- FalconX network has purchased Arbitrum tokens worth $1.65M from Binance.

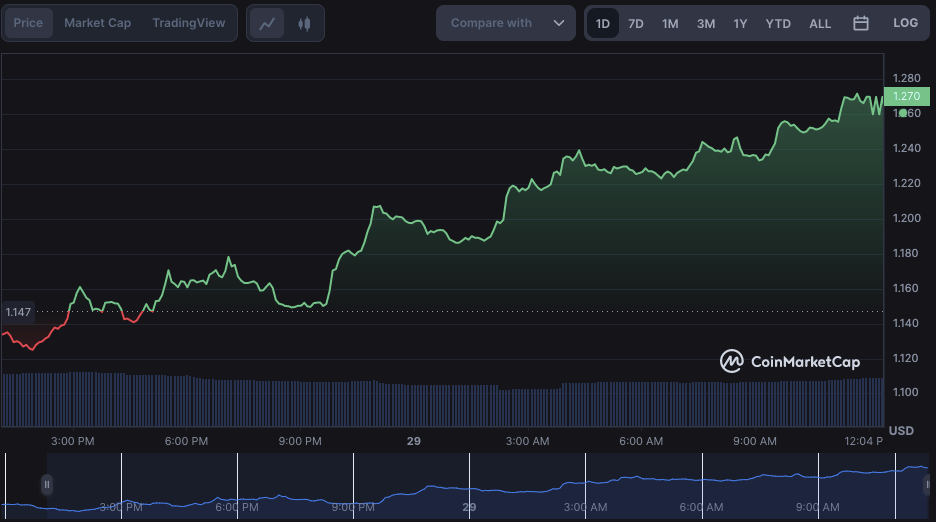

- Arbitrum’s native token has surged over 10% amid the report.

- The retention rates of Arbitrum’s native applications were higher than those of Optimism.

Arbitrum, the Layer 2 scaling solution for Ethereum, has seen a surge in the price of its native token, $ARB, following reports by Lookonchain that a major institution has bought a significant amount of it from Binance.

According to reports, FalconX, a digital asset trading platform, purchased 1.65 million $ARB tokens, worth around $2.06 million, from Binance earlier today.

This news has caused a significant increase in the price of $ARB, which rose by over 10% in a matter of hours.

According to experts, this investment by FalconX is seen as a significant vote of confidence in the Arbitrum network, which has received media attention over the last several weeks. Reputable analytical firms like Messari have additionally heightened speculation on Arbitrum due to the excitement around its environment.

The argument behind Messari’s remarks is that new protocols are recognized as a significant revenue generator that often acts as an appealing offering to members of their society.

Messari’s accompanying charts also show that the retention rates of Arbitrum’s native applications were higher than those of Optimism, another L2 scaling solution. Specifically, Arbitrum outperformed Optimism in ecosystem benchmark and network application coverage areas.

Further, according to market watchers, the purchase of such a large amount of $ARB tokens by a major institution like FalconX is a strong signal of the growing interest in the network and its potential for future growth. Crypto proponents also believe this has led to speculation that other institutions may follow suit and invest in $ARB tokens, further driving up the price.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.