- Bullish APENFT (NFT) price prediction ranges from $0.0000003100 to $0.0000006600

- Analysis suggests that the NFT price might reach above $0.00000065.

- The NFT bearish market price prediction for 2023 is $0.0000002900.

There are other digital currencies besides Bitcoin (BTC) and Ethereum (ETH) that people who want to diversify their portfolios and learn more about cryptocurrencies should consider. APENFT (NFT) is one of them.

With the TRON and Ethereum Layer-1 protocols and BTFS distributed storage, the APENFT Marketplace provides a multichain metaverse GameFi and NFT trading platform. A user can browse NFT collections, make purchases and sales, as well as add titles and descriptions to their uploaded artworks.

If you are interested in the future of NFT and want to know its predicted value for 2023, 2024, 2025, and 2030 – keep reading!

Table of contents

- APENFT (NFT) Market Overview

- What is APENFT (NFT)?

- APENFT (NFT) Current Market Status

- APENFT (NFT) Price Analysis 2023

- APENFT (NFT) Price Prediction 2023-2030 Overview

- APENFT (NFT) Price Prediction-2023

- APENFT (NFT) Price Prediction 2024

- APENFT (NFT) Price Prediction 2025

- APENFT (NFT) Price Prediction 2026

- APENFT (NFT) Price Prediction 2027

- APENFT (NFT) Price Prediction 2028

- APENFT (NFT) Price Prediction 2029

- APENFT (NFT) Price Prediction 2030

- APENFT (NFT) Price Prediction 2040

- APENFT (NFT) Price Prediction 2050

- Conclusion

- FAQ

APENFT (NFT) Market Overview

HTTP Request Failed... Error: file_get_contents(https://pro-api.coinmarketcap.com/v2/cryptocurrency/quotes/latest?slug=apenft): Failed to open stream: HTTP request failed! HTTP/1.1 429 Too Many RequestsWhat is APENFT (NFT)?

With the TRON and Ethereum Layer-1 protocols and BTFS distributed storage, the APENFT Marketplace provides a multichain metaverse GameFi and NFT trading platform. Users can browse NFT collections, make purchases and sales, and add titles and descriptions to their uploaded artworks. NFT is the official governance token for the APENFT ecosystem, and it is a decentralized digital asset backed by ERC-20/TRC-20 protocols.

Both BTFS and the underlying technology of Ethereum and TRON, two of the most prominent blockchains, back APENFT. The project’s ultimate goal is to create one-of-a-kind ERC-721/TRC-721 coins based on registered NFTs representing works of art of the highest caliber.

NFT tokens are stored in ERC-20 or TRC-20 smart contracts, and the rights and interests in the underlying artworks belong to the NFT token holders. The BTFS infrastructure indefinitely holds artwork and metadata corresponding to ERC-721/TRC-721 tokens.

The mission of APENFT is to create a network of blockchain nodes consisting of artworks, artists, the community, and a panel of experts to realize features and solve pressing problems (such as centralized valuation, illiquidity, and counterfeits) plaguing the present art market.

With the help of APENFT, artists and their works can be converted on-chain with a simple mouse click, giving previously unappreciated works of art a fresh lease on life.

APENFT’s mission extends beyond simply registering works as NFTs on the blockchain to assisting artists and related organizations. Using data gleaned from in-depth analyses of policy documents and market reports, APENFT employs a vast team of industry watchers and leaders.

Only one token, APENFT, has been issued by APENFT; it is a decentralized digital currency built on the ERC-20/TRC-20 protocol and serves as the Proof of Stake for the APENFT foundation (PoS). As the official APENFT governance token, it can validate claims and access the APENFT network.

Users who hold NFTs have access to voting rights, profit distribution, and airdrops. Huobi, Kucoin, Uniswap, and Pancakeswap are just some of the CEX and DEXs where you may buy and sell the token. At the end of 2020, the total market value of NFT had risen to $250 million. March 2021 saw sales of $220 million. In the next decade, 50 of the top 100 artists and pieces of art will be registered as NFTs.

APENFT (NFT) Current Market Status

The maximum supply ofAPEBFT (NFT) is 999,990,000,000,000 NFT, while its circulating supply is 990,105,683,025,577 NFT, according to CoinMarketCap. At the time of writing, NFT is trading at $0.0000003167 representing 24 hours increase of 39%. The trading volume of NFT in the past 24 hours is $20,214,911 which represents a 6.78% decrease.

Some top cryptocurrency exchanges for trading APENFT (NFT) are Kucoin, Bitfinex, Uniswap V2, and Bithumb

Now that you know NFT and its current market status, we shall discuss the price analysis of APENFT(NFT) for 2023.

APENFT (NFT) Price Analysis 2023

Will the NFT’s blockchain’s most recent improvements, additions, and modifications help its price rise? Moreover, will the changes in the payment and crypto industry affect NFT’s sentiment over time? Read more to find out about NFT’s 2023 price analysis.

APENFT (NFT) Price Analysis – Bollinger Bands

The Bollinger bands are a type of price envelope developed by John Bollinger. It gives a range with an upper and lower limit for the price to fluctuate. The Bollinger bands work on the principle of standard deviation and period (time).

The upper band as shown in the chart is calculated by adding two times the standard deviation to the Simple Moving Average while the lower band is calculated by subtracting two times the standard deviation from the Simple Moving Average.

When considering the above chart, we can see that NFT moving in a zigzag pattern inside the Bollinger bands. Currently, after ricocheting off of the lower band NFT seems to be moving upwards toward the SMA. Moreover, the Bollinger bands are placed parallel to the horizontal axis. As such, we may see the NFT prices move sideways.

The above chart shows how most of NFT’s price movement has been on a downtrend since the beginning of this year. Although it had brief periods of green there wasn’t a green trend that lasted long. Currently, NFT is on a downtrend as the Bollinger band trend indicator shows the zone as red. Moreover, the Bollinger band width percentile indicator at the bottom of the chart shows a value of 65.87%, which means that the bandwidth is at a mid-level.

However, since the BBWP line seems to be heading downward, there is a possibility that the Bollinger bandwidth could reduce. This would mean that the volatility for NFT will also reduce.

APENFT (NFT) Price Analysis- Relative Strength Index

The Relative Strength Index is an indicator that is used to measure whether the price of a cryptocurrency is over or undervalued. For this purpose, it has two extreme regions known as the overbought and oversold regions.

When the RSI reads a value (>70) then the crypto is overbought, which means that due to more buying the demand has increased as such the price has also increased. On the other hand, when it is oversold, many are selling, as such, its price is undervalued.

Currently, the RSI for APENFT is at 45. Since this value is considered neither overbought nor oversold, we could say that NFT is on a strong trend. The buying pressure seems to be increasing for NFT, as such, when the price keeps increasing there is a high chance that the RSI could also move up with the prices.

The above chart shows the longer timeframe for APENFT. Currently, we can see that it gives a reading of 35.12 and the RSI line is placed parallel to the horizontal axis. As such, we may see some sideways movement in the future.

Moreover, the chart above also shows a bullish divergence. A bullish divergence occurs when the RSI makes higher highs while the crypto makes lower highs, as shown in the chart. Traders could use these signals to deduce a divergence in trend.

APENFT (NFT) Price Analysis- Moving Average

The exponential moving average is not much different from the simple moving average. The EMA gives more weightage to the present prices while the SMA equally distributes the values to the frequency. Hence, when the EMA is plotted in the graph it gives a rough idea about how the cryptocurrency has been performing in the past.

Moreover, the 50-Day EMA is considered the short-term length, and the 200-Day EMA is considered the long-term. Whenever the 50-day EMA crosses the 200-day EMA from below it is called a Golden cross, while if it crosses from above, then it is a death cross.

When considering the chart above, we could see that both EMAs have a downward gradient. This means that the price of NFT has been falling for a long time. Lately, we could see that NFT tested the 50-day EMA on multiple occasions but wasn’t able to break above it as the bears were too strong for the bulls. Currently, NFT is once a gain heading for the 50-day EMA. This time if there’s power behind the rising value of NFT, then, we may see it break the 50-day EMA and reach the 200-day EMA shortly.

However, if the bulls are not present then NFT could be rejected at the 50-day EMA as it was rejected multiple times on previous occasions.

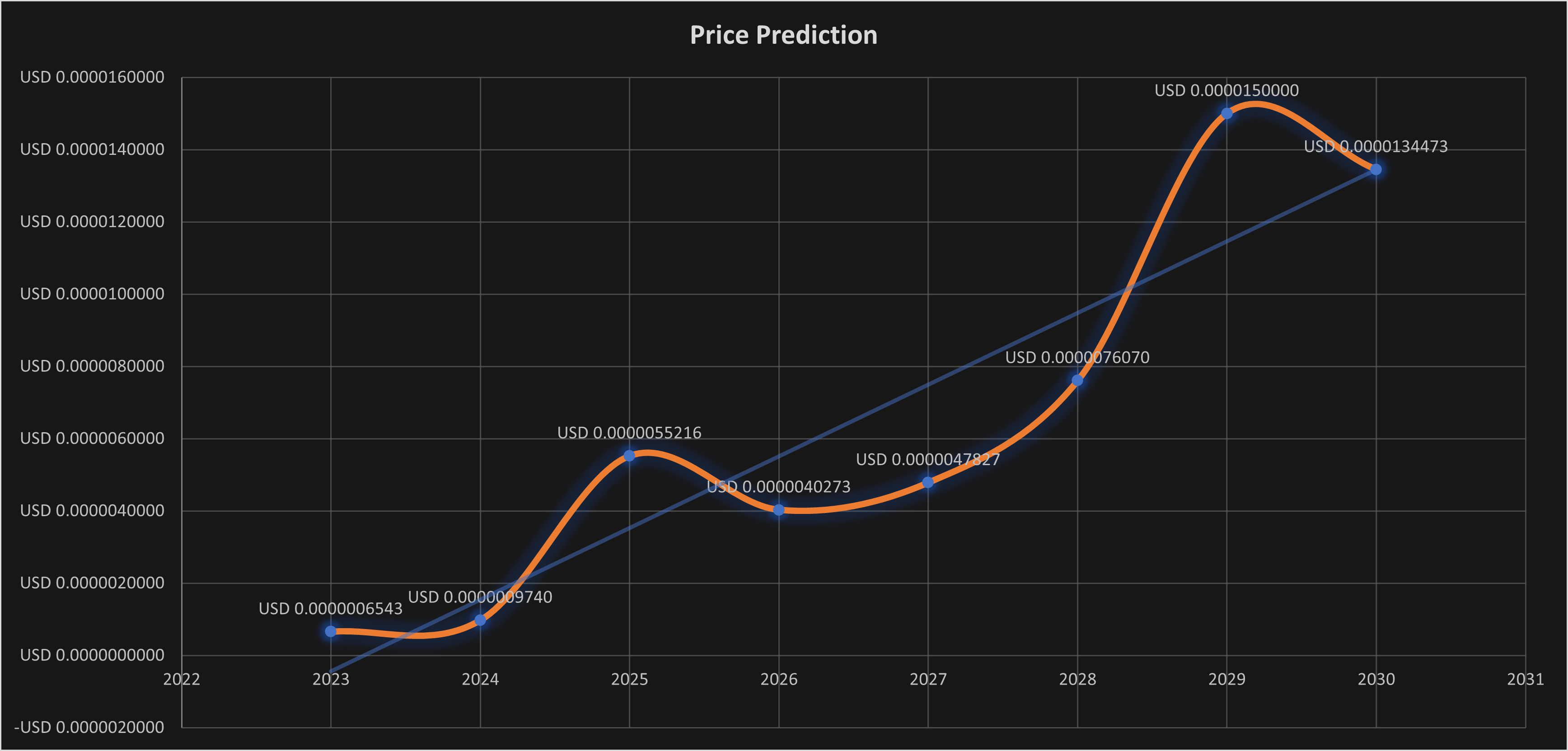

APENFT (NFT) Price Prediction 2023-2030 Overview

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $0.0000005000 | $0.0000006543 | $0.0000007000 |

| 2024 | $0.0000008500 | $0.0000009740 | $0.000001000 |

| 2025 | $0.0000045000 | $0.0000055216 | $0.0000075000 |

| 2026 | $0.0000035000 | $0.0000040273 | $0.0000050000 |

| 2027 | $0.0000040000 | $0.0000047827 | $0.0000050000 |

| 2028 | $0.0000070000 | $0.0000076070 | $0.0000080000 |

| 2029 | $0.000010 | $0.000015 | $0.000020 |

| 2030 | $0.0000125000 | $0.0000134473 | $0.0000200000 |

| 2040 | $0.0000300000 | $0.0000351740 | $0.0000400000 |

| 2050 | $0.0000500000 | $0.0000566223 | $0.0000600000 |

APENFT (NFT) Price Prediction-2023

We could see that APENFT has been descending since the beginning of 2023. It has been trading inside the falling wedge making lower highs and lower lows. Notably, NFT broke out from the lower trend line in June 2023. However, it got right back into the falling wedge pattern after that.

NFT could break out from the wedge at any given time. If it breaks out of the wedge and follows the conventional break out from the wedge, then we may see it rise and reach $0.0000006543. However, on its way up it may find resistance at $0.0000005164.

Nonetheless, in the unfortunate event that NFT crashes, then, it may fall into unprecedented lows as there seems to be no support for NFT below.

APENFT Price Prediction – Resistance and Support Levels

The above chart shows that NFT crashed headlong in June 2022. Its crash was supported at 0.618 fib retracement level. Thereafter, NFT kept moving sideways till August 2022. It fluctuated between the 0.618 and 0.382 fib retracement levels. However, it started falling again and was supported by the 2:1 Gann fan line which helped it spike a little bit and reach the 0.5 fib retracement level.

After reaching 0.5 fib retracement, NFT is currently crashing below the 2:1 Gann fan line. It seems to have reached the bottom of its fall since NFT is moving sideways.

APENFT (NFT) Price Prediction 2024

There will be Bitcoin halving in 2024, and hence we should expect a positive trend in the market due to user sentiments and the quest by investors to accumulate more of the coin. However, the year of BTC halving didn’t yield the maximum for NFT based on the previous halving. Hence, we could expect NFT to trade at a price, not below $0.0000009740 by the end of 2024.

APENFT (NFT) Price Prediction 2025

NFT may experience the after-effects of the Bitcoin halving and is expected to trade much higher than its 2024 price. Many trade analysts speculate that BTC halving could create a huge impact on the crypto market. Moreover, similar to many altcoins, NFT will continue to rise in 2025 forming new resistance levels. It is expected that NFT would trade beyond the $0.0000055216 level.

APENFT (NFT) Price Prediction 2026

It is expected that after a long period of bull run, the bears would come into power and start negatively impacting the cryptocurrencies. During this bearish sentiment, NFT could tumble into its support regions. During this period of price correction, NFT could lose momentum and be way below its 2025 price. As such, it could be trading at $0.0000040273 by 2026.

APENFT (NFT) Price Prediction 2027

Naturally, traders expect a bullish market sentiment after the crypto industry was affected negatively by the bears’ claw. Moreover, the build-up to the next Bitcoin halving in 2028 could evoke excitement in traders. However, there’ll be a dip in price before the excitement will be reciprocated in NFT. As such, we could expect NFT to trade at around $0.0000047827 by the end of 2027.

APENFT (NFT) Price Prediction 2028

As the crypto community’s hope will be re-ignited looking forward to Bitcoin halving like many altcoins, NFT may reciprocate its past behavior during the BTC halving. Hence, NFT would be trading at $0.0000076070 after experiencing a considerable surge by the end of 2028.

APENFT (NFT) Price Prediction 2029

2029 is expected to be another bull run due to the aftermath of the BTC halving. However, traders speculate that the crypto market will gradually become stable by this year. In tandem with the stable market sentiment, NFT could be trading at $0.000015 by the end of 2029.

APENFT (NFT) Price Prediction 2030

After witnessing a bullish run in the market, NFT and many altcoins would show signs of consolidation and might trade sideways and move downwards for some time while experiencing minor spikes. Therefore, by the end of 2030, NFT could be trading at $0.0000134473

APENFT (NFT) Price Prediction 2040

The long-term forecast for NFT indicates that this altcoin could reach a new all-time high(ATH). This would be one of the key moments as HODLERS may expect to sell some of their tokens at the ATH point.

If they start selling then NFT could fall in value. It is expected that the average price of NFT could reach $0.0000351740 by 2040.

APENFT (NFT) Price Prediction 2050

Since Cryptocurrency will be revered and widely accepted by most people during the 2050s, we will see the masses believe more in it. As such NFT could reach $0.0000566223

Conclusion

If investors continue showing their interest in NFT and add these tokens to their portfolio, it could continue to rise. NFT’s bullish price prediction shows that it could reach the $0.00000065 level.

FAQ

With the TRON and Ethereum Layer-1 protocols and BTFS distributed storage, the APENFT Marketplace provides a multichain metaverse GameFi and NFT trading platform. Users can browse NFT collections, make purchases and sales, and add titles and descriptions to their uploaded artworks. NFT is the official governance token for the APENFT ecosystem, and it is a decentralized digital asset backed by ERC-20/TRC-20 protocols.

NFT tokens can be traded on many exchanges like other digital assets in the crypto world. Kucoin, Bitfinex, Uniswap V2, and Bithumb are some of them.

NFT has a possibility of surpassing its present all-time high (ATH) price of $0.00000764. However, due to the positive sentiments of its investors, this could be reached within a short frame of time.

NFT is one of the few cryptocurrencies that has shown resilience for many days. If this momentum is maintained, NFT might reach $0.00000065 soon after its breaks the Resistance 1 level.

NFT has been one of the most suitable investments in the crypto space. It has been rising exponentially, hence, traders may be allured to invest in NFT.

NFT has a present all-time low price of $0.007989.

NFT was launched in March 29, 2021.

Justin Sun co-founded NFT.

The maximum supply of NFT is 999,990,000,000,000 NFT.

NFT can be stored in a cold wallet, hot wallet, or exchange wallet.

NFT is expected to reach $0.00000065 by 2023.

NFT is expected to reach $0.0000009740 by 2024.

NFT is expected to reach $0.0000055216 by 2025.

NFT is expected to reach $0.0000040273 by 2026.

NFT is expected to reach $0.00000047827 by 2027.

NFT is expected to reach $0.0000076070 by 2028.

NFT is expected to reach $0.000015 by 2029.

NFT is expected to reach $0.0000134473 by 2030.

NFT is expected to reach $0.0000351740 by 2040.

NFT is expected to reach $0.0000566223 by 2050.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.