- Bitcoin’s open interest exceeds $18 billion, a historically volatile level.

- Analysts predict a possible shakeout before Bitcoin’s next major price move.

- Funding rates show mild bullish sentiment, but a correction could still be imminent.

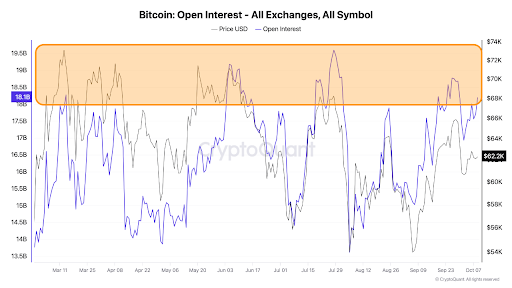

Bitcoin’s open interest has exceeded $18 billion, a historically significant level often preceding market corrections. Bitcoin’s price has also retreated to a low of $60,314 today.

The rise in open interest, which tracks the number of outstanding derivative contracts, suggests growing speculative activity in the market. Recent charts by CryptoQuant show that open interest has ranged between $13.5 billion and $19.5 billion in recent months. Previous peaks in open interest have often coincided with price corrections.

Historical Correlation Between Bitcoin Crashes and High Open Interest

In July, when open interest was above $19 billion, BTC’s price neared $68,000. However, a sharp decline followed, bringing BTC’s price down to $54,000, with open interest similarly declining.

A similar pattern emerged in June when open interest hovered between $16.5 billion and $17.5 billion, while Bitcoin’s price fluctuated between $55,000 and $66,000. This highlights the correlation between Bitcoin’s price and open interest.

Funding Rates Remain Stable Despite Surge in Open Interest

Despite the surge in open interest, Bitcoin’s funding rates remain relatively stable. Current rates, at 0.011%, are slightly above their 200-day simple moving average (SMA). This indicates that long traders—those betting on Bitcoin’s price to rise—currently dominate the market.

Historically, funding rates have turned negative during major market corrections, often signaling a forthcoming price recovery. However, the current neutral level suggests that while bullish sentiment is present, it is not overwhelming. This could indicate a shallow correction, should one occur.

Analyst Anticipates a Final Shakeout Before the Next Big Move

According to CryptoQuant analyst Aytekin Cetinkaya, a final shakeout involving long liquidations could reduce open interest and stabilize the market ahead of Bitcoin’s next price rally. This liquidation event would likely bring open interest down to healthier levels, paving the way for more sustainable growth towards a potential all-time high.

Cetinkaya remarked, “It wouldn’t be surprising to see some long liquidations that lower open interest and prepare the market for its next move.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.