinger bands buy time for a breakout as ETH touched the lower band.

Crypto Tony, a trader and analyst retweeted Whale Alerts, a blockchain transaction surveyor’s tweet which stated that 149,999 ETH was transferred from an unknown wallet to Coinbase. The transferred ETH accumulates to $261,949,642.

However, the reason behind this mass transaction is yet to be determined. It could be that the whale is gearing up to exchange ETH for some other coin, or could be something else that the whale could be having up its sleeve, hence, traders may need to take precautions.

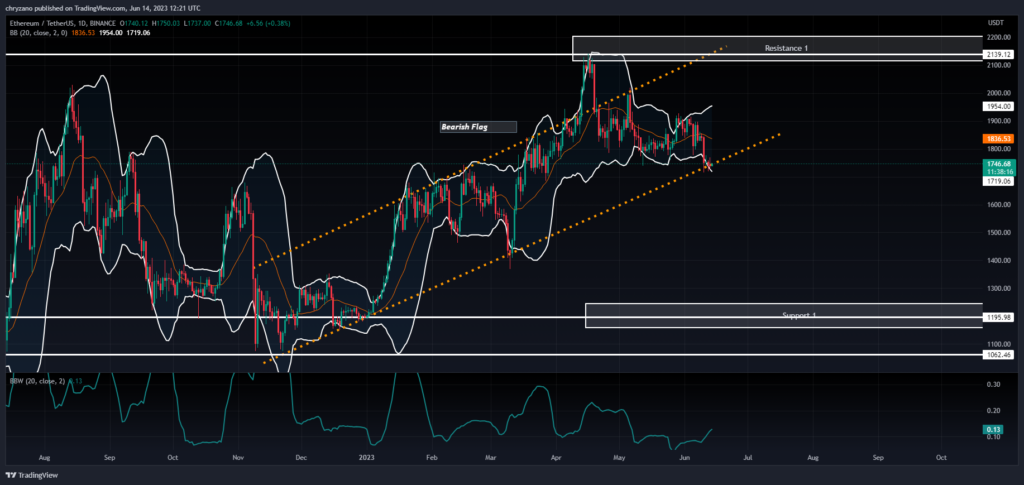

When considering the above chart, Ethereum has been trading in a bearish flag since late November 2022. ETH touched the upper trend line most of the time during its abode in the flag. It has been making higher highs and higher lows for almost six months. As such we could expect Ethereum to break out from the flag at any given time.

According to the best practices of trading the bearish flag, it is advisable to have the take profit of the short position just below the Support 1 level. The above thesis is based on the best practice of trans-positioning the height of the wedge at the early stages of formation, to the breakout point from the wedge.

Moreover, the stop loss could be placed at the top trend line of the wedge to give enough slack for ETH to fluctuate. If Ethereum crashed from the wedge it could reach $1062.

When considering the timing of the breakout, the Bollinger bands seem to negate the fact that ETH might break out from the wedge now. This is because ETH has touched the lower Bollinger Band, hence, it may retrace and rise. As such, ETH further has the possibility to continuously fluctuate inside the wedge for quite some time. Moreover, the Bollinger bandwidth indicator is also rising, hence, the bands may widen further and there could be increased volatility.

Hence, it is of utmost importance for traders to time the market, particularly the breakout point from the wedge. It is advisable that they use the proper combination of indicators to adjudicate the market behavior.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.